Aerospace and Energy/Power Generation

Aerospace industrial production is poised for growth and energy-related manufacturing remains a strong part of the American economy.

Aerospace Production Poised for Growth

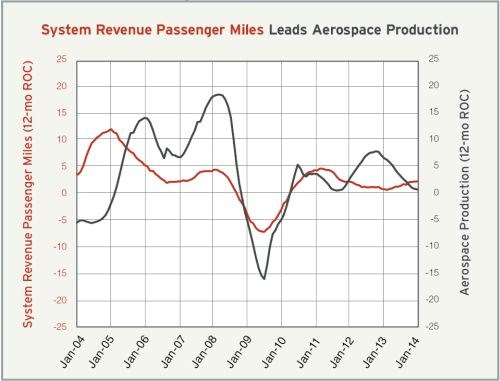

Aerospace industrial production grew at a decelerating rate throughout 2013, and that trend has carried into the first five months of this year. Currently, the annual rate of change in aerospace industrial is at 0.0 percent. But the trend in aerospace industrial production should start to turn around soon for two reasons. First, the rate of change in the month-over-month production data has grown in two of the last three months. This should start to show up in the annual data in the next couple of months. Second, system revenue passenger miles have experienced accelerate growth since early 2013. Based on past trends, aerospace industrial production should accelerate in the second half of 2014.

Our aerospace business index has reflected the decelerating growth trend of aerospace industrial production in the early part of this year. In fact, aerospace was the only end market that is tracked by our survey to contract. While our index shows production on a generally downward trend, new orders have grown the last two months. The rate of growth in backlogs has improved somewhat, which indicates that capacity utilization in the industry should improve soon. Hurting the industry at the moment is the rapid acceleration in material prices and contraction in prices received by manufacturers.

You can see all of our data related to the aerospace industry at gardnerweb.com/forecast/aerospace.htm.

Energy a Leader for American Manufacturing

Energy-related manufacturing remains a strong part of the American economy. While rising oil prices may put a damper on consumer spending, they do increase the level of production in energy-related industries. The price of oil has increased fairly significantly in recent months. This is a good sign that production oil and gas-field machinery should grow at a faster rate in the second half of 2014, which will be an improvement on the flat rate of growth since the middle of 2013.

Production of engines and turbine generators has been booming since the end of 2013. Currently, production is growing at an annual rate of just over 9 percent. Other than the recent boom in power generation production from 2011 to 2012, this is virtually the fastest rate of growth in engine and turbine production since the mid-1990s.

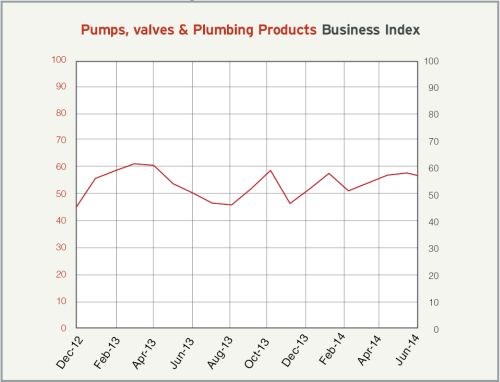

Another end market that is energy-related is pumps, valves and plumbing products. There is not a lot of publicly available data related to this market, but our monthly business index can provide some insight. In June, the industry expanded for the fourth straight month. New orders have been growing for four months as well, but that growth rate did slow down noticeably in June. Production has been increasing at a significant clip since last August, and the future business expectations index is at its highest level since the index began in December 2011.

You can see all of our data related to the energy industry at gardnerweb.com/forecast/oilgasmining.htm, gardnerweb.com/forecast/powergeneration.htm and gardnerweb.com/forecast/pumpsvalvesplumbing.htm.

.JPG;width=70;height=70;mode=crop)