Decoding Reshoring: Motivations, Challenges and Technological Influences

Harry Moser, founder and president of the Reshoring Initiative, sits down for a Q&A on the motivations behind reshoring decisions, offering insights into economic, strategic and regulatory considerations.

The U.S. has experienced an unprecedented 14 years of manufacturing employment growth as millions of jobs have been reshored, according to the U.S. Bureau of Labor Statistics. Now is the time for U.S. shops to invest in the newest technologies to become competitive. Photo Credit: Stock, Copilot

The U.S. has experienced an unprecedented 14 years of manufacturing employment growth as millions of jobs have been reshored, according to the U.S. Bureau of Labor Statistics. Now is the time for U.S. shops to invest in the newest technologies to become competitive. Photo Credit: Stock, CopilotHarry Moser, founder and president of the Reshoring Initiative, sits down for a Q&A on the motivations behind reshoring decisions, offering insights into economic, strategic and regulatory considerations.

Q: What factors are currently driving the reshoring of molds and tooling to the United States and Canada?

Harry C. Moser, founder and president, Reshoring Initiative: The reshoring of molds can be evaluated from three perspectives:

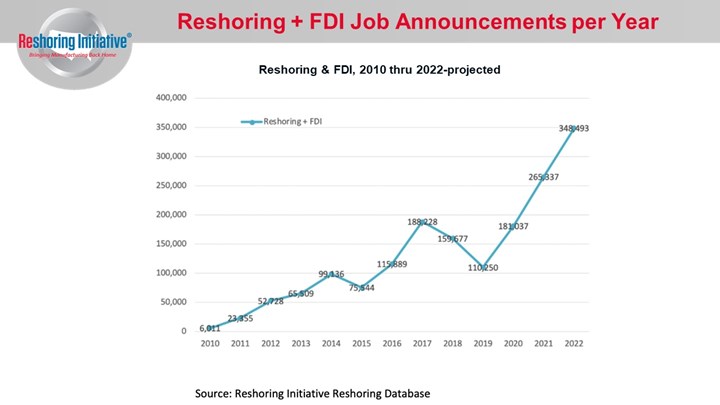

(1) An increase in the number of molds due to more end products being assembled in North America. True. The number of jobs reshored per year has increased from 6,000 in 2010 to 350,000 in 2022. This general trend of reshoring has been booming, driven by factors such as geopolitical risks (GPR) and tariffs.

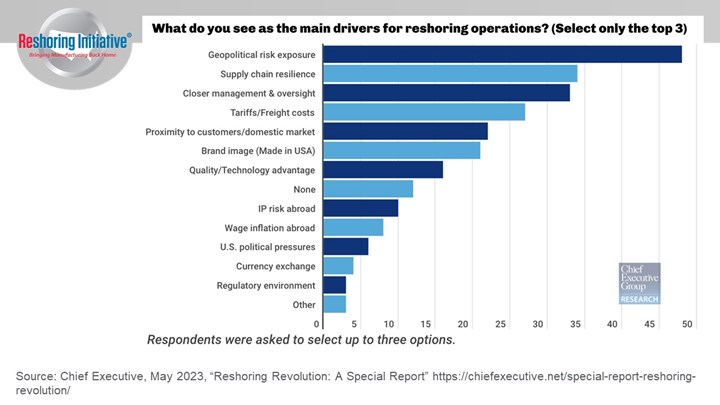

GPR is the probability in one year of a major disruption in trade resulting in the cessation of imports from that country to the U.S. as a result of an adverse geopolitical event. The importance of factoring in geopolitical risk when making sourcing decisions for a business has surged in the last few years to become the #1 driver, so the Reshoring Initiative introduced a tool quantifying the geopolitical risk for products from each country, which serves as a starting point for assessing your or your customers’ business’ geopolitical risk exposure.

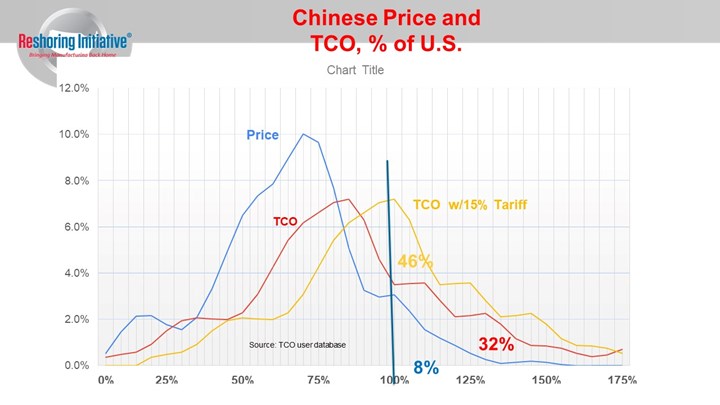

We are also revising the Total Cost of Ownership (TCO) Estimator to include geopolitical risk, ESG and identifying components subject to Section 301 tariffs. Most companies make sourcing decisions based solely on price, often resulting in a 20 to 30% miscalculation of actual offshoring costs. The TCO Estimator is a free online tool that helps companies account for all relevant factors — overhead, balance sheet, risks, corporate strategy and other external and internal business considerations — to determine the true total cost of ownership. Using this information, companies can better evaluate sourcing, identify alternatives and even make a case when selling against offshore competitors.

