MMT Blog

Shop Talk: A Hot Mess and the Value of a Good Spare Tire

Canon Virginia, Inc. celebrates the real-world moments that unite shop floors everywhere. We hope that by sharing industry stories together, we can all laugh, learn and grow.

Read MoreMold Components: Sourcing Insights + Expert Tips

Mold components enable molds to work as they are the mechanisms used to deliver a quality end product. Access exclusive, online-only content, including a suppliers list, various mold component products, services and more.

Read MoreMMT Chats: Moldmaking to Aerospace Manufacturing

Mold builder explains how the business adapted when traditional customers left, finding new opportunities in the aerospace and space industries.

WatchMoldmaking Activity Recovers in May With Bump Up to 48.0

Dramatic swings in Moldmaking Index reflect instability amid changes to tariff policy.

Read MoreDesigning a Better Heat Exchanger - Part 1

This summer, let’s get back to the basics. For this summer school basics series, Pellet to Part explores each stage of the plastic injection molding process. This week we review considerations for mold water cooling systems.

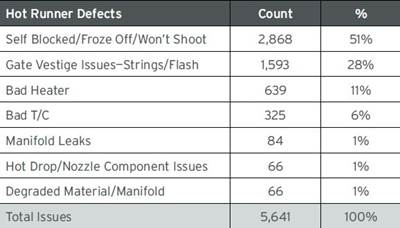

Read MoreTechnology Review and Sourcing Guide 2025: Hot Runners

A hot runner system is an assembly of heated components used in plastic injection molds that inject molten plastic directly into the cavities of the mold. Access exclusive, online-only content, including a suppliers list, hot runner products as well as services.

Read MoreTechnology Review and Sourcing Guide 2025: Mold Materials

Building a high-quality mold begins and ends with the proper selection of appropriate mold materials. Tool steel, aluminum, copper and alloys are a just a few you can find in this exclusive, online-only content that includes a supplier list for mold materials.

Read MoreTechnology Review and Sourcing Guide 2025: Software

Various software technologies are utilized when it comes to creating an optimized mold, from engineering services, to data management, AI and robotics. Access this exclusive, online-only content for a suppliers list, related products and software services within the moldmaking industry.

Read MoreUnderstanding Manifold Thermal Expansion

Molders, mold builders and repair technicians must fully understand thermal expansion to ensure they don’t damage critical seals during manifold repairs or routine cleanings.

Read MoreControlling the Melt Delivery System Heat Source

This summer, let’s get back to the basics. For this summer school basics series, Pellet to Part explores each stage of the plastic injection molding process. This week: understanding the heating systems along the melt delivery path.

Read More4th of July: Celebrating American Moldmaking

The moldmaking community shows strong support for military veterans and active service members, making Independence Day a meaningful time to recognize their contributions to both manufacturing and patriotic causes.

WatchYour One-Stop Guide to Moldmaking Resources

A complete print and online listing that helps mold buyers and builders find the information they need to make better buying choices throughout the supply chain.

Read More