End Market Report: Aerospace/Defense & Packaging

Plastics Packaging Outlook: Moderate Growth in 2012, and Aerospace/Defense Spending Outlook.

Plastics Packaging Outlook: Moderate Growth in 2012

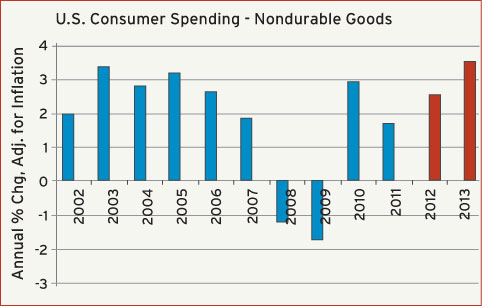

Our forecast for the U.S. market for plastics packaging products in 2012 is positive, but the overall growth rate will be moderate by historical standards. The biggest end markets for packaging products are all consumer non-durables. After adjusting for inflation, consumer spending for non-durable goods has registered an average annual gain of 1.8% in the past decade. Growth is expected to be stronger in the next two years due to a gradual recovery in the overall U.S. economy. We predict that real GDP will expand by nearly 3% this year, and this will push the demand for packaging up by 3 to 5%.

The growth in demand for plastics packaging has exceeded the growth in spending for non-durables in recent years, and this trend will likely continue for the foreseeable future. Innovations in the design and manufacture of plastics materials and products have resulted in lower production, shipping, and storage costs for many types of non-durables, and it has also created some totally new products.

The price of plastics resins will be a big problem for the plastics packaging sector this year. Resins prices follow the trend in crude oil prices, and as the global economy starts to recover, the trend in crude oil prices can only go up. Higher energy prices favor the use of many types of plastics packaging in the long-run, but high materials costs will be a problem for some processors in the short-term.

Other issues gaining momentum are concerns about the perceived problems with health, the environment, and recycling/disposal of plastics packaging products. Bag bans, plastics bottle de-selection, and conflicting stories about biodegradability and recyclability will have an increasing effect on consumer demand for plastics products.

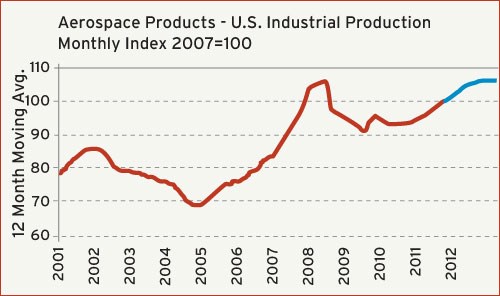

Aerospace/Defense Spending Outlook

Both the short- and long-term trends in spending for aerospace products are promising on net, but this market is very difficult to forecast. On the positive side, the Defense Department recently announced its plans for the next generation of fighter jets. These planes will possess amazing capabilities and will come with an enormous price tag. They will incorporate a large number of parts made from composite materials, so the needs for new molds, dies and tooling will be substantial. The problem is that it is very difficult for a new moldmaker to get a piece of this action.

There are some other factors that cloud the outlook. One is that the U.S. government is under increasing scrutiny to reduce its budget deficit. It is not likely that the defense portion of the budget will be cut dramatically, but it is possible. This could have an effect on the number of new planes that get ordered. Another factor is the amount of geopolitical uncertainty and upheaval in the world. America is not about to concede air superiority to any other country, and if fighting breaks out somewhere else, then the demand for new aerospace products will most likely rise. All of this means that the inherent uncertainties in both global and domestic politics will be the likely cause of future changes in the aerospace industry, not the expansion and contraction phases in the traditional business cycle.

The fastest growing aerospace segment is un-manned aircraft (drones). These planes are cheaper to make, cheaper to operate, less dangerous to their pilots and they are more effective at performing their tasks. These aircraft also use a substantial amount of plastic and composite parts. Military deployment of drones will continue to rise, and we can also expect a sharp rise in civilian use of drones, particularly for law enforcement.

Related Content

How to Solve Hot Runner Challenges When Molding with Bioresins

A review of the considerations and adaptations required to design hot runners and implement highly productive injection molding operations.

Read MoreSumitomo (SHI) Demag Plans for ‘Electric’ K 2025 - Booth #

Debuts include an all-electric multicomponent IntElect 350t combined with a SAM-C20 robot and two high-speed PAC-E machines targeting high-speed packaging applications.

Read MoreR&D Drives Innovation and Problem-Solving at Michigan Blow Mold Builder

Mid-America Machining focuses on reshaping designs, “right weight" initiatives, continuous improvement and process refinement to enhance moldmaking efficiency.

Read MoreHammonton Mold, ADOP France Forge Strategic Partnership in Injection Blow Moldmaking

Hammonton Mold Inc., a leading full-service mold shop based in New Jersey specializing in injection blow molds (IBM), proudly announces its official partnership with ADOP France, a prominent IBM mold manufacturer based in Normandy, France.

Read MoreRead Next

Overcoming Pain Points in Moldmaking with AI

Shops that embrace AI as a tool, not a threat, can enhance efficiency, preserve expertise, and attract tech-savvy talent.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More