Total MBI for October 2015:

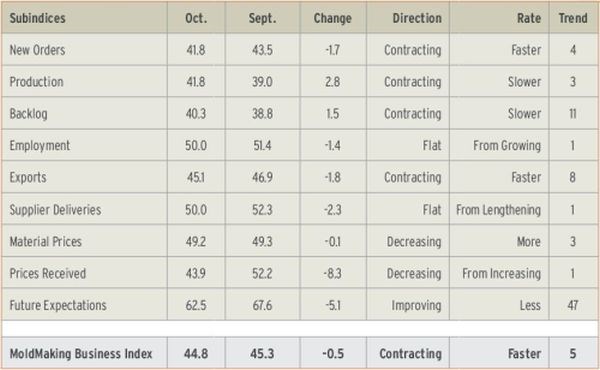

With a reading of 44.8, the MoldMaking Business Index showed that the industry contracted in October for the fifth month in a row, with the contraction rate having consistently accelerated in each of those months.

With a reading of 44.8, the MoldMaking Business Index showed that the industry contracted in October for the fifth month in a row, with the contraction rate having consistently accelerated in each of those months. The index generally has trended lower since February, and in October, the industry contracted at its fastest rate since December 2012.

New orders contracted at an accelerating rate for the fourth month in a row to their lowest level since November 2012. Production contracted for the fourth time in five months, but after a particularly shop drop in the two months prior, this index did improve somewhat in October. New orders have been above production for a couple of months, and, as a result, the backlog index contracted at a decelerating rate in September and October. Employment was unchanged after expanding the previous three months. Because of the strong dollar, exports continued to contract in the month, and supplier deliveries were unchanged after having lengthened in September. This index has been relatively low, however, indicating slack in the supply chain.

The material prices index contracted for the fifth time in nine months, the only five months that the index has been below 50. This reflects the fall in almost all commodity prices due to the weak global economy. While prices received increased in September and had been trending up since June, this index saw a significant drop in October. Prices received decreased in the month at their fastest rate since the index began in December 2011, and future business expectations fell to their lowest level since November 2012.

The index for companies with more than 250 employees has jumped dramatically to 71.0 from 41.7 in August. Since October 2014, these larger companies have expanded rapidly. All other plant sizes struggled in September and October, however, and the smallest facilities, those with fewer than 50 employees, contracted at their fastest rate since early 2013.

Custom processors contracted for the fourth month in a row, posting their lowest index since September 2014. Metalcutting job shops contracted for the fifth time in six months, falling below 40, which was their lowest level since the survey began.

While the West was the only region to expand in September, all six regions contracted in October. The West, North Central-East, and North Central-West regions contracted at similar rates, while the South Central region plunged to its lowest level since April.

Future capital spending plans remained well below average. Compared with one year earlier, they were still contracting at a fairly significant rate in October, however the rate of contraction has decelerated quite dramatically.

Related Content

-

From Injection Mold Venting to Runnerless Micro Molds: MMT's Top-Viewed June Content

The MoldMaking Technology team has compiled a list of the top-viewed June content based on analytics. This month, we covered an array of topics including injection mold venting, business strategies and runnerless micro molds. Take a look at what you might have missed!

-

Transforming Moldmaking into Digital Industrial Manufacturing

Moldmaking and digitalization is at the core of this global industrial manufacturing company’s consolidation and diversification plan.

-

The Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)

_300x250 3.png;maxWidth=300;quality=90)