Future Expectations Remain Optimistic

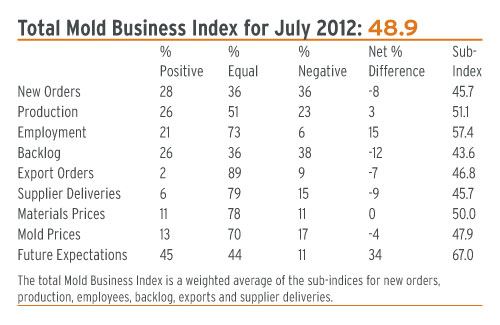

Total Mold Business Index for July 2012: 48.9

For the first time in fifteen months, our July survey shows that overall activity levels for North American moldmakers declined. The Mold Business Index (MBI) for July 2012 is 48.9 (a value under 50.0 indicates a decrease for the month). The latest MBI value is a 5.6-point decrease from the June value of 54.5, and it is a 1.1-point decrease from the 50.0 posted in July of 2011.

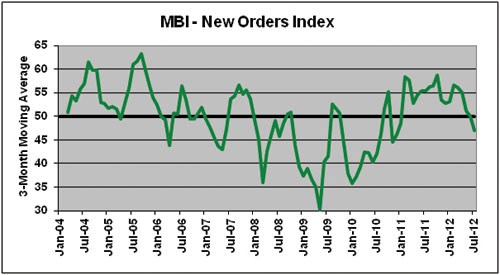

For the third straight month, a drop was reported in the important New Orders category. This drop in orders was only partially offset by gains in Production and Employment levels. Supply conditions remain unfavorable, but they do not appear to be getting worse. Fewer respondents reported longer Supplier Delivery Times, and Materials Prices were unchanged overall. Mold Prices were steady-to-weaker. Future Expectations slipped a bit, but remain optimistic.

At the present time, the U.S. economy is struggling to maintain a real growth rate in the 2%-range. This is well below the rate needed to generate a broad array of new jobs and boost household incomes back on a sustainable upward trajectory, but it is still definitely better than a recession. We do not expect the growth in the economy to accelerate anytime soon; however, the economic data released in the past few weeks indicate things should not get much worse. Employers added 163,000 jobs in July, which was the strongest monthly increase since February. One month does not constitute a trend, but it is an indicator that business confidence is turning the corner and that the recovery in the labor market is gradually improving. Another positive sign is that personal income growth escalated 0.5% in June, the biggest gain since March.

The manufacturing sector has been one of the bright spots in the economy during the past few quarters, but it is starting to show signs of strain. The ISM Manufacturing Index in July was below the breakeven level of 50 for the second consecutive month. On the positive side, capital spending by businesses grew at a decent rate in the second quarter, and capital goods shipments posted 5% annualized growth in each of the first two quarters of 2012. These are important indicators of demand for new molds and tooling. Firms still intend to invest in equipment this year, as recent Fed surveys of plans for capital spending over the next six months remain upbeat.

This improvement in the macroeconomic data notwithstanding, demand for new molds slowed again in July. The New Orders component for our MBI mustered only a 45.7. The slippage in this category is also apparent in the recent downward trends in Backlogs, Mold Prices, and Future Expectations. At 51.1, the Production sub-index indicates that moldmakers are maintaining their workloads despite the fact that new orders have slowed. The Employment component decelerated but remained well into expansionary territory. Its value of 57.4 indicates that shops are still trying to hire qualified workers. The Backlog component suffered a significant drop this month to 43.6.

The Mold Prices sub-index for June is 50.0. Mold prices have rebounded a bit this year, but a few respondents still report that strong pressure on prices persists. The prices paid for materials and components are still rising for some shops, but the upward momentum in prices has weakened. The sub-index for Materials Prices this month is 50.0. The Supplier Delivery Times component is 45.7, so delivery times are slowly stabilizing. There was a small decline in offshore orders, as the Export Orders sub-index is 46.8.

The most-cited problem confronting North American moldmakers in recent weeks is the shortage of skilled labor. Other problems receiving multiple mentions are: demands from customers for longer payment terms, shorter lead-times, and lower mold prices; uncertainty about the U.S. economy and the federal government; and foreign competition, particularly from China.

The Mold Business Index is based on a monthly survey of North American mold makers. Using the data from this survey, Mountaintop Economics & Research, Inc. calculates a diffusion index based on 50.0. A value above 50.0 for the MBI indicates that business activity expanded when compared with the previous month, and a value below 50.0 means that business levels declined.

Related Content

The Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

Read MoreOEE Monitoring System Addresses Root Cause of Machine Downtime

Unique sensor and patent-pending algorithm of the Amper machine analytics system measures current draw to quickly and inexpensively inform manufacturers which machines are down and why.

Read MoreSteps for Determining Better Mold Prices

Improving your mold pricing requires a deeper understanding of your business.

Read MoreMold Builder Uses Counter-Intuitive Approach for Mold Challenges

Matrix Tool Inc. answers customers’ hard questions with creative solutions for cavity spacing, tool sizing, runner layout and melt delivery that reveal the benefits of running in a smaller press size at lower cavitation but higher yield.

Read MoreRead Next

Overall Business Activity Held Mostly Steady

Total Mold Business Index for November 2009: 50.0

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More

_300x250 4.png;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)