Overall Business Levels Expanding

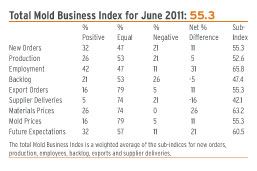

Total Mold Business Index for June 2011: 55.3

Overall business levels for North American moldmakers expanded again last month. The Mold Business Index (MBI) for June 2011 is 55.3. This is a 1.8-point increase from the May value of 53.5, and it is a sparkling 10.3-point increase from the MBI value of 45.0 recorded in June of last year. Another gain in New Orders and a solid rise in Employment levels were the main factors in the increase in this month’s MBI. On the down side, Supplier Delivery Times are still getting longer, and Materials Prices are still rising. There were a few respondents who indicated that mold prices are continuing to get firmer.

Manufacturing enjoyed a solid rebound in June; however, the first half of 2011 ended with a number of other economic reports indicating a slowdown in the U.S. recovery. Energy prices have eased a bit, but the impact of the still-high price for gasoline is evident in the weaker data for consumer confidence, personal income, and consumption. The gains in manufacturing are still a definite reason for optimism, and we expect real GDP growth to accelerate moderately in the second half of 2011 after a disappointing performance in the first half of the year.

The New Orders component for our MBI shows that the number of new projects increased in the latest month, as this sub-index for June is 55.3. New orders for molds have increased in every month except one thus far in 2011. The latest Production sub-index posted a steady-to-better reading of 52.6. The Employment component is 65.8, indicating that hiring activity is expanding at an accelerating rate for those shops who can find qualified candidates. Overall backlogs for moldmakers were mostly steady, as the Backlog component this month is 47.4.

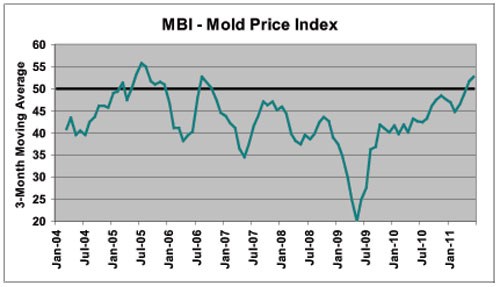

The Mold Prices sub-index for June is 55.3, and this marks the fourth consecutive month that overall mold prices were steady-to-higher. The prices paid for materials and components--especially steel and resins--continue to rise. The sub-index for Materials Prices is 63.2. Supplier Delivery Times are again longer, as this sub-index is 42.1. There was an increase in offshore orders for new molds, as the Export Orders sub-index is 55.3.

By a wide margin, the most-cited problem confronting North American moldmakers in recent weeks is the shortage of skilled labor.

Our Injection Molding Business Index posted another increase in the second quarter of 2011 when compared with the previous year. This Index grew by 7% in 2010, and the forecast calls for a gain of 5% in 2011. Gains in the MBI depend on sustained growth of 4 to 5% in the output of injection molded products. The trend in the moldmaking data lags the trend in the processing sector by six months.

Related Content

-

MMT Chats: Acquisition Trends and Lessons for Mold Builders

Jim Berklas is a former full-time M&A lawyer for several of the largest private equity firms in the country and has 25 years of M&A experience and 200 closed transaction. Today, he is founder and M&A Leader with Augmented Industry Services. He joins me for this MMT Chat on mergers and acquisitions trends and strategies within in the mold manufacturing industry. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

-

Women Impacting Moldmaking

Honoring female makers, innovators and leaders who are influencing our industry's future.

-

Leading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

.jpg;maxWidth=970;quality=90)