Permanent Tax Savings

An interest charge domestic international sales corporation (IC-DISC) has become a viable planning opportunity for permanently reducing income tax liabilities.

Historically, an interest charge domestic international sales corporation (IC-DISC)

has been a tool U.S. taxpayers can use to defer income associated with export sales. In recent years, the IC-DISC also has become a viable planning opportunity for permanently reducing income tax liabilities because it converts ordinary income into qualified dividend income, which is subject to a reduced tax rate.

The IC-DISC is available to both manufacturers and distributors, and it is not limited to any specific type of entity. Closely held C corporations, S corporations, limited liability companies (LLCs) and partnerships that export goods, either directly or indirectly, can benefit from an IC-DISC. For those manufacturers and distributors that export qualified property, the permanent tax savings can be significant.

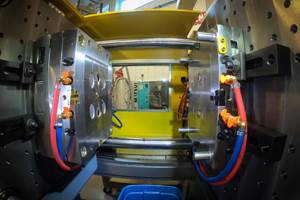

The following illustrates how a mold builder can benefit from an IC-DISC:

1. Operating company X forms a separate U.S. corporation that elects to be treated as an IC-DISC in accordance with the Internal Revenue Code.

2. Operating company X pays a commission to the IC-DISC on its export sales.

3. Operating company X deducts the commission paid to the IC-DISC, reducing its taxable income, which is calculated at ordinary income tax rates.

4. By statute, the IC-DISC is tax-exempt and pays no Federal income tax on its distributed commission income.

5. The IC-DISC pays a qualified dividend to the owner(s) of the IC-DISC, subject to capital gains taxes.

Specific requirements exist that are critical to ensuring that the IC-DISC maintains tax-exempt status and the mold builder realizes the tax benefits:

• The IC-DISC must be a U.S. corporation with one class of stock of at least $2,500 of par or stated value.

• The corporation must elect to be treated as an IC-DISC within 90 days of incorporation.

• 95 percent or more of the gross receipts of the IC-DISC must be qualified export receipts.

• 95 percent or more of the assets of the IC-DISC must be qualified export assets.

• The exported goods must be manufactured, produced, grown or extracted within the U.S., with no more than 50 percent of the fair market value of the export property attributed to goods imported into the U.S.

• The export property must be sold or leased for direct use, consumption or disposition outside of the U.S.

There are numerous ways to structure the ownership and commission payments. Companies will want to consider which structure will fit their specific goals, whether it be reduction of income tax liabilities, wealth transfer, asset protection and/or incentivizing key employees.

There are a number of methods and two safe harbors for calculating commissions. Those safe harbors are 4 percent of the qualified export gross receipts or 50 percent of the taxable income from the sale of qualified export property. Taxpayers may determine commissions on a transactional basis to maximize the benefits using the allowable methodologies.

An IC-DISC can enable a mold builder to reduce overall income tax liabilities, however, proper planning is necessary to ensure that the IC-DISC is established correctly and that tax benefits are maximized each year.

Related Content

Making Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

Read MoreMold Builder Uses Counter-Intuitive Approach for Mold Challenges

Matrix Tool Inc. answers customers’ hard questions with creative solutions for cavity spacing, tool sizing, runner layout and melt delivery that reveal the benefits of running in a smaller press size at lower cavitation but higher yield.

Read MoreMMT Chats: Acquisition Trends and Lessons for Mold Builders

Jim Berklas is a former full-time M&A lawyer for several of the largest private equity firms in the country and has 25 years of M&A experience and 200 closed transaction. Today, he is founder and M&A Leader with Augmented Industry Services. He joins me for this MMT Chat on mergers and acquisitions trends and strategies within in the mold manufacturing industry. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

Read MorePredictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreRead Next

Five Important Tax Changes Beneficial to Your Shop

On December 17, 2010 President Obama signed The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (2010 Tax Relief Act) that includes important depreciation and IRC Sec. 179 deduction changes, which were retroactive to September 9, 2010 and will benefit both large and small manufacturers.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More

.jpg;maxWidth=300;quality=90)

_300x250 3.png;maxWidth=300;quality=90)