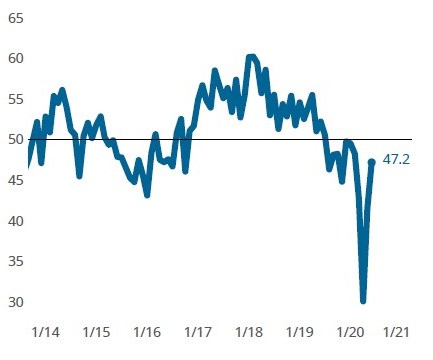

Moldmaking Industry May Have Found its Post-COVID Floor

The MoldMaking Index points to the expansion of new orders for the first time since COVID-19 shook the economy in March.

The Moldmaking Index moved higher again in June as all components reported less volatile readings. The Index has rebounded over 17 points since its April 2020 all-time low.

The GBI: Moldmaking increased during June to close at 47.2, marking a second month of increasing readings. Adding further encouragement to the top-line reading was that all sub-components of the Index, excluding supplier deliveries, reported improved numbers as well. Index readings which increase in absolute terms but remain below 50—the point representing “no change” compared to business activity in the prior month—indicate that a shrinking proportion of survey respondents are reporting contracting activity and a greater proportion are experiencing no change, or increasing activity. June’s overall reading was supported by new orders and production readings which came in above and near at a reading of 50.

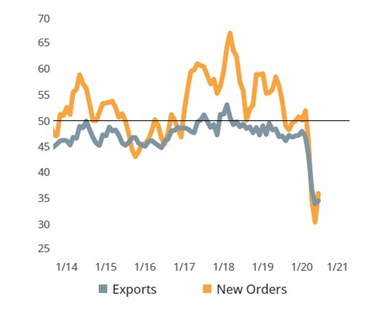

Moldmaking new orders registered expanding growth for the first time since COVID’s unprecedented disruption to the manufacturing sector. Should new orders continue to register future months of expanding activity, it will be a clear sign that the industry has found a floor from which it can begin to recover.

The brightest spot in June’s data included an expansionary reading in the forward-looking new orders component. This is the first time the GBI has seen an expansionary new orders reading since COVID-19 took hold of the economy in March. Breaking through the 50 line indicates that a majority of survey participants experienced flat or increasing new orders compared to May, thus setting a potential floor on the contraction in new orders sparked by the disruption the economy has experienced over the pandemic. Lastly, while index components, including production and employment often lag the new orders reading, these components may see improved readings in the coming months.

Related Content

-

Women Impacting Moldmaking

Honoring female makers, innovators and leaders who are influencing our industry's future.

-

Mold Builder Uses Counter-Intuitive Approach for Mold Challenges

Matrix Tool Inc. answers customers’ hard questions with creative solutions for cavity spacing, tool sizing, runner layout and melt delivery that reveal the benefits of running in a smaller press size at lower cavitation but higher yield.

-

OEE Monitoring System Addresses Root Cause of Machine Downtime

Unique sensor and patent-pending algorithm of the Amper machine analytics system measures current draw to quickly and inexpensively inform manufacturers which machines are down and why.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)