Gardner Industry Report: Medical & Electronics

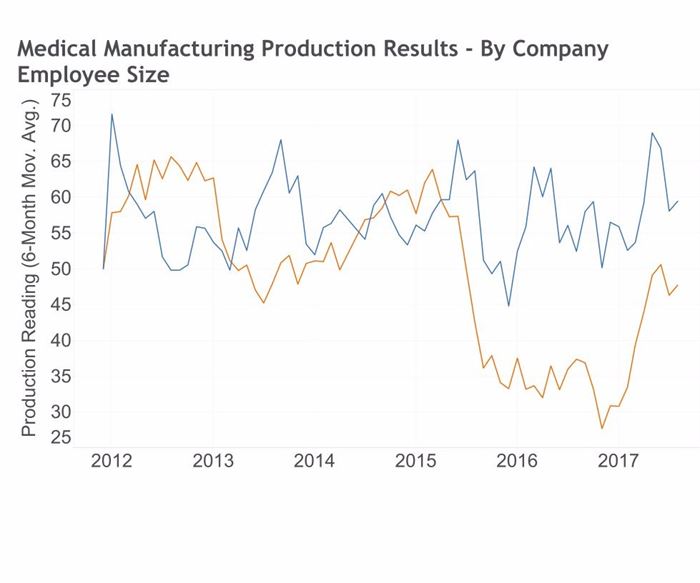

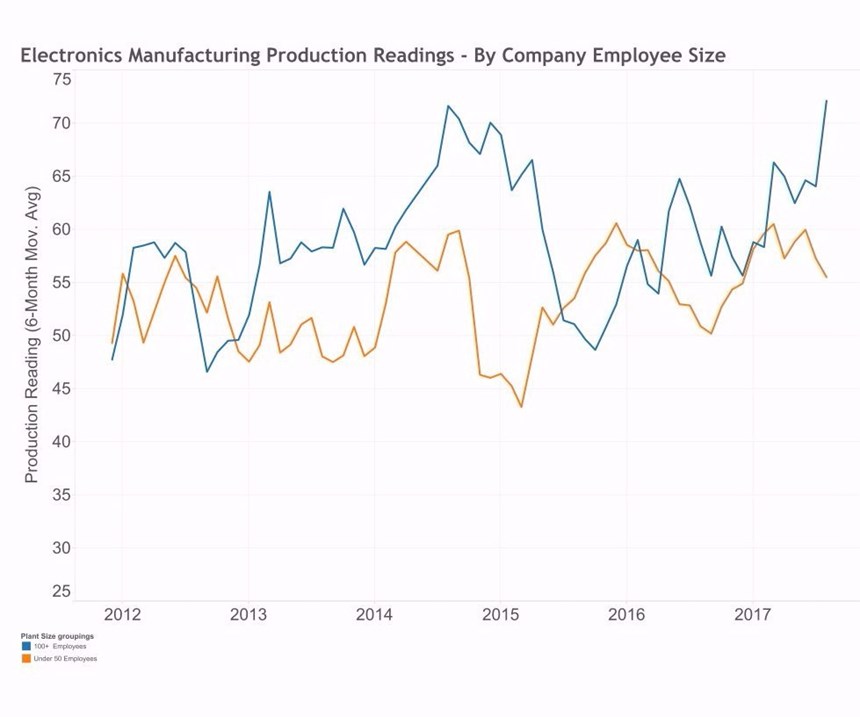

Medical device firms with 50 employees or fewer are producing less than firms with at least 100 employees. Electronics will likely grow in the second half of 2017.

Significant Strengthening in Medical Goods Production

Production of medical durable goods through the first-half of 2017 showed significant strengthening as the industrial production figures from the U.S. Federal Reserve increased from 95.3 in March to 107.4 in June. That is the highest that this figure has been in more than 10 years. According to the website of SelectUSA, a program by the U.S. International Trade Administration (a division of the U.S. Department of Commerce), “More than 80 percent of medical device companies in the United States consist of fewer than 50 employees.”

The trends in the Moldmaking Index data are consistent with trends from the Census Bureau data on industrial production for medical equipment and supplies. Data from the Census Bureau is more aggregated than data from Gardner because it polls a more diverse base of manufacturers. The Moldmaking Index polls smaller manufacturers, which makes it possible to get a deeper understanding of the trends and movements that are occurring in the manufacturing industry and that are occurring across a wide range of end-markets.

According to the most recent data that is available from the U.S. Centers for Medicare and Medicaid Services, increases to expenditures for medical durable goods since the Great Recession have averaged between 3 and 4 percent when the data is not adjusted for inflation. Heavier out-of-pocket and private health insurance spending on durable medical equipment caused much of this increase.

Strong Electronics Production Growth Predicted for Second Half of 2017

The electronics manufacturing data from Gardner Business Intelligence’s proprietary business index database indicates that electronics production, which started expanding in late 2016 and has accelerated since May, may be reaching its climax. Increases in new orders and growth in export orders drove the rate of growth in production during the second and third quarters of 2017. The six-month moving average measure of production for electronics through August 2017 is reminiscent of the growth observed in 2014, in which production readings remained highly elevated during the second and third quarters of 2014.

Examining production readings by size reveals additional insights on the market. “Large” firms (those with more than 100 employees) are reporting much higher rates of growth than smaller firms (those with fewer than 50 employees). The six-month moving average production readings among large firms at the end of August surged over 78.6 while the comparable production reading among small firms was 52.1, which is down from readings of over 60 in the previous two months.

For the overall electronics sector, the rising readings in production, new orders, exports and backlog, taken together in consideration of multi-year high readings of business sentiment suggest that the electronics industry is likely to enjoy strong growth during the second half of 2017.

Related Content

-

The In's and Out's of Ballbar Calibration

This machine tool diagnostic device allows the detection of errors noticeable only while machine tools are in motion.

-

U.S. Economy Indicates Prospects for Moldmakers

An examination of the U.S. economy suggests its resilience against a recession, yet a mixed outlook for moldmaking and plastics persists.

-

Leading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

.jpg;width=70;height=70;mode=crop)

_300x250 3.png;maxWidth=300;quality=90)