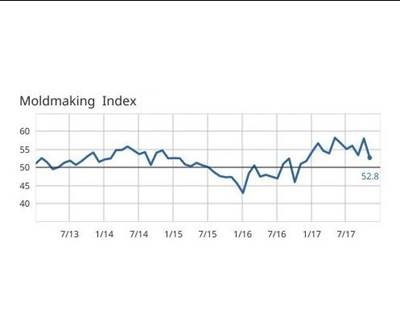

Mold manufacturing in the U.S. is consistently affected by the interplay of internal and external factors. Therefore, with a weaker domestic and global economic outlook, it is not surprising that the Gardner Business Index (GBI) Moldmaking contracted in December for the fourth consecutive month.

Mold Builders Recalibrate Outlook as Internal Factors Evolve

The U.S. economy continues to adjust from inflationary growth rates in 2020 and 2021 — financed by massive fiscal stimulus and zero interest rates — to long-term sustainable growth. In addition, the economy began normalizing in 2022, starting with the Federal Reserve tightening financial conditions to rein in inflation, which increased the risk of a recession.

As a result, inflation has moderated, as evidenced by the 6.4% headline inflation rate in December from the 9.0% rate in June. However, given that the current inflation rate remains well above the Federal Reserve’s 2.0% target, manufacturers can expect additional interest rate hikes in 2023.

Higher borrowing costs against prospects of weaker aggregate demand will continue to cause pullbacks on business investment spending, including in the manufacturing sector. For example, business investment spending on equipment — not just plastics equipment — has already slowed to an estimated 3.4% in Q4 2022 from 10.7% in Q3 on an annualized basis.

In addition, business investment spending on structures declined in all four quarters — falling by an estimated 6.9% in Q3 and 5.9% in Q4 on an annualized basis. All told, higher borrowing costs contributed to weaker manufacturing activity beginning in the second half (H2) of 2022.

Moldmaking is a critical component of the plastics industry’s value chain, a leading indicator of plastics conversion activity.

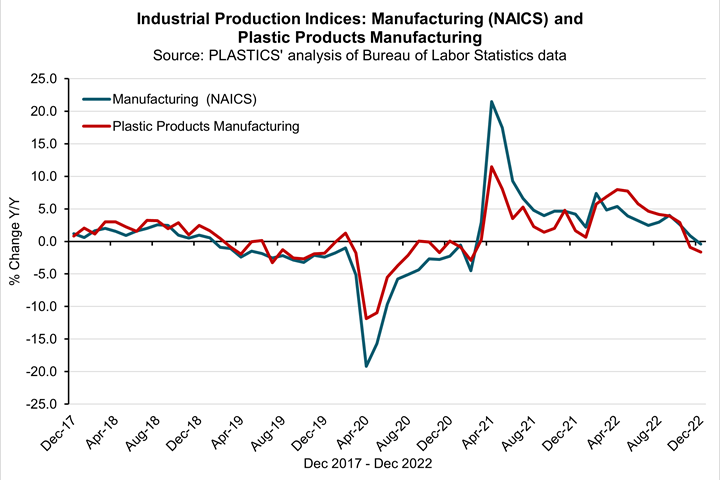

The manufacturing sector is the primary customer of the plastics industry. Moldmaking is a critical component of the plastics industry’s value chain, a leading indicator of plastics conversion activity. By extension, moldmakers take clues from the manufacturing sector. Changes in the level of manufacturing activity will factor into a moldmaker’s outlook. Judging from the Industrial Production Index on total manufacturing, the economy’s manufacturing sector started to slow in Q1 2022, increasing by 4.8% year over year (Y/Y). Manufacturing slowed in Q2 and Q3, increasing by 4.2% and 3.1%, respectively.

In October, manufacturing increased by 2.6% Y/Y followed by a 1.4% Y/Y increase in November. The 0.4% Y/Y decrease in manufacturing in December is consistent with the December GBI Moldmaking. Plastic product manufacturing rises and falls with the total manufacturing activity of the economy. The chart below shows the Y/Y change in Industrial Production Indices on total manufacturing and plastic products manufacturing.

Industrial Production Indices: Manufacturing total and plastic products manufacturing. Photo Credit: PLASTICS’ analysis of Bureau of Labor Statistics data.

