Outlook for 2017: Cautiously Optimistic

Despite limited economic and manufacturing climates, mold builders can continue to grow with a solid business strategy and a focus on operational excellence.

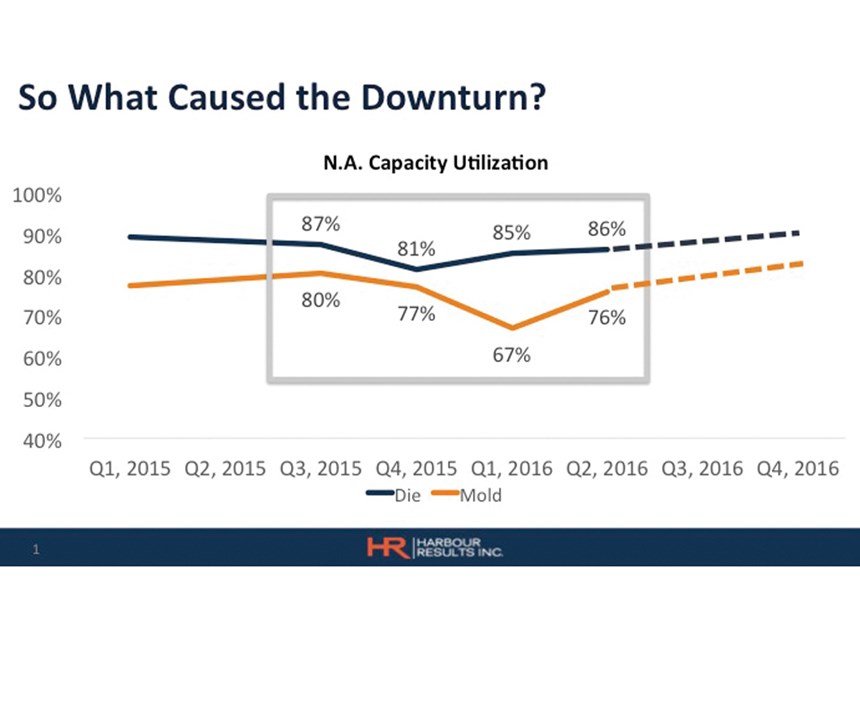

Data clearly indicate that the U.S. manufacturing industry was relatively stable in 2016, with overall production up slightly from previous years. However, a closer look at last year’s data for the tool and die industry, and specifically mold manufacturing, prove conditions were a bit more challenging for that segment of manufacturing. Harbour Results’ latest Harbour IQ pulse survey (a business intelligence tool designed to collect performance, financial, operational, trend and market data) was completed by more than 100 global tool shops in the second quarter of 2016, and that data shows that capacity fell to a low of 67 percent among those shops in early 2016, although it was expected to rebound to 78 percent by the end of the year (see Figure 1).

Many analysts predict there will be limited manufacturing growth in the year ahead, thanks to several key factors. First, the U.S. dollar is expected to remain strong against other currencies across the globe. This limits how much U.S. manufacturers within certain industries can export their products. Additionally, after several years of limited growth in manufacturing, many companies are focused on cost savings rather than on investing capital to grow their production capabilities. Finally, a sustained downturn in certain industries has impacted entire manufacturing supply chains. For example, according to energy consultancy Wood Mackenzie, more than $200 billion in exploration projects within oil and gas and mining have been cut since 2014, and that has impacted all players in that supply chain, including the tool and die supplier.

The news is not all bad for the overall manufacturing industry, however. Consumer spending, and both home and commercial construction are predicted to continue to be strong, and certain segments within the U.S., such as automotive, are expected to maintain strong sales in 2017. LMC Automotive, a Troy, Michigan-based automotive forecasting firm, predicts U.S. vehicle sales will stay steady at 17.4 million units in 2017. Additionally, HRI’s forecast data indicate the automotive industry expects to source tooling to support 70 new vehicle launches, which is more than in any other year since 2014.

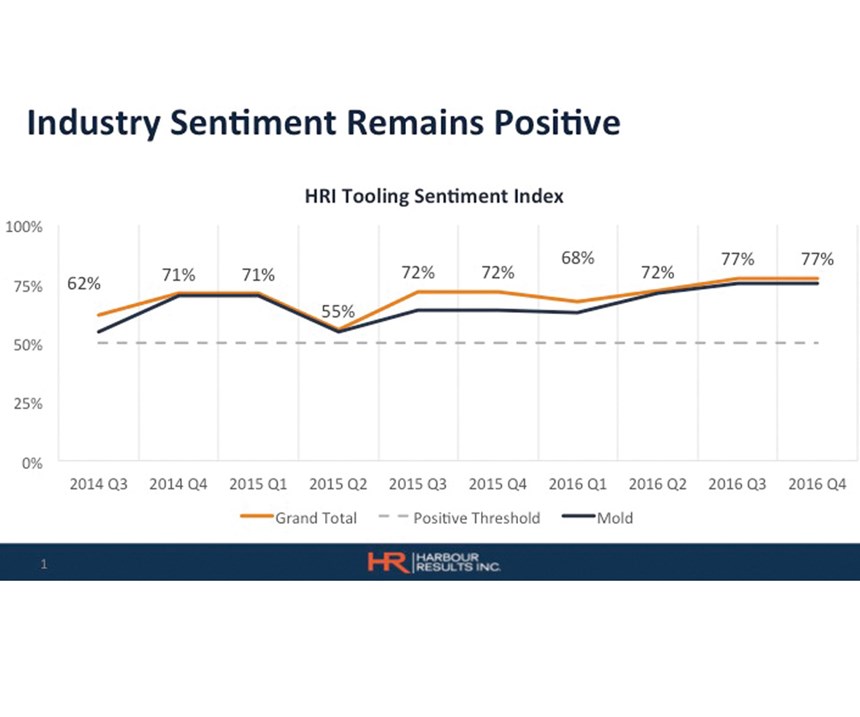

Within this mix of information, the mood of the mold industry remains positive. The most recent Harbour IQ pulse survey reveals that 77 percent of surveyed shop owners had a positive outlook for the end of 2016 and the beginning of 2017 (see Figure 2).

