Packaging and Electronics

Stong food/beverage industry means more packaging; electronics seeing weak growth.

Strong Food/Beverage Industry Means More Packaging

Real disposable income was at an all-time high of $12,464 billion (seasonally adjusted at an annual rate) in February, having grown 2.7 percent over one year earlier and virtually identical to the rate of growth in the previous three months. It was the fourth month in a row that income grew less than the historic average of 3.1 percent, however, and all income data since October was revised lower. The annual rate of change fell to 3.2 percent in the month, which was the fourth straight that the annual rate of growth decelerated. While this was still above the historical average, it was the slowest rate of annual growth since April 2015.

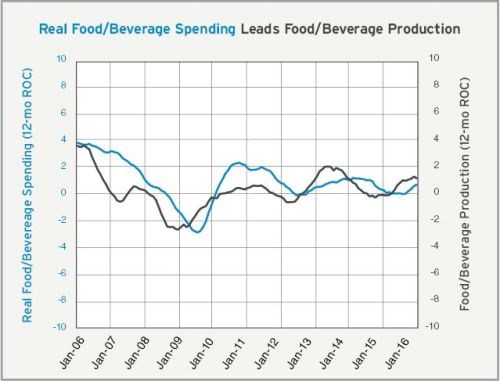

Consumer spending on food and beverage started 2016 with very strong growth, increasing more than 1.3 percent month-over-month in both January and February compared with 2015. As a result, the annual rate of change in February grew at the fastest rate since December 2014.

Other than in 2003, food and beverage production in March grew at its fastest rate in nearly a decade. The rate of growth has accelerated quite sharply since the middle of last year. One would expect that increased consumer spending would lead to more production, and this, in turn, should increase the demand for plastics packaging.

Electronics Seeing Weak Growth

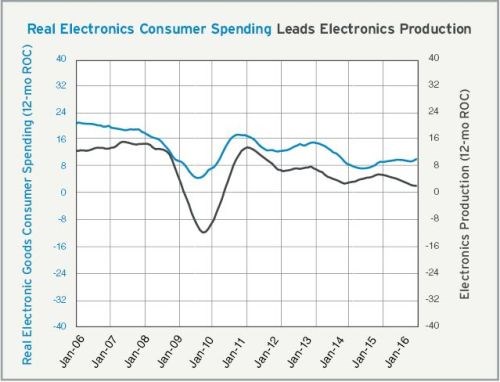

Real disposable income is an excellent leading indicator of consumer electronics spending (see above for the analysis of real disposable income). Real electronics spending never contracts in the United States, but the rate of growth generally has decelerated since 1999 when it reached its peak of just over 30 percent. Since 1999, electronics spending has grown at a slower and slower rate on a steady trend line. Despite the fairly strong growth in real disposable income, consumer electronics spending did not see as much of a bump as expected based on historic trends and correlations. Now that income growth is slowing, consumer spending on electronics should see slower growth in the upcoming months.

Electronics production has followed a fairly similar path to electronics spending. Production reached its peak rate of growth in 1998, and has grown at a steadily slower and slower rate since. There were also two year-long periods of contraction during the last two recessions. Currently, electronics production has grown at a decelerating rate for about a year. Other than the two contractions, the current annual rate of growth is the slowest since the early 1990s, and, based on the leading indicators, it is likely that electronics production will continue in its trend of decelerating growth.

Related Content

-

Compact Stack Mold for Thin-Wall Packaging

Oerlikon HRSflow says the patent-pending design allows the use of smaller injection molding machines while still promising the high output a stack mold tool.

-

Innovative Mold Building Enhances Packaging Material Efficiency, Elevates Recyclable Design

A manufacturing-focused design and optimized tooling enhance material efficiency in packaging for a new medical instrument.

-

Customized CAM Strategies Improve Five-Axis Blow Mold Machining

The proper machining process and workflow can impact blow mold production, making your CAM software selection critical.

.JPG;width=70;height=70;mode=crop)