Weaker business investment is matched with slower growth in household consumption. As personal disposable income started falling — when fiscal stimulus effects waned — personal consumption expenditures (PCE) began slowing down. The PCE in Q3 2022 increased by 8.6% Y/Y from 9.2% Y/Y and 11.5% in Q2 and Q1, respectively. Personal disposable income growth slowed to 0.6% in Q2 Y/Y, improving to 1.7% in Q3 Y/Y. When the economy contracts, the risk of higher personal income volatility increases, which will cause adjustments in household consumption. Consequentially, it will affect the manufacturing and services sectors of the economy.

Internal and external factors will continue to affect economies and their industries. As the economy adjusts in 2023, it will have an uneven effect on plastics’ end markets and plastics production and shipments.

External Factors Continue Affecting U.S. Mold Builders

As the global economic outlook continues evolving, international organizations will revise their previous forecasts. The World Bank, for instance, now projects the global economy to grow by 1.7% in 2023. This is a downward revision for the 3.0% growth previously forecast. In January 2023, the International Monetary Fund (IMF) revised its 2023 global economic outlook to 2.9%. Additional revisions in the global economic outlook of Washington, D.C.-based international organizations — the World Bank and the IMF — could be expected ahead.

The Organization of Economic Cooperation and Development (OECD), an intergovernmental organization based in Paris, France, currently projects a 2.2% world GDP growth in 2023. While all three international organizations cast different projections of global output forecasts, all organizations expect slower global economic growth this year compared to last year. Lower global economic output translates to lower trade in goods and services. The World Trade Organization revised its merchandise trade volume forecast for 2023 to a 1.0% increase from 3.4%.

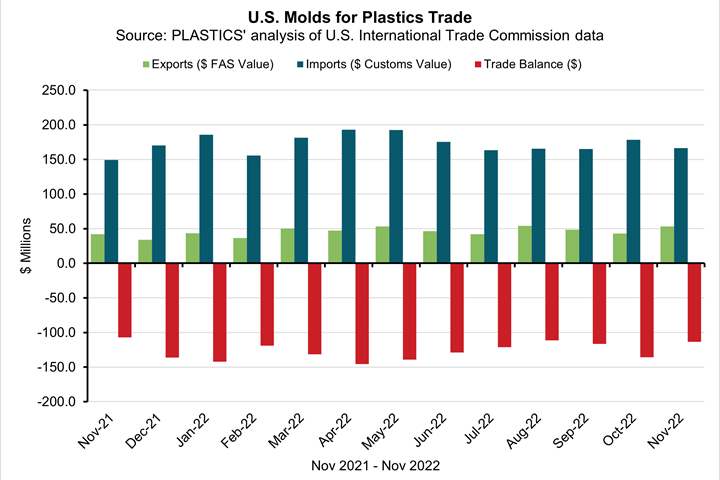

The latest available data from the U.S. International Trade Commission show that the value of U.S. exports of molds for plastics rose by 24.5% in November to $53.3 million from the previous month as shown in the graph below. Data came in significantly above the 2.1% forecast. From a year earlier, exports were up 26.2%. As of November, U.S. exports of molds for plastics in 2022 averaged $47.1 million monthly. Whether December will also see an increase is highly unlikely. A 5.0-8.0% decrease would be more likely given weaker global economic conditions in recent months.

Moreover, a strengthening U.S. dollar through October slowed the growth of U.S. exports of molds. While the U.S. dollar weakened in November and December, additional interest rate hikes will likely cause the U.S. dollar to appreciate. Assuming the U.S. dollar stabilizes under its recent high, any bump-up in exports will be reflected in the first half (H1) of 2023.

U.S. molds for plastics trade. Photo Credit: PLASTICS’ analysis of U.S. International Trade Commission data.

