Packaging Outlook Shifts With New Data

With a large portion of the industry having released its data for the first quarter, capital expenditures for the industry reported contracting growth.

The latest projections for revenues and earnings now contain estimates through the third quarter of 2021. According to these more distant projections, expectations are for less than 1% industry growth before accounting for inflation which could easily result in contracting real revenues and earnings in 2021.

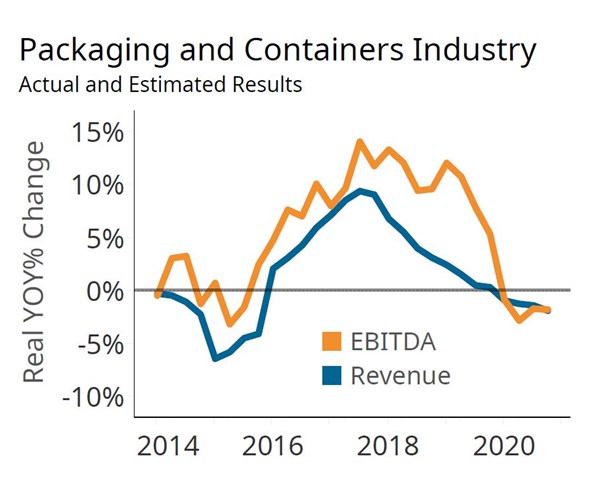

In February, Gardner provided a slowing-growth outlook for the packaging and container industry based on actual financial results from the third quarter of 2018 along with Wall Street’s consensus projections. At that time, capital expenditures had grown strongly over the trailing twelve months while earnings before interest, depreciation and amortization (EBITDA) were growing at nearly 15% and projected to grow even more quickly through the fourth quarter of 2019. The 2019 outlook for the industry at that time looked very promising.

With a large portion of the industry now having released its data for the first quarter of 2019 as of the time of writing, capital expenditures for the industry — which grew during 2018 at double-digit rates — reported contracting growth during the first quarter of the year. Between 2013 and 2017, the industry had booked an outsized portion of capital expenditures during the fourth quarter of each calendar year. 2018 not only saw the industry break this pattern, but fourth quarter 2018 capital expenditures were approximately 7% below the level recorded during the fourth quarter of the previous year.

The extended outlook for the packaging and containers market through 2020 has not significantly changed since Gardner’s last report. Earnings and revenue through 2020 are still projected to experience slowing growth. However, the latest projections for revenues and earnings now contain estimates through the third quarter of 2021. According to these more distant projections, expectations are for less than 1% industry growth before accounting for inflation which could easily result in contracting real revenues and earnings in 2021.

In April, Gardner’s plastics business index data — which broadly measures the plastics industry each month —continued to point to an industry that has strong expectations for the next 12 months. The average business sentiment index reading in the year-to-April period at 71.1 indicates that many plastics processors are optimistic about the remainder of 2019 and early 2020. The further a reading is above 50, the greater the indicated business activity, while readings below 50 indicate contracting business activity. Confirming the trend in Gardner’s business sentiment data is the survey’s employment activity data recorded among plastics processors. Through the first four months of the year, employment activity expanded, suggesting that more processors were willing to hire and train new employees. Since new employees are typically unprofitable to a business immediately upon their employment, they create upfront expenses for a business, as such growing employment readings imply that processors must have optimistic business expectations in order to expect that a new employee will generate a positive return in the longer-term.Related Content

-

Mold Builder Zahoransky, Koch Establish Cooperation for Personal Care Sector

The two companies join portfolio competencies and technologies to provide sustainable, environmentally friendly packaging solutions.

-

Customized CAM Strategies Improve Five-Axis Blow Mold Machining

The proper machining process and workflow can impact blow mold production, making your CAM software selection critical.

-

Compact Robotic Palletizer Easily Automates Packaging Process

The Cube cell, complete with a KUKA KR50-R2500 robot, is targeted for small- and medium-sized businesses looking to automate the palletization of their end product.

.jpg;width=70;height=70;mode=crop)

_300x250 1.png;maxWidth=300;quality=90)