Mold Prices Steady; Future Expectations Remain Optimistic

Total Mold Business Index for August 2012: 48.6

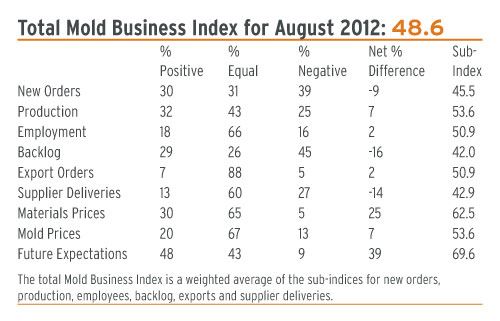

For the second straight month, our survey shows that overall activity levels declined modestly in August with an MBI of 48.6, which is a 0.3-point decrease from July’s 48.9, and a 7.7-point decrease from last August’s 56.3.

For the fourth straight month, a drop was reported in New Orders, which was only partially offset by gains in Production and Employment levels. Supply conditions remain unfavorable, and there was an increase in those reporting longer Supplier Delivery Times and higher Materials Prices when compared with last month. Mold Prices were steady-to-firmer. Future Expectations remain optimistic.

The U.S. economy, as well as most of the U.S. manufacturing sector, entered into a holding pattern this summer, and that is where we currently remain. I expect that soon after the beginning of 2013, many sectors of the economy will see things pick up substantially. And in less than a year, my forecast calls for a real economic recovery to begin because after five long years of declines, the prices for U.S. homes have hit bottom and are now starting to rise.

It is still quite early in the cycle and the recovery in the residential construction and real estate sector is vulnerable to many risks. Even in the best of conditions, it will take at least two years of steady growth to return to full health. But for manufacturers of plastics products—not just plastics building materials but all types of plastics products—future demand will increase right along with rising home prices.

New Orders came in little changed from last month at 45.5. The recent slippage in new orders is also apparent in the sub-index for Backlogs, which registered only 42.0 this month. The Production sub-index posted a positive 53.6 in August, which indicates that moldmakers are working off their backlogs and perhaps digging up enough repair work to maintain their workloads despite the fact that new orders have slowed. The Employment component remained positive, but just barely. Its value of 50.9 indicates that shops are still trying to hire qualified workers if they can find them, but not as aggressively as earlier in the summer.

Mold Prices is 53.6 as they rebounded a bit, and no respondents reported that price pressure was increasing. The prices paid for materials and components are still rising, and the upward momentum in prices increased. Materials Prices is 62.5 and Supplier Delivery Times is 42.9. Delivery times are getting longer for most shops, but there were some reports that steel is more readily available. Lastly, Export Orders is 50.9, a small increase.

Related Content

-

The Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

-

MMT Chats: Acquisition Trends and Lessons for Mold Builders

Jim Berklas is a former full-time M&A lawyer for several of the largest private equity firms in the country and has 25 years of M&A experience and 200 closed transaction. Today, he is founder and M&A Leader with Augmented Industry Services. He joins me for this MMT Chat on mergers and acquisitions trends and strategies within in the mold manufacturing industry. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

-

Editorial Guidelines: Editorial Advisory Board

The Editorial Advisory Board of MoldMaking Technology is made up of authorities with expertise within their respective business, industry, technology and profession. Their role is to advise on timely issues, trends, advances in the field, offer editorial thought and direction, review and comment on specific articles and generally act as a sounding board and a conscience for the publication.

_970x90 1.png;maxWidth=970;quality=90)

.jpg;maxWidth=300;quality=90)