Residential Housing the Key to Sustained Recovery

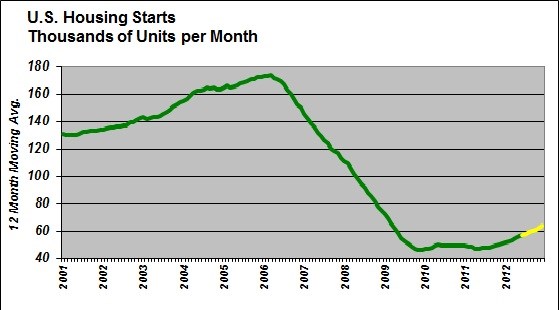

The number of new houses started in the U.S. in June posted its highest monthly total in four years. The June tally was 25% stronger than the same month in 2011. For the year to date, the number of new houses started in 2012 is up 27% when compared with the first six months of last year. All of this should come as welcome news.

The number of new houses started in the U.S. in June posted its highest monthly total in four years. The June tally was 25% stronger than the same month in 2011. For the year to date, the number of new houses started in 2012 is up 27% when compared with the first six months of last year. All of this should come as welcome news.

The Great Recession ended three years ago, but many will argue that the American economy has yet to enter a full-fledged recovery. Instead, we have sputtered along for three years at a sub-par rate of overall growth. The employment data are better than they were during the depth of the recession, and a few sectors of the economy, most notably manufacturing, have exhibited promise. But most consumers, as well as many small business owners, have never really been confident that things were genuinely getting better. In fact, the consumer confidence data have been range-bound at levels that are only marginally higher that they were just after the housing bubble burst.

This pattern of bumping along the bottom can also be seen in the data that measures the number of new houses started and the median prices of existing homes sold. I have long believed that the trend in housing starts and median home prices is the best leading indicator there is for measuring Americans’ propensity to consume. In other words, when the residential construction and real estate sectors are growing, it is highly likely that all of the other sectors of the economy will also enjoy an expansion.

These two sectors have languished near their cyclical lows ever since the bubble burst in 2008, but the recent data suggests that they are at long-last beginning to recover. Keep in mind that they are coming off of very low bottoms, and the gains at first will be gradual (I admit that a gain of 27% so far this year sounds a little better than gradual, but like I said, the total this year is compared to a very low total from last year that was near the cyclical bottom). If the monthly data continue to get steadily better, and there is an improving chance that this will happen, then by this time next year it will finally start to look like a sustainable recovery has developed.

Analyses of historical housing bubbles show that it consistently takes four or five years for the market to heal after the bubble bursts. It looks like this time will be no different. The bad news is that this crucial sector of the U.S. economy suffered severe damage, and it required an uncomfortably long period of time to heal. It is not yet healthy, but the vital signs are improving. Barring further shocks, things will be much improved in 2013.

Related Content

-

VIDEO:"The Smith Boys" on How Moldmaking is an Innovation Machine

"The Smith Boys" AKA President of DME Peter Smith and Director of Sales, Scott Smith discuss why the moldmaking industry is an innovation machine and how it is crucial to remedying global supply chain issues.

-

Embracing ESG: One Mold Builder's Path to Sustainability and Success

The story of how a company in the moldmaking, injection molding and metal parts industry is navigating the challenges and opportunities associated with sustainability.

-

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.