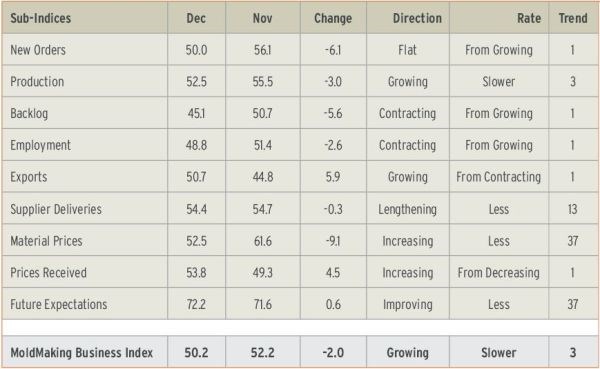

With a reading of 50.2, the Gardner Business Index showed that the moldmaking industry grew in December for the third month in a row. Prior to October, the index had been in a steady and steep decline since May, but the last three months of the year clearly broke that downtrend. The pattern in the index the last four or five months had been similar to the same timeframe in 2013, indicating that ups and downs over this time period could be due to seasonal affects. Month over month, the index increased 6.4 per-cent in December, the first month of month-over-month growth since Aug-ust. Annually, the rate of change continued to grow.

New orders were flat, having expanded significantly the previous two months. Production increased for the third straight month, having expanded every month but one in 2014. Backlogs contracted after expanding in November, however, compared to one year earlier, the backlog index increased 9.7 percent. The annual rate of growth had been higher than 10.0 percent for six months. Based on the trends in backlogs, capacity utilization should continue to increase into the second quarter of 2015, indicating increased capital spending by the moldmaking industry this year. Employment contracted in December for the fifth time in six months, while exports expanded for the first time since May. Supplier deliveries continued to lengthen at a significant rate.

The rate of increase in material prices collapsed in December to its slowest rate since the index began three years earlier. At the same time, prices received increased at their fastest rate since January 2014. Prices received increased four of the last five months of 2014. Future business expectations improved for the second month in a row, reaching their highest level since June.

Plants with 50-99 employees suffered from very poor business conditions in December. Their index dropped to 39.2, which was the lowest since the survey began. Plants with 20-49 employees expanded for the third month in a row, while facilities with fewer than 20 employees contracted after growing in November.

Custom processors expanded for the second month in a row, although the rate of growth in December was very modest. After expanding the previous two months, metalcutting job shops contracted for the third time in five months.

The North Central–East had booming expansion the last quarter of 2014. Each month its index was higher than 57.0. The West and North Central–West also grew in December,

while the Northeast contracted at an even faster rate than it had the previous three months.

Future capital spending plans for the next 12 months con-tracted 43.7 percent compared to December 2013. With sharp month-over-month contractions the last two months of the

year, the annual rate of change slowed to 3.7 percent. This was by far the slowest rate of annual growth in future capital spending plans over the last year.

Related Content

-

Tackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

-

Mold Design Review: The Complete Checklist

Gerardo (Jerry) Miranda III, former global tooling manager for Oakley sunglasses, reshares his complete mold design checklist, an essential part of the product time and cost-to-market process.

-

MMT Chats: Marketing’s Impact on Mold Manufacturing

Kelly Kasner, Director of Sales and Marketing for Michiana Global Mold (MGM) talks about the benefits her marketing and advertising, MGM’s China partnership and the next-generation skills gap. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

.jpg;maxWidth=970;quality=90)

.JPG;width=70;height=70;mode=crop)

_300x250 3.png;maxWidth=300;quality=90)