Aerospace/Defense and Energy/Power Generation

Total Output of Aerospace Products Will Decline This Year; U.S. Demand for Electricity Is Steadily Creeping Higher

Total Output of Aerospace Products Will Decline This Year

It looks like the effects of the federal budget sequester are starting to show in the data that measures total production of aerospace products in the U.S. According to data that is compiled and reported by the Federal Reserve Board, output of aerospace products in the U.S. decreased slightly in the second quarter of this year when compared with the same quarter of the year ago. This followed an increase in production of 2% in the first quarter. Our forecast calls for a gradual acceleration in the quarterly rate of decline through the end of this year. We expect that total annual output of aerospace products will decrease by 1%- 2% in 2013 when compared with the total from 2012.

As the accompanying chart illustrates, U.S. production of aerospace products slowly, but steadily escalated during the three-year period that followed the recession year of 2009. The industry had not yet recovered to the level that was registered during the last cyclical peak in 2008, but it was getting close. Unfortunately, the industry data will likely be a downward trend for the next year or two.

The good news is that the total effects of the sequester on the overall U.S. economy will not be as severe as was initially feared. The bad news is that the aerospace industry will likely be amongst the hardest hit, and this sector will suffer the impacts of federal budget cuts longer than most other sectors. Fortunately, the long-term prospects for this industry remain bright. Our nation's defense strategy will increasingly rely on superiority in the air, and at the same time the non-defense sector will continue to benefit from steady global increases in air travel and shipments of cargo by air.

U.S. Demand for Electricity Is Steadily Creeping Higher

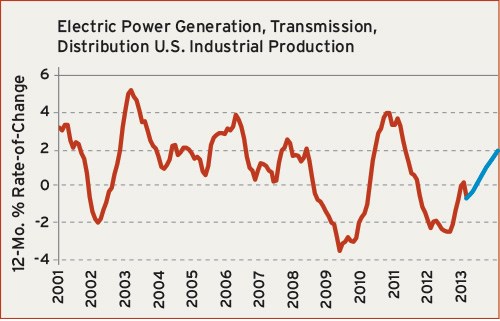

Through the first half of 2013, the data that measures electric power generation, transmission and distribution in the U.S. is 1% higher when compared with the comparable period in 2012. The accompanying chart shows that the electric industry was in a cyclical downturn through most of last year, but output of electricity has been in an uptrend for most of this year. Our forecast calls for an overall gain of 2% in this data in 2013 when compared with 2012.

The long-term trend in this data is best characterized as one of moderate growth. Prior to the recession in 2009, the annual growth rate averaged about 2% per year. Since that time, the average annual growth rate has been closer to 1%, with most of the growth occurring in 2010. For 2011 and 2012 the average rate of growth was slightly negative.

Clearly, this industry relies on steady growth in the overall economy to generate demand for more electricity. Solid gains in the construction and the manufacturing sectors create the most demand, and these two sectors have not yet recovered to anywhere near their pre-recession levels. The recovery in this country is still about two years away from getting back to the pre-recession levels in both manufacturing and construction activity. So it will be very difficult for the electric power data to expand by more than 1% or 2% per year until the other sectors of the economy are expanding more robustly.

The sluggish economic recovery notwithstanding, perhaps the most important long-term factors for suppliers to the electric power industry are the industry’s conversion to burning more natural gas and also the increased demand for a smarter, more efficient distribution grid. Both of these trends will escalate in the coming years, and both will generate increasing demand for a wide array of new products to rebuild the supporting infrastructure.

Related Content

Women Impacting Moldmaking

Honoring female makers, innovators and leaders who are influencing our industry's future.

Read MoreLeading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

Read MoreMold Builder Uses Counter-Intuitive Approach for Mold Challenges

Matrix Tool Inc. answers customers’ hard questions with creative solutions for cavity spacing, tool sizing, runner layout and melt delivery that reveal the benefits of running in a smaller press size at lower cavitation but higher yield.

Read MoreFrom Injection Mold Venting to Runnerless Micro Molds: MMT's Top-Viewed June Content

The MoldMaking Technology team has compiled a list of the top-viewed June content based on analytics. This month, we covered an array of topics including injection mold venting, business strategies and runnerless micro molds. Take a look at what you might have missed!

Read MoreRead Next

Are You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More

.png;maxWidth=300;quality=90)

_300x250 1.png;maxWidth=300;quality=90)