How to Justify New Machine Tool Technology

A look at some of the factors influencing the success of your machining center investment.

In the ongoing battle for survival and profitability in manufacturing businesses, the latest technology is more important than ever. It allows shops to do more in one operation with less direct labor, produces more consistent, higher quality parts and helps reduce the cost per piece produced.

Still, some shops, accustomed to the ‘way they’ve always done it’ may believe that old technology will see them through. It won’t. At least not in this global market. The need to understand how to profitably and wisely invest is urgent—if you want to be competitive. Buying new technology is a strategic decision to assure the future competitiveness of your company. Evaluate it properly and thoroughly.

This article will show the need to take a comprehensive look at all factors that influence the success of an investment: what the different factors are, how important they are, and how to use them, including factors that cannot be calculated, a return on investment perspective, and a detailed production cost-analysis perspective.

Assessment Process

Justifying new technology is a multi-step process that requires a thorough assessment of a number of factors at work in your manufacturing operation.

1. Understand your costs.

- Use a transparent costing system

- Evaluate all cost factors

- Evaluate the influence of new technology on the cash flow

- Calculate production cost and evaluate the influence of investment of new technology on production cost and return on investment

2. Understand potential benefits of CNC technology; measurable benefits.

- Productivity

- Reduced setup and tool change time

- Improved uptime

- Throughput

- Scrap rate

- Tooling cost

- Maintenance cost

- Job preparation cost

There are also intangible benefits that may not be calculable, but can have a major effect on your machining success—including quality, accuracy and surface finish, which should not depend on operator skill and should not require constant checking; and, preset quick change tooling with standardized inserts that save production time (up to 15 percent or more compared to setting the tools on the machine so the machine is productive for a greater part of the shift).

3. Understand the costs of older equipment.

• Lower efficiencies

• Longer than planned setup times

• Requires vanishing skills to set up and operate

• Requires tweaking to successfully run good parts—only a few setup/operators in your company have this ability

• Incapable of today’s quality requirements

• Cannot statistically hold tolerances

• Produces excessive scrap parts, hurting efficiency, adding to material cost

• Frequent unplanned downtime for repairs

• In-house maintenance personnel (overhead)

How to Determine the Payback

Many companies try to justify the purchase of capital equipment based on a 2- to 3-year payback. That forces the purchase of less expensive or dedicated machines at the outset and ignores the impact of new parts and new work beyond that—in 5 to 6 years. It may cost more today to account for the possibilities in 5 to 6 years, but making a foresighted decision now can actually avoid future capital expense. Remember, today’s capable machines have a useful life far beyond 2 years.

There are a number of ways to evaluate the payback of new technology. Doing a return on investment (ROI) analysis can help you to make a good decision on whether to buy an expensive or less expensive machine.

ROI analysis indicates how the investment will impact a company’s cash flow, based upon the revenues and expenses associated with the project. ROI is given as a percentage rate of return.

The company performing the ROI analysis must determine the rate of return for the investment based on the project cost and the impact the investment would have on its cash flow. Once the rate of return is determined, the company must then determine if it is an acceptable rate of return. Typically a 20 percent or greater rate of return is considered acceptable.

However, this justification method does not consider important technical and strategic aspects for maintaining competitiveness. Quality, for instance, is one of today’s top priorities for equipment end-users. This factor is a good example of what is not fully recognized in an ROI analysis. Quality depends not only on the type of equipment being used, but also on the process, eliminating handling and resetting.

While the ROI analysis method has traditionally been used to analyze high-volume multi-year projects, it can also be used to analyze the wisdom of buying a machine for low-volume production of a large variety of parts over a number of years. There are many additional factors that you might want to consider, such as tax implications regarding new machinery.

It is possible to have a high ROI and a low profitability, and the opposite is also true. Look at a new machine purchase from both standpoints. Perform an ROI analysis, and also look at the long-term impact of the investment. Although profitability may initially be higher when looking at a lower-priced machine, due to long-term benefits—such as durability, flexibility, reduced cycle time and better part quality—the higher quality machine purchase can be the most favorable choice.

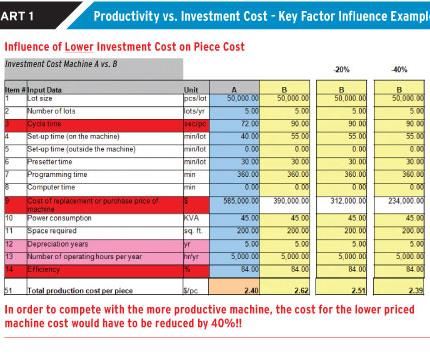

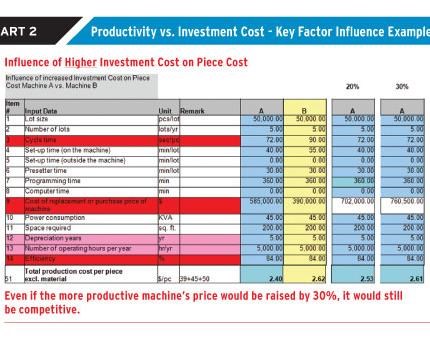

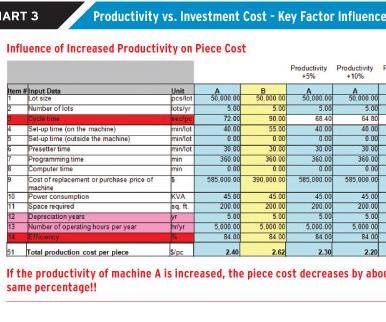

If you really want to make your company productive, you must learn that the initial cost of the machine tool is only one factor—and not the most important one. With a 20-percent increase in productivity—faster cycle times, shorter setup times—you can very nearly justify a machine costing nearly 1.5 times a lower-cost choice. If the productivity differential is greater than 20 percent, this could be two times or more.

Summary

The truth about ROI is that it is important to take a comprehensive look at all aspects of an investment—including factors that are crucial to success, but cannot be calculated; having a good understanding of the financial impact of the investment, as calculated in the IRR/ROI formula; and, looking at a detailed piece-cost analysis to compare competing equipment, and understanding the overwhelming importance of productivity.

www.indextraub.com

Related Content

Predictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreLeading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

Read MoreMold Design Review: The Complete Checklist

Gerardo (Jerry) Miranda III, former global tooling manager for Oakley sunglasses, reshares his complete mold design checklist, an essential part of the product time and cost-to-market process.

Read MoreThe Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

Read MoreRead Next

How to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More

_300x250 3.png;maxWidth=300;quality=90)