Business Levels for Moldmakers Expanded

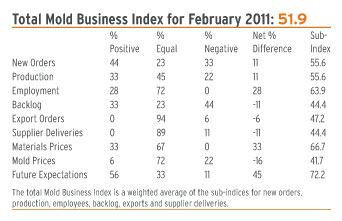

Total Mold Business Index for February 2011: 51.9.

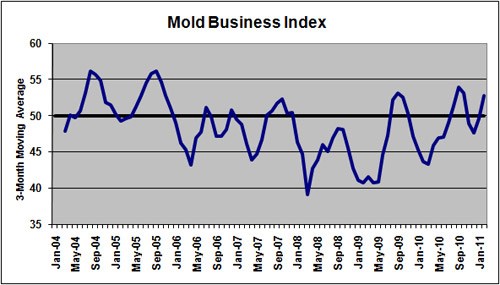

Business levels for moldmakers expanded in February, though the rate of growth decelerated when compared with January. The MBI for February 2011 is 51.9—a 5.6-point decrease from the January value of 57.5, but a solid 6.8-point increase from the 45.1 value posted last February. It is increasingly apparent that the seasonal downturn that typically occurs this time of year is much less severe in 2011. Supplier Delivery Times are longer, Materials Prices are higher, and Mold Prices are lower; however, the other activity indicators point to continued improvement.

The U.S. economy picked up steam at the end of 2010. The trends in the data for retail sales, vehicle sales and home sales firmed in the fourth quarter. Business investment was strong, and export gains were solid. For the manufacturing sector, the end of 2010 left many firms in a position of strength. Companies have cut costs, squeezed huge productivity gains from their workforces and accumulated cash cushions. Perhaps the biggest surprise was the dramatic reduction in inventory accumulation that has carried over into the first quarter of 2011. Job gains remain sluggish, but firms cannot expand much further without adding manpower.

The strong fourth quarter was the result of gains in both domestic consumption and net exports. Pent-up demand for durable goods spurred consumption while exports got an assist from the accelerating global recovery and a weak dollar. So manufacturers have led the charge, particularly in durables such as electronics, autos and machinery.

China’s economy is still export-driven, but the pendulum is starting to swing back in ways that will provide a boost to U.S. manufacturers in the coming years. There are three forces that are driving this shift: (1) Chinese investment in industrial infrastructure and construction continues at a furious pace—driving domestic demand for their manufactured goods and fueling inflation; (2) This is a drain on China’s trade surplus because it diminishes the nation’s competitive low-cost advantage; and, (3) China’s central bank is revaluing its currency in an effort to stem the inflation. For U.S. manufacturers, the combination of Chinese inflation and a stronger yuan will release some of the pressure from China’s exports.

New Orders show that the number of new projects continued to escalate in recent weeks, as this sub-index for February is 55.6. Production levels picked up as well, and the latest Production sub-index is also 55.6. The Employment component is 63.9, which means that hiring activity continues to rise. The Backlog component is a middling 44.4.

The Mold Prices sub-index for February is 41.7. So mold prices are still declining, but we still believe that prices should soon start to firm up. The prices paid for most types of materials and components continue to escalate. The sub-index for Materials Prices is 66.7. Supplier Delivery Times are again longer, as this sub-index is 44.4. There was no significant change in offshore orders for new molds, as the Export Orders sub-index is 47.2.

Related Content

-

The Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

-

From Injection Mold Venting to Runnerless Micro Molds: MMT's Top-Viewed June Content

The MoldMaking Technology team has compiled a list of the top-viewed June content based on analytics. This month, we covered an array of topics including injection mold venting, business strategies and runnerless micro molds. Take a look at what you might have missed!

-

Making Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

_300x250 3.png;maxWidth=300;quality=90)