The Bottom Line: Tips for Proper Reporting

Here's what you need to know about legislation changes, tax filing deadlines and IRS enforcement updates that were implemented in 2015.

Last year, the Protecting Americans from Tax Hikes Act of 2015 (PATH) changed the filing due dates for Form W-2 returns that are to be filed after December 31, 2016. In addition, the Trade Preference Extension Act of 2015 (TPE) increased the penalties for returns filed after December 31, 2015, and the Surface Transportation and Veterans Health Care Choice Improvement Act of 2015 modified various tax return due dates and extension periods applicable for tax returns filed after December 31, 2015. Here is a breakdown of what you need to know for each of these legislation changes, tax filing deadlines and IRS enforcement updates.

Form W-2. Form W-2 is used by mold builders and other employers to report remuneration, including noncash payments, for services performed by an employee during the calendar year. It is important to note that Form W-2 is required to be filed even if the payment is less than $600, if any income, Social Security or Medicare tax is withheld.

New filing deadline for Form W-2 with the SSA. Prior to the PATH Act, the deadline for filing Form W-2 with the Social Security Administration (SSA) using paper forms was the last day of February following the calendar year for which the filing was made. The deadline for companies that file the forms electronically was the last day of March. Under the PATH Act, the new filing deadline is January 31, regardless of whether the forms are filed on paper or electronically. The due date for providing wage statements to employees and written statements to employees receiving non-employee compensation has remained the same as under pre-2015 Path Act law, January 31.

Increased penalties. A penalty applies to companies that fail to file on time, fail to include all required information or include incorrect information on the returns. The TPE Act increased the penalties for returns filed after December 31, 2015. The amount of the penalties is based on when the returns with correct information are filed. Changes to the penalty amount include the following:

• The base penalty increased from $100 to $260 for each information return that is not filed at all or is not filed correctly by August 1.

• The penalty amount for corrections made within 30 days increased from $30 to $50.

• The penalty amount for corrections made by August 1 increased from $60 to $100.

• The penalty amount for intentional disregard is now the greater of $530 or 10 percent of the aggregate dollar amount of the items required to be reported correctly on the return.

Penalty exceptions. In general, the penalties will not apply to any failure that the filer can show was due to reasonable cause and not willful neglect. In addition, any Form W-2 with incorrect dollar amounts may not be subject to penalties, as long as the errors are minor and the return was filed on time and was corrected by August 1.

Companies that are required to e-file, but fail to do so, may also incur a penalty. Tool shops who submit less than 250 information returns can file returns using paper forms, but payers who submit 250 or more information returns must file electronically. Generally, mold builders’ information returns include W-2 and 1099s.

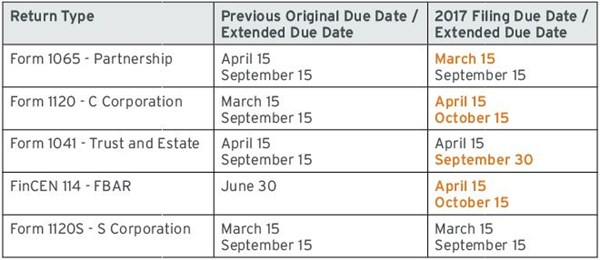

Revised dates for Form 1065, Form 1120, Form 1041, FinCEN 114 and Form 1120S. The Surface Transportation and Veterans Health Care Choice Improvement Act of 2015 modified various tax return due dates and extension periods applicable for tax returns beginning after December 31, 2015. The changes are intended to help individuals file timely and accurate tax returns. Under the previous due dates, individuals often had insufficient time to prepare returns, because information required from a flow-through entity such as a S corporation, partnership or limited liability company (LLC) was not available before the income tax return was due. The original and extended due dates for 2016-calendar-year filers have been summarized in the chart below, with revised due dates in orange.

Changes for fiscal year filers. Partnership tax returns will be due the 15th day of the third month after the end of their tax year, with a six-month extension rather than the previous five-month extension. Trust and estate tax returns will have a maximum extension of five and a half months after their original due date of the 15th day of the fourth month after the end of their tax year. C corporation tax returns will be due the 15th day of the fourth month after the end of the tax year. Under a special rule for C corporations with fiscal years ending on June 30, the rule change won’t apply until tax years beginning after December 31, 2025. States may need to enact legislation if they decide to change their due dates to conform to the new federal due dates.

Form 1099 compliance. The IRS now assesses additional taxes and penalties for non-compliance related to 1099s. IRS agents are being specifically instructed to obtain general ledger analysis of accounts in order to do a search for vendors requiring 1099s and possibly impose penalties on failure to file.

Form 1099. Information returns are required to be filed when payments are made in the course of carrying on a trade and business. Form 1099-MISC, Miscellaneous Income, is the information return that is used to report rents, commissions, fees, payments to an attorney and other forms of compensation for services paid to nonemployees totaling $600 or more. The IRS uses this information to determine whether the recipient has properly reported the payment received.

Exceptions. Some payments do not have to be reported on Form 1099-MISC, although they may be taxable to a third party. A few exceptions include payments made to a corporation, including a LLC that is treated as a C or S Corporation (it is important to note that there are a few exceptions to this general rule and one of them is attorney fees); payments to a tax-exempt organization including tax-exempt trusts; and payments of rent to real estate agents.

New filing deadline. The PATH Act of 2015 changed the filing dates for Forms 1099-MISC with a reportable amount in the non-employee compensation box. Beginning with returns related to tax year 2016, employers must file Forms 1099-MISC on or before January 31 of the year following the calendar year to which the return relates, regardless of whether the forms are filed on paper or electronically. The previous due dates for filing with the IRS were February 28 for paper forms and March 31 for electronic filing (more than 250 information returns). January 31 is the due date for related payee statements and remains the same as under pre-2015 PATH Act law.

Increased penalties. A penalty applies to companies that fail to file on time, fail to include all required information or include incorrect information on the return. The TPE Act increased the penalties for returns to be filed after December 31, 2015. Key changes to the penalty amount include, the base penalty increase from $100 to $260 for each information return that is not filed and the penalty amount for intentional disregard is now the greater of $530 or 10 percent of the aggregate dollar amount of the items required to be reported correctly on the return.

With changes to relevant due dates, increased penalties and increased IRS enforcement, mold builders must ensure proper reporting. Proper planning is necessary to ensure these significant penalties are not imposed upon your shop.

Related Content

Considerations for Mold Base Material Selection

Choosing the right material can greatly affect the profitability and cost of your application.

Read MoreThe Benefits of Hand Scraping

Accuracy and flatness are two benefits of hand scraping that help improve machine loop stiffness, workpiece surface finish and component geometry.

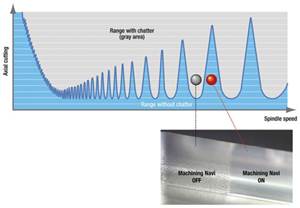

Read MoreHow to Eliminate Chatter

Here are techniques commonly used to combat chatter and guidelines to establish a foundation for optimizing the moldmaking process.

Read MorePlastic Prototypes Using Silicone Rubber Molds

How-to, step-by-step instructions that take you from making the master pattern to making the mold and casting the plastic parts.

Read MoreRead Next

How to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More

.jpg;maxWidth=300;quality=90)

_300x250 1.png;maxWidth=300;quality=90)