AMBA Reports: Mold Building Industry Remains Strong

The numbers reported by more than 80 different firms across the United States in AMBA’s most recent economic survey indicate a more positive outlook on future growth than expected, and the outlook for the moldmaking industry in general seems strong and steady.

Share

Read Next

The numbers reported by more than 80 different firms across the U.S. in AMBA’s most recent economic survey indicate a more positive outlook on future growth than expected, and the outlook for the moldmaking industry in general seems strong and steady.

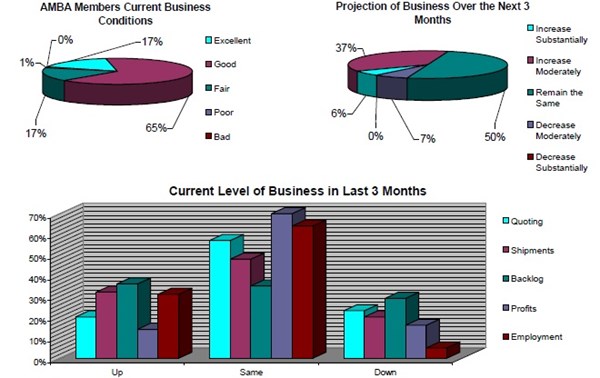

According toe AMBA, although there are some mold shops struggling, overall moldmakers in the U.S. are seeing very good market conditions. Currently, slightly more than 8 out of 10 of the surveyed participants indicated that current business conditions are either excellent or good, (with the overwhelming majority reporting good) and 17 percent reported business being at least fair.

When considering business conditions, moldmaking executives often look at their backlogs and 90-180 day sales pipelines to obtain the proverbial “gut” feel of their own situation. However, adding to the positive outlook is the fact that profits also are being maintained. From the last survey AMBA conducted in the fall of 2012, over 60 percent of the survey participants indicated that profits remained the same compared to today, where over 70 percent are now reporting their profits as remaining steady.

Those indicating profits are down also have improved from the last survey period moving from 20 percent to 16 percent of the participants reporting profit declines. (With this being said, there does exist a cautionary flag about profitability that must be noted. Beginning at the start of 2012, a decreasing trend line shows the number of moldmaking executives identifying profits as being “up” has been on a consistent decline for the last four quarters - nearly half of the positive responses received slightly over one year ago.)

With this said, projections are even stronger with 93 percent forecasting that the business will increase substantially, moderately or remain the same. Fortifying the outlook is the fact that the SPI indicated in mid-December that the value of exported molds grew by 18 percent during the first nine months of 2012.

Finally, 95 percent of survey respondents have maintained or increased their workforce levels while the “work-week” hours have remained extremely consistent over the last 18 months, running at a median of 50 hours. This is significant because it continues to indicate a very steady business climate for the majority of moldmakers.

_300x250 3.png;maxWidth=300;quality=90)