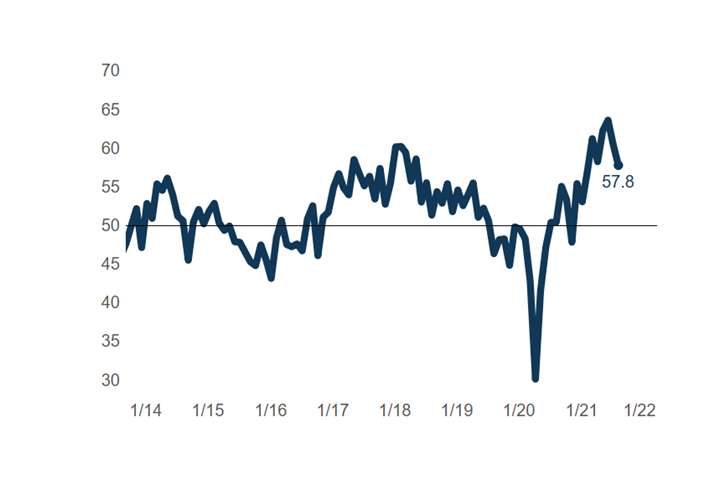

Moldmaking Index Reports Slowing Expansion for Second Sequential Month

Index reports sequentially slowing months for first time in 2021, with total new orders and export activity breaking a longstanding equilibrium.

The Moldmaking Index declined in absolute terms for a second sequential month during August. This is the first time the Index has done so since the fourth quarter of 2020.

The Moldmaking Index fell nearly three points in August to close at 57.8. The decline was caused in part by a nine-point and two-point decline in production and employment activity respectively. The reading for supplier deliveries—which monitors order-to-fulfillment timeliness— declined by nine points, signaling that a growing minority of surveyed participants experienced same or shorter order-to-fulfillment times in August. Overall, this latest reading was still well above historic norms.

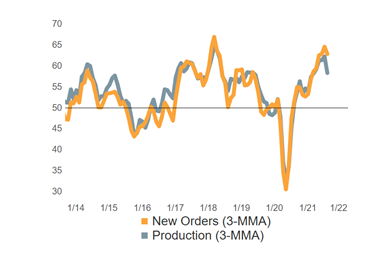

New orders activity for 2021 greatly exceeded that of production in August, breaking a longstanding equilibrium that could elevate future backlog and pricing power readings.

Total new order and export order readings were only slightly lower relative to their July readings and continued to signal strong demand. August’s nine-point spread between new orders and production readings represents one of the largest production “deficits” in the history of the Index going back to 2011. In the past, these measures maintained a close relationship, with only a minimal spread between their monthly readings, and even less so any sizable production deficit. Should the inversion of their long-held relationship persist, moldmakers and molders could experience both elevated backlog activity and further heightened pricing power. Increased pricing power would both mitigate rising production costs and protect operating margins.

Related Content

-

Moldmaking Index Suggests Positivity Moving into 2025

Future business expectations surge on the heels of improvements across all components.

-

Moldmaking Activity Contraction Slows in August

Future business expectations still improving, but more slowly.

-

Moldmaking Accelerated Contraction in June

June’s moldmaking index took a relatively steep downward turn, landing at a new low for the year.

.jpg;width=70;height=70;mode=crop)