End Market Reports: Computer and Medical

U.S. Computer Industry Emerging from Slump; Production of Medical Supplies and Equipment Is Accelerating

U.S. Computer Industry Emerging from Slump

According to data recently released by the Federal Reserve Board, the total production of the U.S. computer industry in the first quarter of 2013 was flat when compared with the total from the first quarter in 2012. Normally, a flat quarter would not be much to cheer about. But in this case it is pretty good news. That’s because the domestic computer industry has been in a severe recession since 2008, and since that time the industry has contracted 45%.

So a flat quarter may represent the cyclical bottom, and this industry could now start to rebuild. It has a long way to go to its pre-recession peak, but at least it is heading in the right direction. Following an annual decline in total output of 5% in 2012, our latest forecast calls for an increase of 5% in 2013.

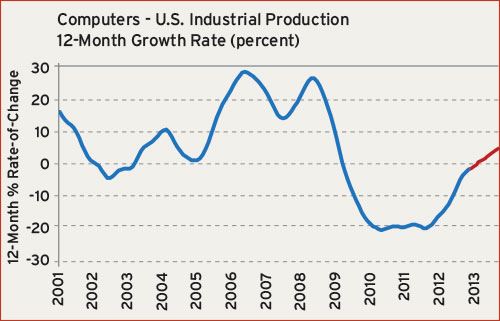

The chart shows the 12-month rate of change for the U.S. computer and peripheral equipment industry. A rate of change chart illustrates the growth rate of an industry. When the line is above zero the industry is growing at that rate, and when it is below zero the industry is contracting. For most of the past two or three decades, the computer industry in America was a stellar performer. Companies such as Dell, IBM, and Hewlett-Packard were amongst the fastest-growing companies in the world. But this industry took a nosedive during the recession in 2009, and it continued to drop for the next three years.

There are several negative factors that explain this decline. First, a lot of the production of computer products has gone to Asia. Second, a huge amount of consumer spending for technology has shifted to mobile devices such as smartphones and tablets, and most of these products are not manufactured in America. And finally, this industry has suffered from sluggish business investment for new equipment due to uncertainty about the direction and strength of the overall U.S. economy. These issues will not be eliminated anytime soon, but conditions will steadily improve over the next few quarters.

Production of Medical Supplies and Equipment Is Accelerating

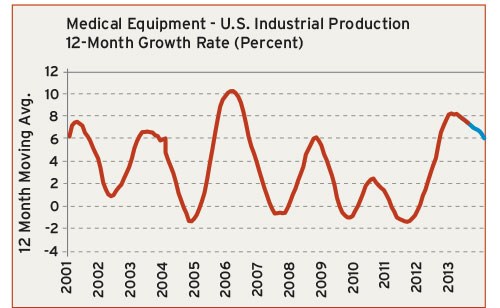

The total U.S. output of medical supplies and equipment escalated by more than 8% in the first quarter of 2013 when compared with the same quarter a year ago. This robust gain followed an annual rise of 6.5% in 2012. We expect this momentum to be sustained throughout the remainder of this year, and our forecast calls for an annual gain of 8% in production for 2013.

As the accompanying rate of change chart illustrates, this sector has enjoyed solid growth over the past few years. Since 2001, the average annual rate of growth has been about 4%. This industry did suffer a small decline in the recession year of 2009, but it was very modest compared to most other U.S. industries. Going forward, this industry is expected to enjoy strong demand as a result of the Affordable Care Act (a.k.a. Obamacare). This legislation is expected to increase the number of customers for medical supplies and equipment by 30 to 40 million people.

Most people tend to focus mainly on new, high-tech medical devices when they forecast the future of the medical supplies and equipment market. But the purpose of Obamacare is to expand access to basic medical services to more people. So demand for new devices and new therapies will increase. But this also means that there will be a sharp rise in demand in more mundane medical products that are molded out of plastic such as disposable syringes, clips, caps, and a whole range of packaging products. So even if you are not manufacturing cutting-edge technology, the market for basic medical supplies and equipment will still continue to expand.

Related Content

MMT Chats: Acquisition Trends and Lessons for Mold Builders

Jim Berklas is a former full-time M&A lawyer for several of the largest private equity firms in the country and has 25 years of M&A experience and 200 closed transaction. Today, he is founder and M&A Leader with Augmented Industry Services. He joins me for this MMT Chat on mergers and acquisitions trends and strategies within in the mold manufacturing industry. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

Read MoreThe Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MoreLeading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

Read MoreMold Builder Uses Counter-Intuitive Approach for Mold Challenges

Matrix Tool Inc. answers customers’ hard questions with creative solutions for cavity spacing, tool sizing, runner layout and melt delivery that reveal the benefits of running in a smaller press size at lower cavitation but higher yield.

Read MoreRead Next

Reasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More

_300x250 3.png;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)