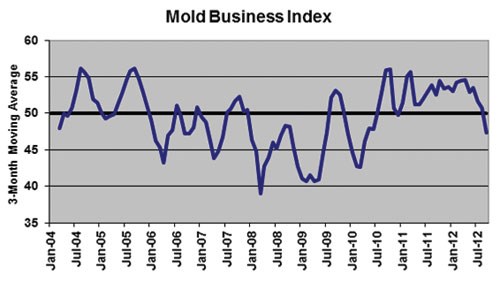

Future Expectations Remain Optimistic Despite Decline in Overall Activity

Total Mold Business Index for September 2012: 44.4

For the third straight month, our survey of North American moldmakers shows that overall activity levels declined with an MBI of 44.4—a 4.2-point decrease from the August value of 48.6 and a 6.8-point decrease from September 2011’s 51.2.

For the fifth straight month, there has been a drop in New Orders, but another increase in Employment levels. Supply conditions are worsening, as there was another increase reports of longer Supplier Delivery Times and higher Materials Prices when compared with August. Mold Prices were again steady-to-firmer, though it is unlikely that the gains in prices received for molds are keeping pace with the rise in the cost of materials. But through it all, Future Expectations remain quite optimistic.

The macroeconomic situation that we reported on last month has not changed much. Manufacturing across the board in the U.S. softened in the third quarter, and there is little to suggest that things will get better in the fourth quarter. Consumers and business leaders are still convinced that the prudent course of action at the present time is to hold off on any major buying or investing decisions until after the election in November. This means that many sectors of the economy should pick up substantially in the first half of 2013. And in less than a year, our forecast calls for a real economic recovery to begin again.

This optimism stems from the fact that the unemployment figures are still gradually improving and the trend of rising prices for homes is slowly gaining traction. We expect these trends to continue regardless of who wins the upcoming election. And as home price and employment levels rise, aggregate demand for all types of manufactured products will rise as well. So for manufacturers of plastics products—not just plastics building materials, but all types of plastics products—future demand will rise as home prices escalate.

New Orders dropped last month, which pushed Backlogs down. Production stayed above the 50-line for a whole year before September, but it succumbed and fell into negative territory. These lower levels of new business, production and backlogs notwithstanding, the Employment component remained positive.

Mold Prices are firmer, but the prices paid for materials and components are rising at an accelerating rate. Materials Prices is 67.9 and Supplier Delivery Times is 39.7. It defies logic how demand for materials from moldmakers could get weaker in the third quarter, but supply conditions from their suppliers are getting tighter. There was no change in offshore orders. The most-cited problem confronting North American moldmakers in recent weeks is the shortage of skilled labor.

Related Content

-

OEE Monitoring System Addresses Root Cause of Machine Downtime

Unique sensor and patent-pending algorithm of the Amper machine analytics system measures current draw to quickly and inexpensively inform manufacturers which machines are down and why.

-

Leading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

-

How to Improve Your Current Efficiency Rate

An alternative approach to taking on more EDM-intensive work when technology and personnel investment is not an option.

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=970;quality=90)