Key Trends Across the Globe

To fully understand what 2017 holds for the mold building industry as a whole, it is important to look at other regions of the globe in addition to the U.S. For example, Canada’s currency exchange rate is driving tool and die business to Canadian mold shops. In fact, Harbour Results’ analysis of the capacity data shows that Canadian mold shops are reaching capacity first, followed by U.S. shops, and those U.S. shops oftentimes benefit from spillover work from Canada.

In 2016, several members of the Harbour Results team traveled to China to gain a better understanding of the mold building industry there. Although already considered a lower cost alternative to onshore businesses, Chinese shops are working to improve their skill sets and become much more competitive by delivering better quality molds. That said, their ability to produce certain products, such as two-shot molds and high-strength steels, is still limited, and logistics continue to hinder extensive use of mold shops in this country by non-Chinese customers.

One country in which manufacturing is flourishing is Mexico. A number of industries, including automotive, consumer goods and aerospace, continue to move manufacturing operations into this country, and this is driving a growing demand for mold and die shop capabilities there. U.S. and Canadian mold shops, as well as shops based in other countries, are starting to set up shop in Mexico to service these growing industries, and Harbour Results expect this movement to continue.

Best Practices for Success

Regardless of the future economic and manufacturing climates, or the size of a business, we suggest developing and implementing a solid business strategy and focusing on operational excellence to deliver mold shop success.

In order to develop a solid business strategy, a mold shop must understand what its core competencies are (what it does best) and build defendable niches that help differentiate the company from its competition. A niche, in this case, is defined as a distinct segment of a market, and there are four that mold builders should consider as possible niches:

1. Technology. Leveraging a specific expertise or technology, for example, hot material capability, cloth-wrapped manufacturing or additive manufacturing, will allow a shop to deliver a unique solution.

2. Operations. Shops with a distinctive operational advantage, such as a global footprint, large package size management or assembly cells, could be uniquely positioned to deliver solutions that are challenging to find.

3. Industry. Acquiring capabilities, certifications or customer relationships can enable a company to target a specific industry such as military or medical, or prototype work.

4. Commodity. A shop can differentiate itself by offering a specific product in which it has manufacturing expertise and that is broadly used across an industry and frequently refreshed, such as lighting assemblies for the automotive industry.

By establishing a niche and building a business plan around it, mold builders should be able to better define target customers and defend their place in the market, even during challenging times. However, it is important to note that niches have lifecycles and shops can “max out” a specific niche. To expand beyond a current niche, shops must take a strategic approach, staying focused on maintaining core competencies, conducting full analysis on new niches and being selective with new customer targets.

Operational excellence is about creating a culture where teams are challenged to continuously improve systems and processes across the shop floor to deliver positive change and drive throughput. Since the economic downturn in 2009 and 2010, the mold industry has made significant improvements in operational efficiency, but there is still work to be done to wring out further inefficiencies. Today, mold and die making is no longer an art, but a manufacturing process. Although each mold is unique, the process for building that mold should be standard and repeatable in order for a shop to remain competitive. The key to reducing all unnecessary activity is collecting and analyzing the right data.

Successful mold shops tend to invest in data technology to help them better understand what is happening on the shop floor. Tools such as enterprise resource planning (EPR) software and machine monitoring systems can assist shops in gathering data points and tracking key trends over time (utilization and efficiency) to help them make informed decisions that will impact their shops. Additionally, shops that are achieving “operational excellence” are monitoring the overall job as opposed to looking at an individual machine’s run time. This holistic approach allows them to better track product status and priority.

This data-driven approach also entails focusing on functions that are critical to effectively aligning the business, such as resource monitoring, capacity and demand planning, and production scheduling. By staying focused on collecting and analyzing data throughout their shops, owners should be better equipped to make decisions and appropriately adjust in order

to drive improved efficiency and reduce lead time.

2017 and Beyond

With a tepid manufacturing forecast for the near term, it is increasingly important for mold building shops to look for opportunities to create competitive advantages. With that in mind, here are three suggestions:

Understand your customers. Who are they? What’s going on in their industries? What are their product plans? What is available to my shop in the market? Gathering customer and market data gives you a leg up on the competition. It will help you develop a solid sales strategy and pursue profitable business

for your company.

Focus on your niche. What is your “why?” If you can focus on why customers should do business with you and on what makes you unique, you may be able to prevent other shops from infringing on your business. Additionally, this focus will help you better run your business.

Invest smartly. Invest with a purpose. For example, to improve your agility, grow your business in other regions, create a sales process or strengthen an aging workforce. Understand what your company’s pain points are, and invest to make improvements.

Related Content

The Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

Read MoreLeading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

Read MorePredictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreOEE Monitoring System Addresses Root Cause of Machine Downtime

Unique sensor and patent-pending algorithm of the Amper machine analytics system measures current draw to quickly and inexpensively inform manufacturers which machines are down and why.

Read MoreRead Next

Trends Impacting the Supply Chain

The cost of manufacturing and product demand are set to cause financial and business climate changes across the moldmaking industry.

Read MoreForecasting and Balancing Business

Aligning operations, sales and business is essential to leveling out the effects of peaks and valleys.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More

.png;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)