MMT Blog

MMT Chats: Championing Moldmaking Recruitment

Production manager is doing his part to help transform skilled trades recruitment through strategic advocacy and digital engagement.

WatchIn Case You Missed It: Top June Content

June brought the heat and some standout content for moldmakers! From tariff tensions to new VR tech, our top articles this month sparked ideas, offered practical takeaways and kept our readers in the know.

WatchHow to Design a Mold with Additive Tooling

Designing molds with additive tooling implementation in mind requires blending traditional mold standards with innovative new ideas of what is possible to push the limits of mold performance.

Read MoreThe Pellet Enters the Melt Delivery System

This summer, let’s get back to the basics. For this summer school basics series, Pellet to Part explores each stage of the plastic injection molding process. This week: Choosing a hot or cold runner system is a decision for the molder and moldmaker that must balance the processing window with budget and time.

Read MoreTooling 4.0: Connecting Industry 4.0 Technology to Your Molds and Molding Process

A packaging supplier applies Industry 4.0 technology to its injection molds so that components talk to each another to understand the dynamics of what is happening inside the mold.

WatchScholle IPN and Tooling 4.0

The MMT editorial team went onsite at Scholle IPN in Northlake, IL, and talked with Don Smith, senior tooling manager, to learn what Tooling 4.0 means to this company.

WatchMMT Chats: Partnerships Help Get the Job Done

MMT Chats welcomes Rich Martin with Convenio Technologies in Easley, South Carolina, to explain how a new group of manufacturing partners has come together to offer flexibility of services to the marketplace to get the job done.

WatchEight Essential Traits of High-Performing Manufacturers

After thirty-five years of studying and working with small to medium-sized shops and facilities, P&Y Management Resources identifies what sets high-performing manufacturers apart from their competition.

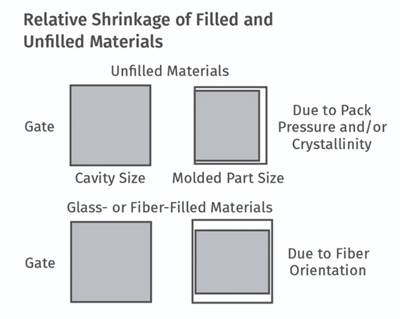

Read MoreBest Practices for Hitting Critical Numbers: Communication and the Shrinkage Factor

Start with an upfront review, discussion and collaboration with the customer and then consider the shrinkage factor.

Read MoreInitial Pellet Contact is the Screw

This summer, let’s get back to the basics. For this summer school basics series, Pellet to Part explores each stage of the plastic injection molding process. This week: the machine’s reciprocating screw, which is often misunderstood and applied to the process incorrectly.

Read MoreCan Robots Help Make Molds?

Automation can benefit mold production, from optimized efficiency to enhanced product quality and consistency.

Read MoreImproving Mold Surface Performance With Nickel-Plated Coatings

Insights from a collaborative academia and industry study to evaluate nickel-plated coatings on injection molds.

Read More