End Market Report: Packaging and Aerospace

Packaging Outlook: Stable to Better; Aerospace Industry was Strong in 2012-- Can It Sustain the Momentum?

Packaging Outlook: Stable to Better

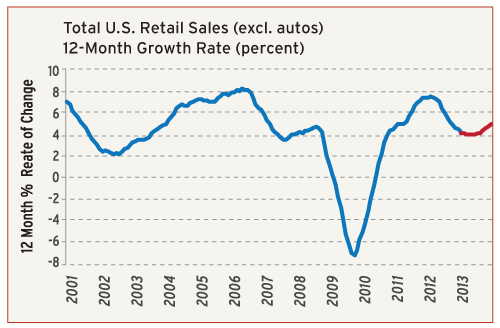

When all of the economic factors that affect packaging demand are considered, the outlook for 2013 calls for a year of moderate growth in the range of 2% to 3%. This is about the same as it has been for the past three or four years. Overall activity will likely be subdued through this summer, but by the end of this year demand for plastic packaging products will start to gain momentum. If all goes well, more rapid gains are in the cards for 2014 and 2015.

The keys to a more rapid increase in the demand for packaging are consistent gains in the data for both employment and household incomes. After four years of only gradual improvement, the data measuring employment levels in the US are poised for a more rapid rise later this year. Income levels took a hit at the beginning of 2013 with the expiration of the payroll tax holiday. It will take a few months before consumers fully adjust to the resulting decline in their paychecks. So growth in consumer spending will be sluggish for another quarter or two.

Moldmakers who supply the packaging end-markets should keep an eye on the retail sales data. The good news is that the economic fundamentals in the US are getting stronger. The crucial residential construction and real estate sectors are finally in a full-scale recovery. Solid gains in the housing sector will create jobs and raise household wealth. This will also result in higher levels of consumer confidence. These are the ingredients for stronger consumer spending, elevated retail sales figures, and rising demand for plastics packaging products.

Aerospace Industry was Strong in 2012-- Can It Sustain the Momentum?

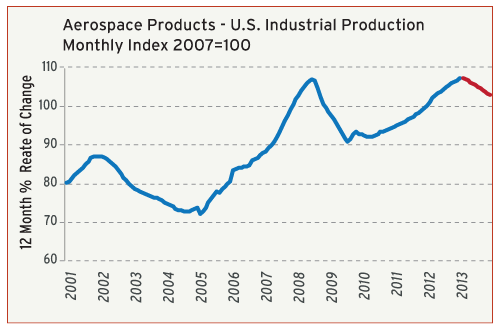

The total output of the US aerospace industry increased by a salubrious 8% in 2012 when compared with the previous year. Under normal circumstances, I would predict another solid year of growth in 2013 based on the momentum in this industry at the end of last year. But we are experiencing anything but normal circumstances so far in 2013. My current forecast calls for a decline of 5% in the total US industrial production of aerospace equipment and parts in 2013. This forecast is likely to be changed as this year progresses, so suppliers to this industry must stay tuned.

There are several negative factors currently affecting the outlook for the aerospace industry. These are: persistent problems with the Boeing Dreamliner; a slow, but gradual rise in the political opposition to America's use of unmanned aircraft (a.k.a. drones); and finally, the uncertainty surrounding the Defense Department budget as a result of the recent sequestration debacle in Washington. I still believe that the most likely outcome will be a favorable resolution of each of these problems. But nobody can guarantee that this will be the case, and this uncertainty will be a constraint on the aerospace industry for at least another year or so.

The good news is that the long term outlook for the aerospace industry is quite bright. The world's airspace will increasingly be developed and utilized in the future. And barring some unforeseen collapse, the American aerospace industry will retain its spot as the top innovator and manufacturer in this sector. These products will increasingly be manufactured out of plastic and other composite materials, so this will continue to be a strong market for moldmakers who can overcome the high barriers to entry.

Related Content

Predictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreTransforming Moldmaking into Digital Industrial Manufacturing

Moldmaking and digitalization is at the core of this global industrial manufacturing company’s consolidation and diversification plan.

Read MoreLeading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

Read MoreMMT Chats: Acquisition Trends and Lessons for Mold Builders

Jim Berklas is a former full-time M&A lawyer for several of the largest private equity firms in the country and has 25 years of M&A experience and 200 closed transaction. Today, he is founder and M&A Leader with Augmented Industry Services. He joins me for this MMT Chat on mergers and acquisitions trends and strategies within in the mold manufacturing industry. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

Read MoreRead Next

Reasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More

.jpg;maxWidth=300;quality=90)