Small Business Tax Planning

Deductions to help reduce your tax bill.

As a small business owner, it’s wise to familiarize yourself with some key deductions that may reduce your tax bill.

Employee Benefit Plans

You may deduct contributions to employee benefit plans (such as health insurance plans and retirement plans). Depending on your circumstances, the maximum contribution that you may deduct per employee in a qualified retirement plan can go up to:

| $100,000 or more $44,000 $41,000 |

With a Defined Benefit Plan With a 401(k) plan With a SEP-IRA or Keogh |

A special feature of the 401(k) and the Defined Benefit plans is that they can allow loans to be made from the plan to the account holder. A retirement plan loan can be up to 50 percent of the participant’s account balance, but in no case may the loan exceed $50,000.

Automobile Expenses

You can elect to deduct the actual expenses incurred (including gas, oil, tires, repairs, insurance, depreciation, and rent or lease payments) for the business-related portion of your car or truck expenses, or simply take the 2004 standard mileage rate of 37.5 cents per business mile. The 2005 mileage rates are 40.5 cents for business.

Social Security Taxes

You may deduct Social Security and Medicaid taxes paid to match required withholdings on employee wages, federal unemployment taxes, as well as real estate or personal property taxes paid on business assets.

Home Office

Depending on whether you use your home or other real estate for business purposes, you may deduct some or all of any mortgage interest paid, as well as some or all of the maintenance and repair expenses associated with the property. The cost of utilities and business supplies associated with business use also are deductible.

Depreciation

Depreciation may be taken on passenger cars, equipment used for entertainment or recreational purposes (i.e., photographic equipment, cell phones and computers), as long as these items are used solely for the business.

Increased Expensing for Your Business

To stimulate the economy, Congress increased the amount that businesses can expense or “write off” immediately from $25,000 to $100,000. For 2003, 2004 and 2005, firms that put less than $400,000 of assets in use in a year can expense up to $100,000 of the cost in lieu of depreciation. The starting point for the investment limitation phase-out increased from $200,000 to $400,000. The dollar limitations are indexed for inflation: $102,000 in 2004 and $105,000 in 2005.

Professional Fees

You may deduct professional fees, such as those paid to a lawyer or accountant.

Meals and Entertainment

You may deduct 50 percent of meal and entertainment expenses associated with the conduct of your business. This category is coming under increased scrutiny by the IRS so it behooves you to document the business purpose associated with the meals and entertainment.

State and Local General Sales Tax

Beginning in 2004, you will have the option of electing to take an itemized deduction for state and local general sales taxes in lieu of the itemized deduction provided for state and local income taxes.

Charitable Donations of Vehicles

Starting in 2005, the deduction allowed for a donated vehicle will generally be limited to the gross proceeds from the sale of the vehicle by the charitable organization.

Remember to keep on file the records and documentation necessary to substantiate all of your deductions. You should consult a tax preparer or professional tax advisor to determine how specific tax rules may impact your individual situation.

Related Content

Steps for Determining Better Mold Prices

Improving your mold pricing requires a deeper understanding of your business.

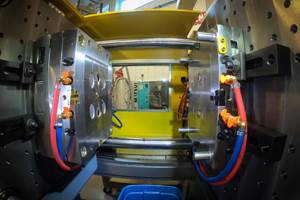

Read MoreThe Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

Read MorePredictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreMaking Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

Read MoreRead Next

How to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

_300x250 1.png;maxWidth=300;quality=90)

.png;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)