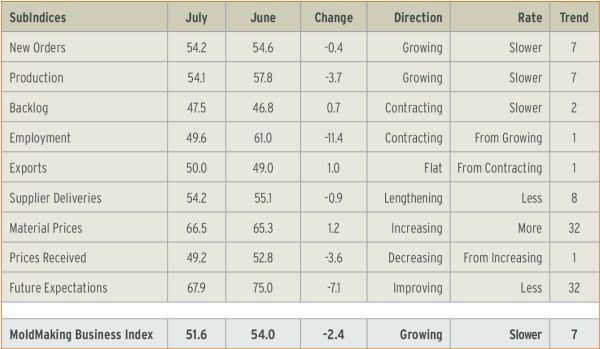

With a reading of 51.6, the MoldMaking Business Index showed that the moldmaking industry expanded in July for the seventh straight month and the ninth time in 10 months. The rate of growth was the industry’s slowest since February, and the index has fallen noticeably the last two months, ending the industry’s accelerating growth trend that began back in 2013. Still, the index has been higher than it was one year earlier for five straight months. As a result, the annual rate of change is growing at its fastest rate since the index began in December 2011.

New orders grew for the seventh month in a row and the ninth time in 10 months, although the rate of growth was little changed from June. Production has expanded every month but two since January 2013, although the rate of increase has slowed sharply the last two months. Backlogs contracted for the second month in a row, but the backlog index is still higher than it was one year ago, which is a positive sign for future capacity utilization and capital equipment investment. Employment contracted at a very minimal rate in July, its first contraction since December 2013. Exports were flat, although the trend in exports has improved rapidly since February. Supplier deliveries continue to lengthen, but the lengthening has been slowing down since February.

Material prices have increased at a fairly constant rate since December 2013, and the rate of increase remains significantly higher than it was throughout 2013. Prices received contracted for the first time since April, and the prices received index has been largely flat in 2014. The combination of these two indices is putting a damper on profits. Future business expectations fell sharply in July to their lowest level since June 2013.

Metalcutting job shops (moldmakers) have grown for five straight months, and the rate of growth has been relatively strong and consistent. While custom processors (molders) had grown the previous four months, their business conditions were flat in July.

Future capital spending plans for the next 12 months were more than $1 million for the fifth month in a row. This is 15-20-percent higher than the historical average. Compared to one year ago, future spending plans increased 8.6 percent, the seventh month in a row of growth. The annual rate of growth decelerated slightly in July, but it remains relatively high.

To see the historical breakdown of our business index and each of its subindices, visit gardnerweb.com/forecast/moldmaking.htm.

Related Content

-

Mold Design Review: The Complete Checklist

Gerardo (Jerry) Miranda III, former global tooling manager for Oakley sunglasses, reshares his complete mold design checklist, an essential part of the product time and cost-to-market process.

-

Editorial Guidelines: Editorial Advisory Board

The Editorial Advisory Board of MoldMaking Technology is made up of authorities with expertise within their respective business, industry, technology and profession. Their role is to advise on timely issues, trends, advances in the field, offer editorial thought and direction, review and comment on specific articles and generally act as a sounding board and a conscience for the publication.

-

Steps for Determining Better Mold Prices

Improving your mold pricing requires a deeper understanding of your business.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)