NPE2024 and the Economy: What PLASTICS' Pineda Has to Say

PLASTICS Chief Economist Perc Pineda shares his thoughts on the economic conditions that will shape the industry as we head into NPE2024.

The plastics economy retracted last year amid an economic turndown. What’s in store for this year, when NPE2024 takes place?

Plastics Technology’s Editorial Director Jim Callari asked Perc Pineda, the Plastics Industry Association’s chief economist, to polish his crystal ball and provide some insights.

Q: How would you characterize 2023 for the plastics industry, and what are your expectations for the U.S. economy as we roll toward NPE2024?

Perc Pineda: Assessing the plastics industry landscape in 2023 reveals a year marked with nuanced shifts across various sectors. From the fluctuations in production levels and shipments to the intricate interplay between labor constraints and export dynamics, the plastics industry encountered challenges and opportunities. Notably, the year witnessed divergent trajectories. While certain segments, such as plastics material pricing and resin manufacturing, grappled with equilibrium adjustments, others, like the mold for plastics trade, mirrored global economic oscillations. For an industry that thrives on innovation, the forthcoming NPE, the largest gathering in the Western Hemisphere for the plastics industry, offers an avenue for post-COVID-19 in-person reconnection of the industry’s supply chain. And the net benefit of which should be positive.

Q: What about the global economy?

A: In early fall 2023, there was a consensus anticipating moderate global economic growth in 2024. At the annual meeting of the International Monetary Fund (IMF) held in Morocco in October 2023, where I was in attendance, the IMF projected a 2.9% growth rate for the year. The expectation was that advanced economies would experience a growth of 1.4%, while emerging and developing economies were forecasted to grow by 4.0%, maintaining the same rate as in 2023. The divergence among regions in this outlook implies potential variations in the performance of the plastic industries across countries.

For the U.S., the primary focus will be on three key countries: Mexico, Canada and China, as they represent the top three largest export markets for the U.S. plastics industry. The current outlook suggests growth rates of 2.1%, 1.6% and 4.2% for Mexico, Canada and China, respectively, in the current year.

However, this optimistic scenario is contingent on the global economy avoiding significant negative shocks, such as an escalation of ongoing geopolitical challenges that could disrupt the supply chain. In the absence of such disruptions, it is plausible that global trade in plastics could once again surpass the World Trade Organization's (WTO) forecast for merchandise trade volume, which currently stands at a projected growth rate of 3.3%. Monitoring potential risks and uncertainties in the geopolitical landscape will be crucial in assessing the resilience of the plastics industry in the face of evolving global economic conditions.

Q: Is the industry still impacted by supply chain issues?

A: The challenges within the supply chain landscape today have shifted from being directly attributed to the COVID-19 pandemic to encompassing broader structural issues within the economy. These challenges are notably linked to demographic shifts, a lower participation rate and a shortage of skilled workers. In November of the preceding year, the capacity utilization in plastics and rubber products manufacturing stood at 76.6%, marking a decline from the 80.4% reported a year earlier. This decrease can be attributed, in part, to a reduced workforce in plastics and rubber manufacturing, despite the unemployment rate in this sector remaining significantly lower than the overall civilian unemployment rate in the broader economy.

It is noteworthy that these supply chain issues are no longer as acute as they were two years ago. The current scenario, while still influenced by economic dynamics, is less directly impacted by the immediate challenges posed by the COVID-19 pandemic. The supply chain disruptions are now more entrenched in the structural aspects of the economy. However, it is important to acknowledge that the stability of the supply chain remains contingent on avoiding significant negative shocks to the global economy, particularly any escalation of ongoing geopolitical challenges that could potentially disrupt the supply chain. As of now, barring such unforeseen disruptions, the pressing nature of supply chain issues has diminished compared to the challenges faced two years ago.

It is noteworthy that these supply chain issues are no longer as acute as they were two years ago.

Q: Are you optimistic about the manufacturing economy in the U.S. in particular? Have you seen much evidence of reshoring?

A: Reshoring is inherently a medium- to long-term initiative, making it challenging to quantify in the short term. However, this does not mean it’s not happening. There’s data on reshoring and foreign direct investment (FDI) manufacturing job announcements. Despite efforts such as acquiring existing manufacturing facilities or transitioning to domestic suppliers, the pace of reshoring appears to be less conspicuous than policymakers might prefer.

Several factors contribute to the relocation of manufacturing to other countries, including labor supply and cost, energy and transportation costs, and the ease of doing business. An assessment of how the U.S. compares to other nations in these three aspects is essential to understanding the outlook for U.S. manufacturing. There’s also the attractiveness for foreign companies to manufacture in the U.S., considering we are the largest market in the world for manufactured goods.

Presently, the U.S. remains optimistic and any potential pullback in manufacturing activity in 2024 is anticipated to be less pronounced than what was observed in 2023. This optimism is grounded in the evaluation of factors influencing manufacturing dynamics and their alignment with the broader economic landscape.

Q: Processors spend most of their time at their plants making sure product is made on time at high quality. But when they are forecasting their business, can you provide some guidance on the indicators they should be tracking?

A: Those in the plastics industry generally comprehend that the sector is mature, and its expansion closely mirrors the overall economic growth, typically gauged by the increase in Gross Domestic Product (GDP). The monthly counterpart to GDP is the Industrial Production Index, serving as an economic indicator. However, it is crucial to note that both GDP and the Industrial Production Index are lagging indicators, reflecting changes after shifts in the macroeconomy have occurred.

