From its inception, the focus of this column has been the Mold Builders Index, which reported business conditions of mold builders only. However, since December 2011 Gardner Business Media, publisher of MoldMaking Technology, has been surveying its entire readership of durable goods manufacturers. With this expanded survey, Gardner is providing data on business trends for all of the markets it serves.

The expanded survey and additional data means that this column can enhance its reporting from the business trends for mold builders to the business trends for the entire moldmaking industry, which is the focus of this magazine. Now, this column will report on the Moldmaking Index. However, because of the enhanced data collection, indices can be created for specific parts of the moldmaking industry, including mold builders, mold buyers, regions of the country and plant sizes. While the column will highlight some of these specifics, most of the information will be found online (we will let you know when that website is ready). We think you will find the enhanced survey and expanded data helpful in managing your business.

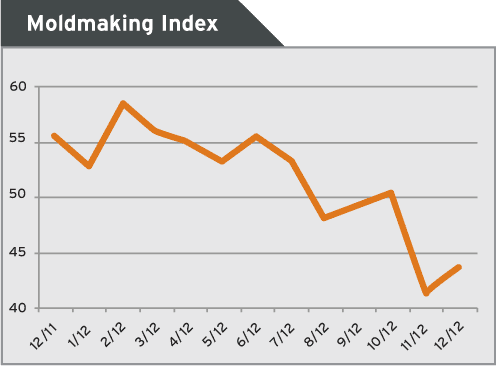

For the sixth straight month, a survey of the North American moldmaking industry indicates that overall activity levels continue to decline. The Moldmaking Index for December 2012 is 43.6 (a value under 50.0 indicates a decrease in business levels for the month). The latest index value is a 2.4-point increase from the November value of 41.2, but it is an 11.9-point decrease from the 55.5 posted in December 2011.

A drop was reported in the New Orders category for the fifth straight month. Supply conditions, as measured by the Supplier Delivery Times and Materials Prices components, were mixed when compared with the previous month--supplier delivery times were steady but there was a significant rise in materials prices. Prices Received was steady, though the gains in prices received are still not keeping pace with the increases in costs for materials. Future Expectations rebounded from a sharp drop in November.

The New Orders component is 41.8 in the latest month. The trend of declining new orders over the past few months continues to result in diminishing Backlogs. The Backlog sub-index is 36.0 for December. The Production sub-index of 42.8 is still below the breakeven mark of 50, but it is significantly better than the previous month. The Employment component is 46.4, which means that payrolls decreased for the second straight month.

Prices received are suffering a gradual decline over the last four months. The Prices Received sub-index for December is 49.6. The sub-index for Materials Prices exhibited a jump this month to 64.4. The Supplier Delivery Times component is a mostly steady 51.4. There was a significant decline in offshore orders last month, as the Exports sub-index is 43.4.

The Moldmaking Index is based on a monthly survey of subscribers to MoldMaking Technology magazine. Using the data from this survey, Gardner Research calculates a diffusion index based on 50.0. A value above 50.0 for the index indicates that business activity expanded when compared with the previous month, and a value below 50.0 means that business levels declined.

Related Content

The Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

Read MorePredictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreMaking Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

Read MoreThe Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MoreRead Next

Reasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read More

.png;maxWidth=300;quality=90)

_300x250 3.png;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=970;quality=90)