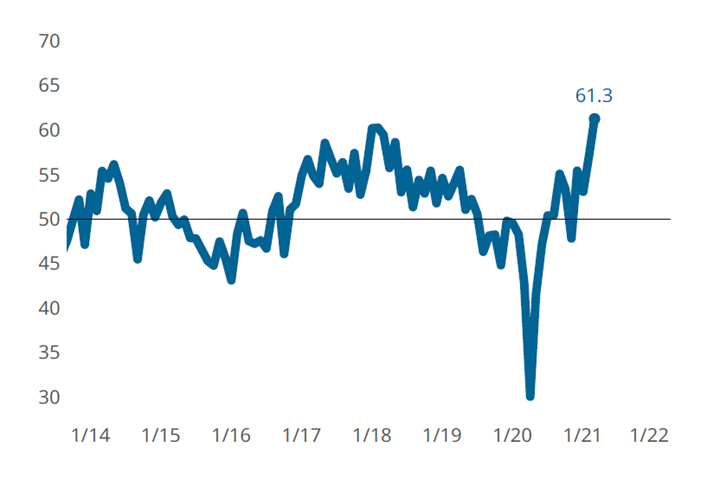

Moldmaking Index Indicate An All-Time High for 2021

An 8-point gain for March Index indicates slowing order-to-fulfillment times paired with a rapid increase in orders and exports demands, taking the Index to an all-new high.

The Moldmaking Index set a new all-time high in March as the combination of lackluster supply chains and rapidly strengthening new orders sent both measures higher. The resulting imbalance of supply and demand is showing itself in the form of higher material costs for manufacturers.

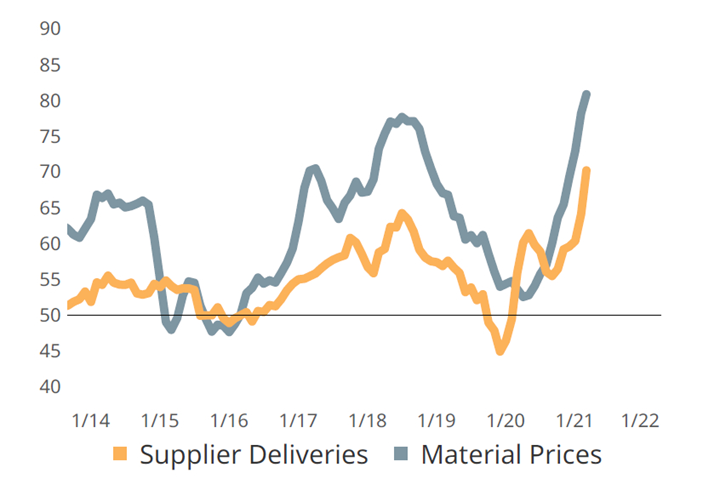

The Moldmaking Index expanded rapidly during March with an 8-point gain that brought the Index to an all-time high of 61.3. All six components of the Index reported expansionary readings led by supplier deliveries, new orders and production activity. The vastly higher reading for supplier deliveries compared to historical readings indicates that an unprecedented proportion of manufacturers are facing slowing order-to-fulfillment times which will slow production. Pairing this with rapidly strengthening new orders and exports demand will only increase the odds that consumers should prepare for price shocks.

Understanding industry conditions using a diffusion index like the Moldmaking Index can be difficult. The best way to understand the significance of two different values for the same measure is to realize that a proper baseline for comparison starts at 50 and not zero. Keeping this in mind, if one compares the current supplier delivery reading of nearly 77 to the prior peak reading of 65, that 11-point spread would necessitate an 80% increase in the number of survey respondents reporting worsening supply chain conditions.

Worsening supply chain conditions have constrained upstream volumes of the critical goods necessary for manufacturers, moldmakers and molders. This has resulted in nearly every moldmaker and molder experiencing rising material prices.

Related Content

-

Moldmaking Activity Has Contracted in a Desirable Direction

April’s moldmaking index contracted again but continued to inch toward a reading of 50 — the hurdle to cross before entering expansion.

-

Contraction in Moldmaking Activity Slowed According to GBI

The moldmaking index almost bounced back to November’s reading but stopped one point shy, as most components slowed or stabilized contraction in December.

-

Moldmaking Momentum Cools With January Index of 48.0

The Index continues to trend in the right direction while future business expectations climb.

.jpg;width=70;height=70;mode=crop)