Plastics Machinery Expectations and Shipments Stay Strong

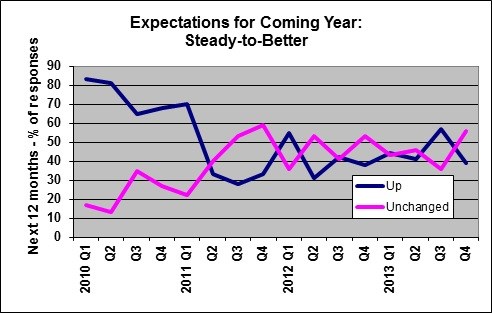

The Committee on Equipment Statistics of SPI conducts a quarterly survey of plastics machinery suppliers that asks about present market conditions and future expectations. Responses reveal an upbeat attitude that is broad-based across the industry. When asked about future expectations or market conditions, 87 percent of the respondents expect conditions to stay the same or even improve in the coming quarter, and 95 percent expect them to hold steady or get better during the next 12 months.

North America and Mexico are still the regions where the strongest gains are expected, but expectations slipped a bit for Europe and Latin America. As for the major end markets, the respondents expect that automotive, medical, and packaging will continue to be the strongest in terms of demand for plastics products and equipment. Expectations for the appliance and construction sectors were significantly improved.

You can hear more about moldmaking opportunities in the North American marketplace tomrorrow at 2pm (EST) durng the SPI/MMT (sponsored by DME Company) webinar: NAFTA Region Market Opportunities for Mold Manufacturers. Register Today!

Other data from the CES survey includes:

Business levels for manufacturers and suppliers of primary plastics machinery (injection molding, extrusion, blow molding, and thermoforming equipment) posted another strong quarterly performance in Q4 of 2013. According to statistics compiled and reported by the Committee on Equipment Statistics of SPI, shipments of primary plastics equipment for reporting companies totaled an estimated $335.1 million in Q4.

This was the strongest quarterly total for all of 2013. The Q4 total represented a gain of 3 percent when compared with the impressive total from Q3 of 2013, and it was just slightly lower than the outstanding total from Q4 of 2012. For 2013 as a whole, the total value for primary plastics equipment shipments was up a solid 8 percent when compared with the annual total from 2012.

The shipments value of injection molding machinery decreased 5 percent in Q4 when compared with the unusually large total from Q4 of 2012. The shipments value of single-screw extruders slipped 2 percent, but the value of shipments of twin-screw extruders spiked up 72 percent. The shipments value for blow molding machines jumped 91 percent in Q4. The shipments total for the volatile thermoforming equipment sector fell 34 percent in Q4 when compared with last year.

The CES also compiles data on the auxiliary equipment segment (robotics, temperature control, materials handling, etc.) of the plastics machinery industry. New bookings of auxiliary equipment for reporting companies totaled $101.3 million in Q4. This represented a 1 percent gain when compared with the robust total from Q3 of 2013. Precise year-ago comparisons for the auxiliary equipment data are not possible at the present time due to a significant change in the number of reporting companies for 2013. It can be reasonably concluded that the four-year uptrend in this data continued, and the quarterly and annual totals for 2013 represent a solid gain when compared with the comparable totals from 2012.

The gain in the CES data on plastics machinery shipments compares favorably to the increases in the two major data series compiled by the US government that measure activity levels in the industrial machinery sector. According to the Bureau of Economic Analysis, business investment in industrial equipment rose by 3 percent (seasonally-adjusted, annualized rate) in Q4 when compared with Q4 of 2012. The other important machinery market indicator, compiled by the Census Bureau, showed that the total value of shipments of industrial machinery escalated 25 percent in Q4.

The industry and survey analysis that appears in this media report was contributed by Mountaintop Economics & Research, Inc. (MER) (billwood@plasticseconomics.com).

Read Next

Are You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.jpg;maxWidth=300;quality=90)