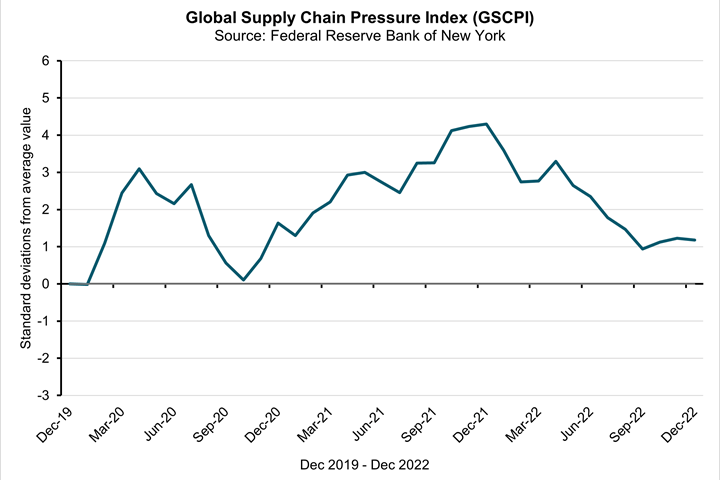

The residual effects of the COVID-19 pandemic continue to influence the global supply chain. While the pipelines for production inputs from domestic and international sources have reopened, supply chain linkages in some areas remain fragile and vulnerable to disruption. Internal factors affecting the supply chain have improved significantly since the pandemic in 2020.

However, external factors continue to slow the supply chain normalization. For example, higher energy prices outside the U.S., particularly in countries supplying inputs to the plastics industry and plastics’ end markets, are capping productivity and causing longer production and delivery time.

Moreover, it has also increased the prices of imported materials. Current and future geopolitical conflicts carry the potential of direct and indirect risks of supply chain disruptions. So far, based on the Global Supply Chain Pressure Index (GSCPI) of the Federal Reserve Bank of New York, the increase in global supply chain pressure in October and November was due to longer delivery times in China despite improvements in delivery times in the U.S.

What’s Ahead for U.S. Mold Builders?

Internal and external factors will continue to affect economies and their industries. As the economy adjusts in 2023, it will have an uneven effect on plastics’ end markets and plastics production and shipments. There are three key points to keep in mind as the economy continues running in a low gear. First, borrowing costs can be expected to remain high as the Federal Reserve continues financial tightening until the inflation rate significantly declines toward the inflation target. This could mean an appreciation of the U.S. dollar will have implications for molds for the plastics trade.

Second, the demand for manufactured goods, particularly those not sensitive to high-interest rates, is projected to remain stable. Growth is still in the forecast for 2023 for plastics, albeit at a lower rate. Short-run effects of weaker economic conditions may be more pronounced in some quarters. However, the medium- to long-term outlook of the plastics industry remains favorable. Third, the plastics industry serves a global market: Its value chain, including moldmaking, will continue to be affected by internal-external dynamics.

About the Author

Perc Pineda

Perc Pineda, Ph.D., chief economist of the Plastics Industry Association (PLASTICS), is an industry thought leader and PLASTICS primary expert and spokesperson on the U.S. and global economy, industry research, statistics, trends and forecasts. He produces PLASTICS’ two annual flagship publications — Size & Impact and Global Trends — and trademarked the Global Plastics Ranking.

@PercPineda / PPineda@plasticsindustry.org / plasticsindustry.org

Related Content

Editorial Guidelines: Editorial Advisory Board

The Editorial Advisory Board of MoldMaking Technology is made up of authorities with expertise within their respective business, industry, technology and profession. Their role is to advise on timely issues, trends, advances in the field, offer editorial thought and direction, review and comment on specific articles and generally act as a sounding board and a conscience for the publication.

Read MoreThe Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MoreHow to Improve Your Current Efficiency Rate

An alternative approach to taking on more EDM-intensive work when technology and personnel investment is not an option.

Read MoreSteps for Determining Better Mold Prices

Improving your mold pricing requires a deeper understanding of your business.

Read MoreRead Next

Coming Back Strong

Investment in machining centers, injection molding machines and complete molds is projected to increase significantly in 2015. Our latest capital spending survey reveals the trends leading to this upswing.

Read MoreTrends Impacting the Supply Chain

The cost of manufacturing and product demand are set to cause financial and business climate changes across the moldmaking industry.

Read More2018: Long-Term Growth Opportunities Abound for Moldmakers

Positive data helps mold builders prepare for upcoming industry changes and growth opportunities.

Read More

.png;maxWidth=300;quality=90)

_300x250 1.png;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)