(2) A higher percentage of plastic parts are being molded domestically. True. The reason is that injection molding is a highly competitive process in the U.S., with factors like competitive resin prices and automation mitigating higher labor costs.

For example, resin prices are competitive in the U.S. due to fracking, as opposed to steel and aluminum, which are often higher priced in the U.S. Injection molding is a highly automated process that reduces the impact of the U.S.’ higher labor costs Many plastic parts do not pack well, yielding increased freight cost per pound.

(3) A higher percentage of molds running in the U.S. being sourced here. Probably not true. Moldmaking demands scarce, high-skill labor. Moldmakers must focus on automation, recruitment/training and advocating for more assembly and part sourcing locally. Using the TCO Estimator can present a more objective view of mold costs, including advantages like delivery, initial rework, life, cycle time, etc.

Q: How has the reshoring trend impacted the competitiveness of the United States and Canada in the global manufacturing landscape?

Moser: Reshoring has significantly improved competitiveness by demonstrating its economic feasibility, closing supply chain gaps that increase the availability of components and materials, increasing capacity utilization, driving investment and productivity, and improving skilled workforce recruitment.

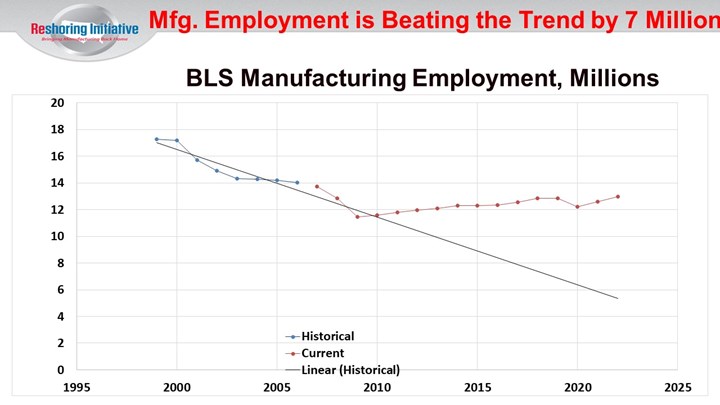

Manufacturing employment has seen unprecedented growth, making careers in the industry more desirable. For decades, manufacturing careers were seen as high risk because of the likelihood of offshoring and the continued shrinkage of manufacturing employment. However, we have experienced an unprecedented 14 years of manufacturing employment growth as millions of jobs have been reshored. This new investment makes manufacturing jobs more desirable to the next generation.

Photo Credit: Bureau of Labor Statistics (BLS)

End-of-year manufacturing employment data from the U.S. Bureau of Labor Statistics (BLS) indicates a resilient uptrend since 2010, briefly disrupted by COVID-19. The regression line, spanning from China joining the WTO to just before the Great Recession, reveals a potential alternative reality with 6 million fewer U.S. manufacturing workers. Notable shifts in offshoring and reshoring rates, as indicated by the graph, underscore the dynamic forces shaping manufacturing employment.

Also, our leading competitor, China, has a projected 30 million manufacturing worker shortfall in the next 5 or 10 years. Most alternative countries do not have the capacity or infrastructure to take on the work China loses.

Q: What challenges or obstacles are companies facing in the process of reshoring molds and tooling?

Moser: The primary obstacle is the higher factory prices, sometimes up to 100% more compared to China. Using the TCO Estimator can help customers understand the value better. It's crucial to strengthen our capacity and productivity by advocating for a shift in resources from liberal arts degrees to apprenticeships and, also, a reduction in the value of the USD by 20 or 30%.

Delivery time is another challenge, which can be addressed through a companywide Quick Response Manufacturing (QRM) strategy to reduce lead times across the company. Time is the central management strategy for QRM, making it well suited for companies that provide custom-engineered products with a high-mix, low-volume profile. QRM is often used alongside existing improvement initiatives such as Lean and Six Sigma methodologies.

Last but not least, effective recruitment and training strategies.

Q: Are there specific industries or types of molds and tooling that are more inclined to be reshored, and why?

Moser: In theory, the easiest tooling to reshore are molds that have some of these characteristics: big and heavy; simple or not labor-intensive; likely to need rework upon delivery; involve many molding cycles; and require intense customer/supplier cooperation.

Q: How are technological advancements and innovation playing a role in the decision to reshore molds and tooling?

Moser: While advanced manufacturing should reduce labor hours and improve delivery, U.S. manufacturing productivity has been rising less than in China over the past decade (about 0.5%/year vs. 6%/yr) as Chinese shops were busy, profitable and took a longer-term focus. It’s time for U.S. shops to invest in the newest technologies to become competitive and leverage advancements in automation and digitalization.

Related Content

What is Driving Mold Lifecycle Management Digitalization?

OEMs are looking to partner with suppliers to share and track data across the supply chain for advanced intervention and process management.

Read MoreMMT Chats: Marketing’s Impact on Mold Manufacturing

Kelly Kasner, Director of Sales and Marketing for Michiana Global Mold (MGM) talks about the benefits her marketing and advertising, MGM’s China partnership and the next-generation skills gap. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

Read MorePredictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreWhat You Should Consider When Purchasing Modified P20 Steel

When buying P20 steels that have been modified, moldmakers must be aware of the variations and key issues that affect delivery, cost and lead times.

Read MoreRead Next

How to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.png;maxWidth=300;quality=90)

_300x250 1.png;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)