Effective business forecasting necessitates the consideration of a blend of lagging, leading and coincident indicators to obtain a comprehensive understanding of economic trends. Building permits and housing starts, for instance, are a good leading indicator suggesting future construction and housing demand. It’s worth noting that business forecasts tend to be specific— sales forecast, expense forecast, new product launch forecast, for instance— have different dimensions. Within the realm of business forecasting, there’s no one size fits all, and forecast models need tweaking over time.

Effective business forecasting necessitates the consideration of a blend of lagging, leading and coincident indicators to obtain a comprehensive understanding of economic trends.

Q: What are your projections for the major markets in plastics? Automotive? Medical? Packaging? Construction?

A: In 2022, a substantial 88.0% of plastics products found their way into personal consumption, indicating a robust market for plastics with the potential for sustained growth. However, the growth trajectory might experience fluctuations, mirroring the shifts in the broader economic business cycle.

Certain segments within the plastics market, such as those catering to necessities like food packaging and medical applications, can be considered stable due to their inelastic demand. In particular, the automotive market is marked by constant innovation, introducing new models annually. This innovation has a profound impact on the entire plastics industry supply chain, spanning materials, tooling and plastics conversion processes. Although higher borrowing costs currently limit the growth of automotive sales, the dependence of a significant percentage of working Americans on personally owned vehicles, coupled with a robust labor market, indicates a resilient demand for light vehicles. This, in turn, is anticipated to sustain demand for plastics in the automotive sector.

The automotive market is marked by constant innovation, introducing new models annually.

Conversely, the plastics market most directly affected by the high-interest rate environment is housing. The expectation is that the construction sector, which exhibited lackluster performance in 2023, will remain subdued until interest rates begin to decline. Monitoring these dynamics provides valuable insights for stakeholders navigating the complex landscape of the plastics industry.

Q: What impact has increased spending on infrastructure had/will have for plastics?

Any implementation of an expansionary fiscal policy, with the potential to boost aggregate demand, is poised to yield a net positive impact on the plastics industry. Specifically, increased spending on infrastructure projects directly tied to the plastics sector will drive additional demand. Notably, enhanced investment in drinking water and wastewater infrastructure can stimulate demand for plastic pipes. Similarly, allocating additional funds for the improvement of recycling infrastructure is another avenue that positively influences the plastics industry.

In essence, such targeted fiscal measures not only contribute to economic growth but also serve as catalysts for the growth and sustainability of the plastics industry by fostering demand through strategic investments in critical infrastructure.

Q: What are your projections for plastics manufacturing in 2024 and beyond? Growth?

A: It is reasonable to anticipate that any reduction in plastics manufacturing activity in 2024 will likely be less pronounced than what was observed in 2023. The concerns associated with inventory overhang are expected to resolve over time, transitioning into a nonissue and subsequently necessitating replenishment.

The outlook for sustained consumer engagement is optimistic, particularly with the potential for lower borrowing costs. This favorable financial climate is poised to uphold consumer spending, consequently bolstering the demand for plastics. As economic conditions evolve, the expectation is that the plastics industry will experience a more resilient performance in 2024, buoyed by a combination of reduced inventory concerns and sustained consumer demand.

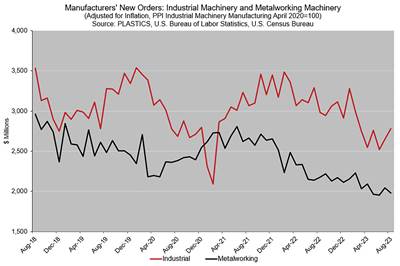

Q: What about shipments of materials and equipment? Do you expect processors are coming to NPE2024 ready to buy?

A: Indeed, the anticipation of encountering innovation is a common expectation at trade shows, especially considering the substantial lead time involved in procuring equipment in this industry. Staying competitive in an industry that thrives on innovation necessitates keeping abreast of the latest advancements in equipment.

It’s crucial to recognize that trade shows present diverse opportunities for all participants across an industry’s supply chain. They encompass educational components, opportunities for networking, access to the latest technological updates and, of course, avenues for making purchases. Acknowledging the multifaceted nature of trade shows underscores their significance as comprehensive platforms for knowledge exchange, networking and staying at the forefront of technological advancements within the industry.

Related Content

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

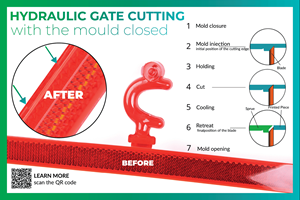

Read MoreHydraulic Gating Cutting Reliably Separates Molded Parts

NPE2024: Material displacement technology offered by Ermanno Balzi Srl enables precise separation of the molded part from the gate during the molding cycle.

Read MoreRecycling Partners Collaborate to Eliminate Production Scrap Waste at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair will seek to recover and recycle 100% of the parts produced at the show.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreRead Next

North American Tooling Spend Forecasted to Reach $8.3 Billion in 2025

Recent automaker profits are funding an increased number of new vehicle launches over the next few years, according to Harbour Results’ latest in-depth study, which in turn is expected to drive up tooling spend growth.

Read MorePLASTICS Presents NPE2024 Education Sessions

NPE’s academic program has been redesigned to aid advancement within the plastics industry.

Read MoreResilience and Reflections: Moldmaking in the Evolving Economic Landscape

As moldmakers navigate this complex year marked by fluctuating business activities, and approach the upcoming year with cautious optimism, three key considerations should guide their decisions.

Read More

.png;maxWidth=300;quality=90)