Industrial Equipment & Machinery and Medical Findings

U.S. manufacturing competitiveness increases. Without AHCA and tax reform, small medical manufacturing companies lose opportunities for profitability.

Asian Firms Moving to U.S. Increases Machinery and Industrial Sales

Asian firms moving to the United States represents a significant departure from a multi-decade off-shoring trend. Foxconn Technology Group, for example, is preparing to move operations from Asia to the U.S. and plans to spend $10 billion on new plants and equipment across several states. Similarly, Samsung Electronics Co. is in discussions to invest approximately $300 million to expand production at its pre-existing South Carolina factory. These are just two examples that highlight how cheaper land, transportation and energy costs and a lower tax rate (in some instances) have made it possible for U.S. manufacturing to increase its competitiveness. The impact of these competitive forces helps drive U.S. industrial equipment and machinery shipments.

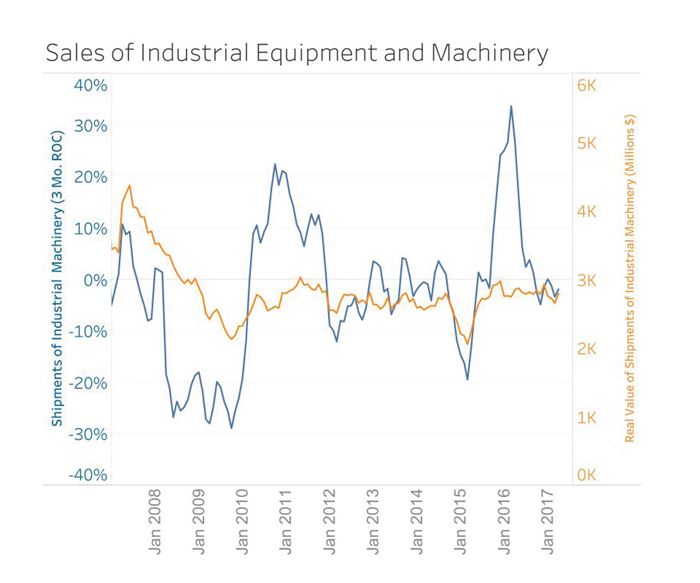

Since the start of 2016, the monthly inflation-adjusted value of U.S. industrial equipment shipments has averaged nearly $2.80 billion. By comparison, monthly shipment values averaged only $2.63 billion in the years between 2012 and 2015, which represent 8 percent growth after accounting for inflation.

Looking forward, Gardner Business Intelligence (GBI) believes that the combination of low unemployment and low oil prices has encouraged demand for durable goods, larger automobiles and housing. As the effects of consumer demand ripple upstream, GBI reports positive trends in the industrial production of machinery, except for oil and gas. GBI is monitoring the housing and automotive markets carefully because of their substantial significance in the industrial equipment and machinery markets.

Healthcare Bill Impacts Medical Devices Market

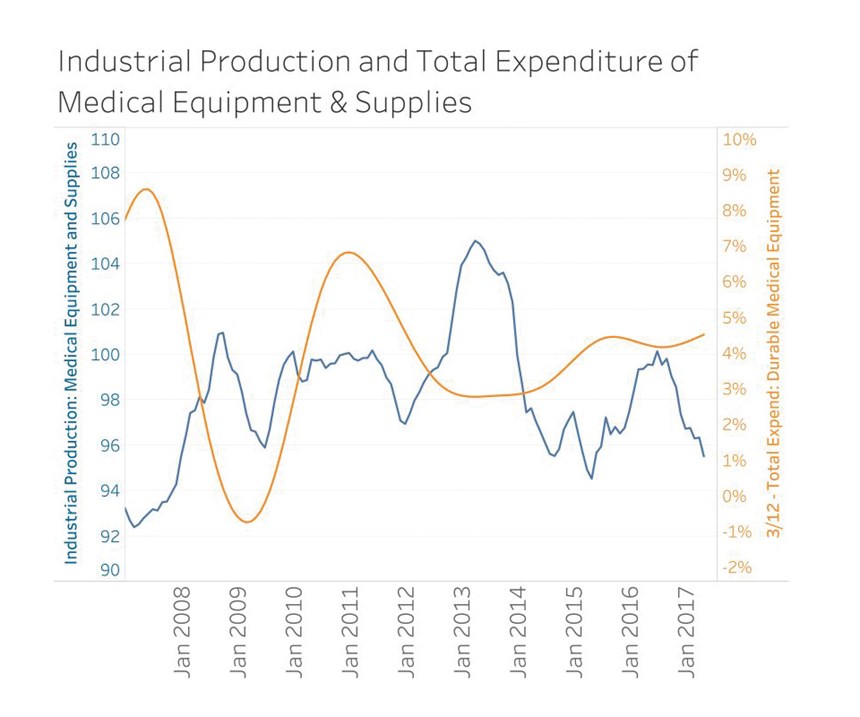

The healthcare industry accounts for nearly 17 percent of the entire U.S. economy. As of the time of this writing, this industry awaits the outcome of the Republican Party’s American Health Care Act of 2017 (AHCA), which has important implications for manufacturing as the bill included language that would repeal the 2.3 percent medical device tax. This would enable the medical devices industry to operate more efficiently with increased quantities of products sold and lower prices for consumers.

The AHCA would limit the availability of Medicaid to the poor, which in turn would reduce the number of people with insurance by 22 million. According to the Congressional Budget Office, this would lower the federal deficit by $321 billion over 10 years. This change would disproportionately impact the nursing home industry because Medicaid covers nearly 60 percent of that industry’s expenses.

The rate at which the AHCA passes has consequences that reach beyond the healthcare industry. Some expect that an inability to pass the healthcare bill by August 2017 could negatively affect the GOP’s ability to overhaul the tax code. One popular tax code revision in proposed legislation would largely benefit small businesses because it would enable them to receive a lower corporate tax rate than they currently receive. Under the current system, certain types of business (and typically small businesses) are taxed at the business owner’s personal tax rate. Should neither the AHCA nor a tax reform bill pass into law, small manufacturing businesses that support the medical industry will lose out on two opportunities for future profitability.

Related Content

MMT Chats: Acquisition Trends and Lessons for Mold Builders

Jim Berklas is a former full-time M&A lawyer for several of the largest private equity firms in the country and has 25 years of M&A experience and 200 closed transaction. Today, he is founder and M&A Leader with Augmented Industry Services. He joins me for this MMT Chat on mergers and acquisitions trends and strategies within in the mold manufacturing industry. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

Read MoreMachine Hammer Peening Automates Mold Polishing

A polishing automation solution eliminates hand work, accelerates milling operations and controls surface geometries.

Read MoreMMT Chats: 5 in 5 with Best Tool and Engineering

MoldMaking Technology Editorial Director Christina Fuges reveals 5 best practices for improving efficiencies within shops...in 5 minutes. Our guest is Joe Cherluck, President of Best Tool and Engineering in Clinton Township, Michigan. This episode is brought to you by ISCAR.

Read More2021 30 Under 30 Honors Program: Mentoring in the Next-Generation of Moldmaking Professionals

Young professionals are vital to the moldmaking industry, and it is important to acknowledge those making strides in shaping the industry's future. MoldMaking Technology recognizes the industry's young talent through its 30 Under 30 Honors Program.

Read MoreRead Next

Are You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)