Moldmaking Activity Begins 2024 With Slowed Contraction

January index reading reflects February-March 2023 readings as it slinks toward a reading of 50. There are high hopes that it may continue on this path to sustained expansion for 2024.

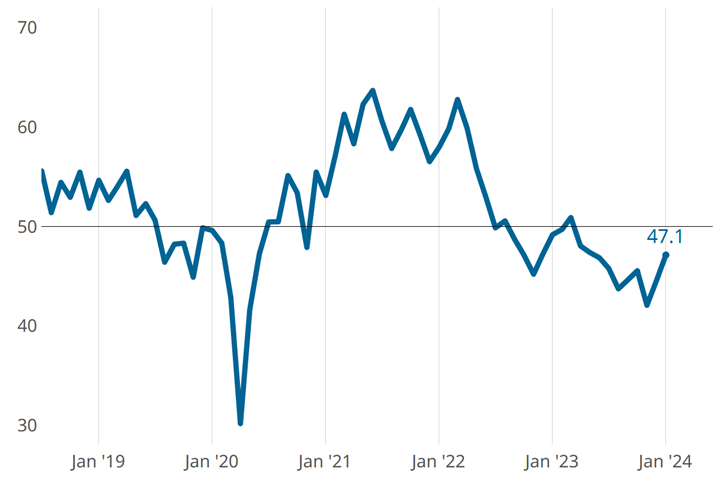

GBI: Moldmaking activity was up 2.6 points in January. Source, all images: Gardner Intelligence

Moldmaking activity slowed contraction in January for the second month in a row, with the Gardner Business Index (GBI) ending January at a reading of 47.1. This reading is up 2.6 points from December — the past two-month trend parallels about a year ago, when moldmaking activity inched its way to readings of 50 and higher (growth territory) beginning in March. Not to get ahead of ourselves, but 2024 seems to be off to an encouraging start.

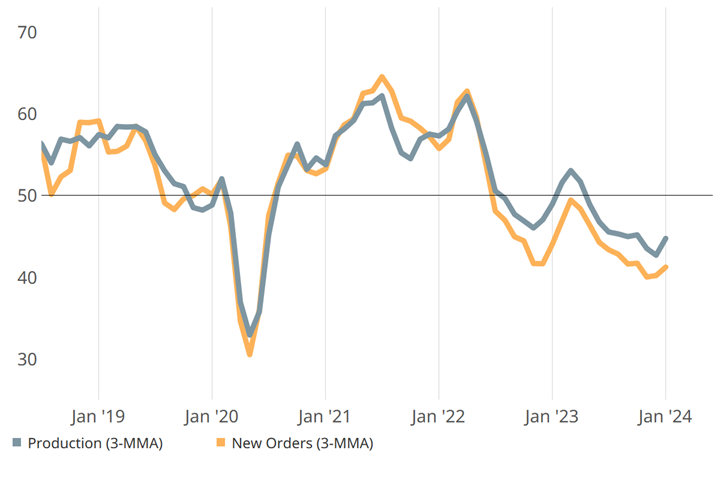

The combination of slowed contraction in new orders and production, combined with stable employment and backlog, drove the slowed contraction in the overall moldmaking index. Supplier deliveries returned to flat activity after contracting during the fourth quarter of 2023 while exports contracted faster in January.

Expectations of future business (not part of the GBI calculation) continue to be bullish and may, in part, reflect a leveling of the rate of material price increases along with the supply chain not being much of an issue.

New orders and production contributed to January’s slowed contraction. (This graph shows three-month moving averages.)

Related Content

-

Moldmaking Industry GBI Contracts for Four Months Straight

The GBI Moldmaking ended the month at 45.8, down one point from June, with components contracting or nearing contraction activity.

-

Moldmaking Industry Contracts for First Time in Two Years

The September Gardner Business Index (GBI) for moldmaking indicates more components are contracting than expanding.

-

May Moldmaking Index Trends Downward

Contraction, experienced by most May components, continues to be familiar territory for the GBI: Moldmaking Index.