Gardner Industry Report: Automotive

New technologies coming to market in the next few years will require investments that will create sustained demand and industry growth for advanced automation, machinery, tooling, composites and plastics.

Gardner Intelligence diligently works to provide MoldMaking Technology’s readers with information that connects economic data to the current and expected business conditions of its readers. To accomplish this goal, Gardner Intelligence collects both economic and equities data from Wall Street firms. By monitoring and reporting data from both domains, Gardner Intelligence creates a more comprehensive view of what is and what will happen in the specific manufacturing spaces covered by Gardner Business Media.

In recent months, we have called attention to declining car and flattening truck sales, among other high-level metrics. Yet, this broad-brush picture misses critical dynamics of the industry, such as how the introduction and mass-placement of new technologies and new drivetrains are creating significant demand for equipment in the automotive industry.

For this reason, Gardner Intelligence recently examined the financial statements of 14 major automotive original equipment manufacturers (OEMs) to discern possible industry trends in capital expenditures, new property plant and equipment and working capital. Gardner Intelligence selected these 14 OEMs because of the richness of the quarterly data they provided during these years in their Security and Exchange filings and then indexed this data to build a representative model of the industry.

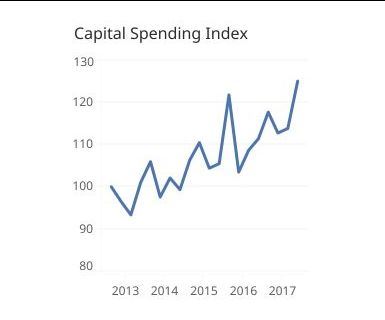

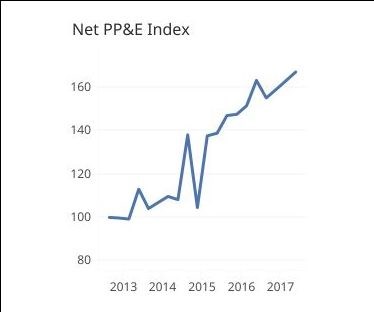

Gardner Intelligence found that between the fourth quarter of 2012 and the third quarter of 2017, Capital Expenditure grew at a nominal annualized rate of 4.7 percent. Unadjusted for inflation, the industry—as represented by our data—is spending 25 percent more on capital expenses than it did at the end of 2012. Additionally, Net Property Plant and Equipment data (Net PP&E) has grown even faster during this time with annualized growth of 17 percent. Net Property Plant and Equipment data includes a broader range of purchases including equipment and the depreciation of old equipment. The result is that Net Property Plant and Equipment today is nearly 70 percent higher than it was in 2012.

Working capital between 2012 and 2015 was relatively stable. In 2016, it fell by over 20 percent from its level at the end of 2012. At present, the 14 firms for which Gardner Intelligence has data are holding 73 percent of the working capital that they had at the end of 2012. Although working capital has diminished during these years, we see that major OEMs are spending more on R&D as a percentage of revenue than they did in the past. According to YCharts, for example, Honda and Daimler spent over 5 percent and 3.7 of their revenues, respectively, on R&D in the third quarter of 2017. This is significantly more than two years ago, when Honda spent 4.25 percent, and Daimler spent 3.25 percent of revenue on R&D in the third quarter of 2015.

While increasing sales in recent years has certainly bolstered some of these figures, it is important to realize that the new technologies coming to market in the next few years will require investments that will create sustained demand and industry growth for advanced automation, machinery, tooling, composites and plastics. All OEMs understand that the significant changes that their industries are facing and will continue to undergo in the next few years will result in significant purchases of more technically capable and complex equipment.

About the Author

Michael Guckes

Michael Guckes is the chief economist for Gardner Intelligence, a division of Gardner Business Media, Inc. (Cincinnati, Ohio, United States). He has performed economic analysis, modeling and forecasting work for nearly 20 years among a range of industries. He is available at mguckes@gardnerweb.com.

Related Content

MoldMaking Technology's Most-Viewed Content 2022: Products

MMT shares the five top-viewed technologies, equipment and services of 2022 in each Engineer, Build, Maintain and Manage tenet based on Google Analytics.

Read MoreTool Paths, ERP & Improving Efficiency in Your Toolroom: What Did You Miss in February?

We covered a variety of topics in February. From tool paths to ERP and PTXPO coverage, we hope you didn’t miss anything but here is your cheat sheet if you did.

Read MoreProducts and Services for Multiple Moldmaking Needs

New year, new technology roundup! Featured here is a collection of product offerings, from profile milling cutters to industry-specific CAD/CAM software to innovative hot work tool steels.

Read MoreDevelopments in High-Speed Machining Technology

There have been many exciting developments in high-speed machining relative to machining centers and controls, tooling and CAD/CAM systems.

Read MoreRead Next

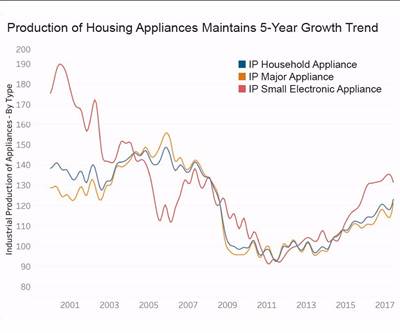

Gardner Industry Report: Appliance & Packaging

Industrial production data for household appliances through the second quarter of 2017 maintained the steady upward trend that started in early 2013. Since the beginning of 2016, packaging consumption has grown between 2 and 5 percent.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)