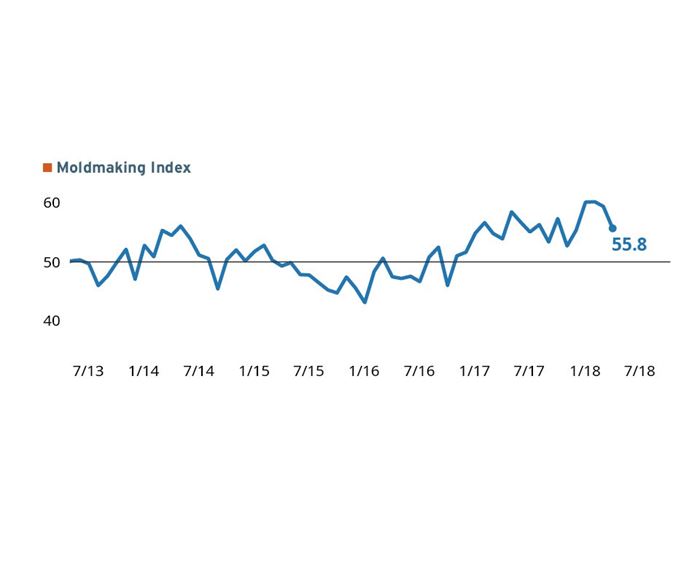

Moldmaking Industry Expansion Slows from First-Quarter Pace

A mix of factors influence the Gardner Business Index (GBI): Moldmaking, at 55.8 for April.

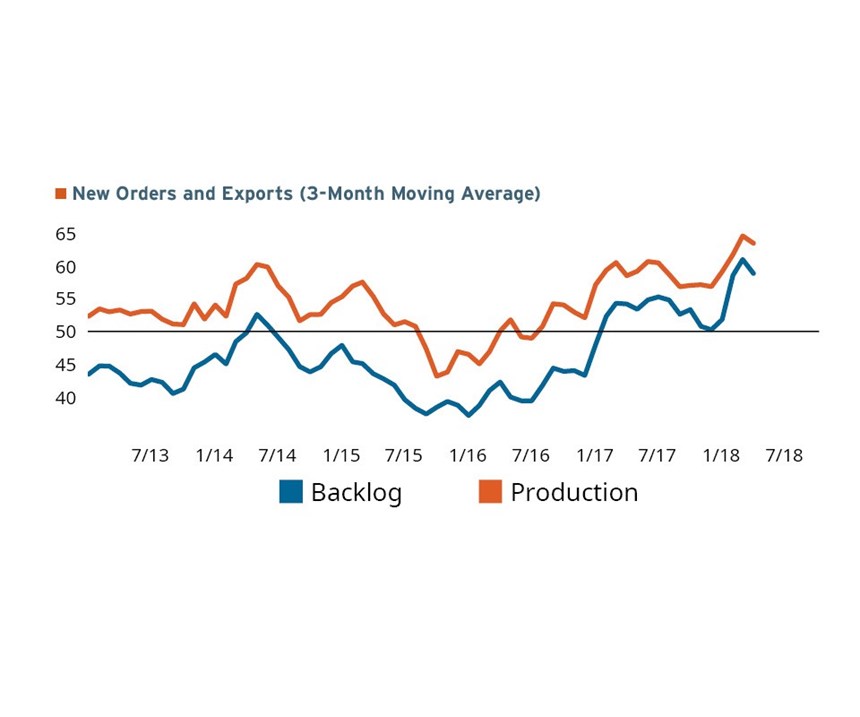

Registering 55.8 for April, the Gardner Business Index (GBI): Moldmaking fell nearly four points during the month after issuing a string of record-level readings earlier in the year. Compared to the same month one year ago, the Moldmaking Index increased by 3.2 percent. Gardner Intelligence’s review of the underlying data for the month reveals that growth in production, new orders and supplier deliveries drove the Moldmaking Index’s averages-based calculation higher while employment, backlog and a contraction in exports pulled the Moldmaking Index’s averages-based calculation lower. All components of the Moldmaking Index recorded lower values in April as compared to the prior month. The contraction in exports marks the first contraction of any Moldmaking Index component since November 2017. This four-month period also marked the end of the longest expansionary run of all of the Moldmaking Index’s components in recorded history.

April’s data indicates that the moldmaking industry is continuing to work off the surge in new orders initiated at the beginning of the year. Beginning with a peak in new-orders growth in January, production, supplier deliveries and backlog all established new recent highs from which they are now retreating as moldmakers move through the initial strain of working to fulfill the earlier rush of new orders. Backlog growth which spiked in February—lagging the spike in new orders by one month—slowed in April to nearly the average expansion level experienced in 2017.

April’s Moldmaking Index reading solely for custom processors moved lower as well and in a similar manner to the broader Moldmaking Index. Unlike the overall Moldmaking Index, custom processors reported faster growth in new orders and backlogs. Surprisingly, custom processors indicated that supplier deliveries contracted during the month. This partially may explain the concurrent decline in the production reading.

About the Author

Michael Guckes

Michael Guckes is the chief economist for Gardner Intelligence, a division of Gardner Business Media (Cincinnati, Ohio, United States). He has performed economic analysis, modeling and forecasting work for nearly 20 years among a range of industries. He is available at mguckes@gardnerweb.com.

Related Content

-

The Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

-

Steps for Determining Better Mold Prices

Improving your mold pricing requires a deeper understanding of your business.

-

Women Impacting Moldmaking

Honoring female makers, innovators and leaders who are influencing our industry's future.

.jpg;width=70;height=70;mode=crop)

_300x250 1.png;maxWidth=300;quality=90)