Know Your Borrowing Options

Growing shops need two lenders to maintain profit margin: a bank and an equipment leasing company.

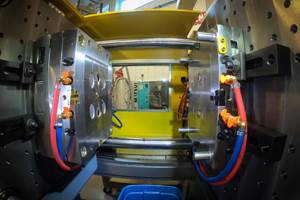

The cost of doing business in mold manufacturing has risen because of increases in capital equipment overhead. These increases in equipment costs are due to the advancement and evolution of today’s machinery. For example, moldmakers are now buying multitasking machines that do more and are therefore more expensive. This raises the question of how a company can continue to expand and still turn a profit.

Growing shops need two lenders to maintain profit margin: a bank and an equipment leasing company. A bank is an essential tool for growth, offering lines of credit and easy methods for financing real estate. An equipment leasing company, like a bank, can help you lease equipment, but it is an ideal resource for equipment acquisitions in particular. Accessing two different lenders allows you to borrow more money, and diversifying lenders enables you to establish more credit while also tapping into the specific benefits of a finance company that specializes in equipment acquisitions.

While banks are under pressure from auditors and operate under highly regulated loan structures, an equipment financing company operates sovereign of the FDIC and other regulators. Leasing through a finance company allows you to preserve your credit and monthly lease payments, and treat them as a business expense rather than as company debt.

Using a finance company also allows you to leverage borrowing capacity. You can borrow money from a bank, but a finance company can help you secure a lease as well, enabling you to expand at a competitive rate. The finance company also offers a variety of payment and buyout options, as well as tax incentives. For example, if the finance company offers an operating lease (one that is off the customer’s balance sheet), the leasing company depreciates the machine. In exchange, the customer gets a lower payment and expenses it on the profit and loss (P&L) statement rather than depreciating it.

In addition, while tax deductions can only be taken on the interest associated with bank-financed equipment costs, a true lease through a finance company can be entirely tax-deductible. Spending $200,000 on a machine, for example, would allow for a $25,000 first-year tax write-off and cash savings of $17,500.

When you lease through an equipment-specific financer, you won’t have restrictions placed on future borrowing, and you avoid the need to pledge any collateral. Since equipment leasing companies have machine knowledge, their leases commonly offer purchase options that better fit your company’s needs and growth. They know the collateral and understand its value. Most banks do not possess the necessary machining knowledge and require a 10- to 20-percent down payment. A lease offers 100-percent financing, with no money down, and can include soft costs like shipping and installation.

Equipment leasing companies also operate as transactional lenders, meaning they place greater value on a company’s equipment than on its overall cash flow and net worth. This is especially true if these asset-based lenders specialize in manufacturing and therefore understand machine tools. Finance companies also don’t deal with checking and savings accounts, while banks often require your commercial business before they will offer a loan.

While banks are important for many reasons, diversifying lenders offers greater flexibility for a company to expand its business and realize its full potential.

Related Content

Leading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

Read MorePredictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreTransforming Moldmaking into Digital Industrial Manufacturing

Moldmaking and digitalization is at the core of this global industrial manufacturing company’s consolidation and diversification plan.

Read MoreThe Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MoreRead Next

Finance: Seven Tips for Landing an SBA Loan

Here are a few tips to facilitate getting your SBA loan approved.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More

.jpg;maxWidth=300;quality=90)

_300x250 1.png;maxWidth=300;quality=90)