Consumer Goods and Electronics

Packaging to see stable growth; electronics likely to remain soft.

Packaging to See Stable Growth in 2015

Real disposable income grew at an above-average rate from December 2014 to March 2015, however the growth rate decelerated in February and March. So, while there was a spurt of decent growth in incomes at the beginning of 2015, it seems likely that incomes are close to or have reached their peak rate of growth.

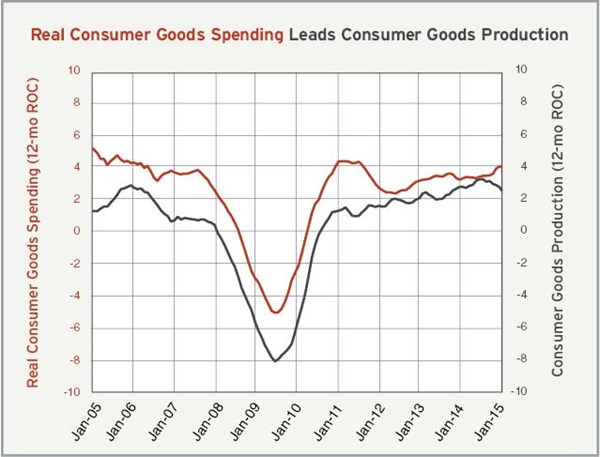

Real disposable income is a good leading indicator of real consumer goods spending, and the softening growth in incomes is already starting to show up in consumer goods spending. Despite growing 5.1 percent in January, which was the fastest rate of growth in consumer goods spending since February 2011, the annual rate of change in consumer goods spending slowed in March. It looks like this trend will continue in the upcoming months.

Changes in spending tend to lead changes in consumer goods production (and consequently packaging) by three to six months. Even though consumer goods spending had been growing faster until just recently, consumer goods production has been growing at a slower rate since September 2014. It’s possible that the recent spurt in consumer goods spending could lead to stronger consumer goods production (and an increased demand for packaging), but I think it’s more likely that consumer goods production will continue to see slower growth, as the economy appears to be softening overall.

Electronics Likely to Remain Soft

The Gardner Business Index shows that the electronics industry has generally been trending down since early 2014. In fact, the industry has contracted in three of the last four months. New orders are growing at virtually the slowest rate in the last five months, while, at the same time, production levels have moderately improved. This is driving down backlogs, however, which points toward weaker capacity utilization in the upcoming months.

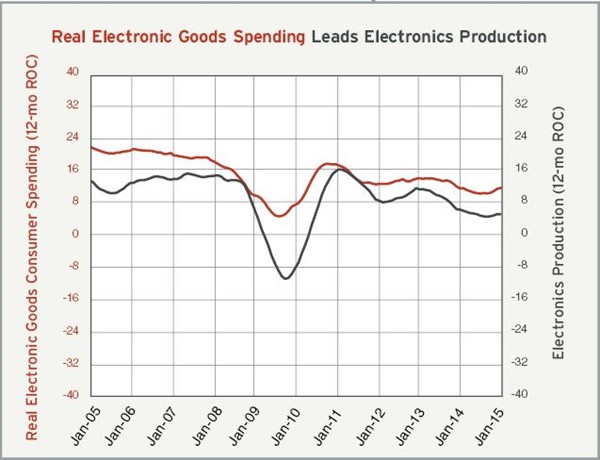

In addition, broader data on spending and production in the electronics industry shows that, while there has been some improvement in recent months, the electronics market remains relatively weak by historical standards. Disposable income has been growing at an accelerating rate for more than a year, and this has contributed to accelerating growth in electronics spending in the first quarter of 2015. It appears, however, that income growth is likely to peak very soon if it has not already, therefore further growth in electronics spending seems to be limited.

Despite the recent surge in electronics spending, electronics production remains relatively weak. The rate of growth has remained relatively flat, which means it is still near the low point of the last four years. And, other than the two contractions due to the recessions of 2001 and 2009, electronics production is growing at its slowest rate since the early 1990s.

Related Content

-

Mold Builder Uses Counter-Intuitive Approach for Mold Challenges

Matrix Tool Inc. answers customers’ hard questions with creative solutions for cavity spacing, tool sizing, runner layout and melt delivery that reveal the benefits of running in a smaller press size at lower cavitation but higher yield.

-

MMT Chats: Marketing’s Impact on Mold Manufacturing

Kelly Kasner, Director of Sales and Marketing for Michiana Global Mold (MGM) talks about the benefits her marketing and advertising, MGM’s China partnership and the next-generation skills gap. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

-

Mold Design Review: The Complete Checklist

Gerardo (Jerry) Miranda III, former global tooling manager for Oakley sunglasses, reshares his complete mold design checklist, an essential part of the product time and cost-to-market process.

.JPG;width=70;height=70;mode=crop)