Mold Industry Continues to Slip

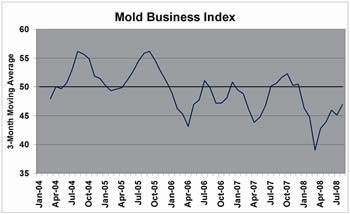

46.7 Total Mold Business Index for September 2008 The total Mold Business Index is a weighted average of the sub-indices for new orders, production, employees, backlog, exports and supplier deliveries.

The MBI for September is 46.7. This is a 3.8-percentage point decrease from the August value of 50.5. The Employment and Backlog components registered steady readings, while declines were reported in the other sub-indices. The persistent rise in the costs of steel and resins kept the Materials Prices component elevated. This sub-index is not included in the overall calculation of our MBI, so the rising prices of materials does not push the Index value higher and is not interpreted as positive news. The Future Expectations component escalated to 73.9.

The latest data from our Mold Business Index (MBI) survey indicates that the mold industry continues to slip, but it is not entirely without reasons for hope and optimism. There is little doubt now that the U.S. economy is in a recession; however, most indicators of business activity continue to perform better than in previous downturns. Overall economic growth will be flat-to-negative for the remainder of the year, but we remain confident that the underlying fundamentals for manufacturers will gradually improve during the early months of 2009.

The data from the plastics industry have been in a downtrend so far this year, and it appears that the downward trajectory will gain momentum as 2008 comes to an end. The good news is that the levels of plastics manufacturing activity remain higher than they were during the last recession. Our Injection Molding Business Index is down 6% for the year-to-date. The Index is expected to hit a cyclical bottom in the fourth quarter of this year, and then it will start posting monthly gains in the first half of 2009. This means that demand for plastics products, as well as new molds and tooling, are near their cyclical bottoms and will gradually increase in 2009.

The sub-index for New Orders of molds was 45.7 in September, indicating that new business levels were moderately lower for the month. Production levels were also lower, as the latest Production sub-index was 43.5. The Employment component was 50.0, which means that there was no net change in overall payrolls last month. There was no reported change in the industry’s backlogs, as the Backlog component was 50.0 in September.

The Mold Prices sub-index for the latest month was 47.8. This was another improvement over the previous month, and it suggests that the prices received for new molds are stabilizing. The prices paid for materials increased once again, but the data indicate that the prices are starting to level off. The latest sub-index for Materials Prices was 67.4. Supplier Delivery Times were moderately slower, as this sub-index posted a value of 43.5. There was no significant change in the number of offshore orders for new molds, as the Export Orders sub-index was 47.8.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Related Content

The Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MoreTransforming Moldmaking into Digital Industrial Manufacturing

Moldmaking and digitalization is at the core of this global industrial manufacturing company’s consolidation and diversification plan.

Read MoreMMT Chats: Marketing’s Impact on Mold Manufacturing

Kelly Kasner, Director of Sales and Marketing for Michiana Global Mold (MGM) talks about the benefits her marketing and advertising, MGM’s China partnership and the next-generation skills gap. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

Read MoreFrom Injection Mold Venting to Runnerless Micro Molds: MMT's Top-Viewed June Content

The MoldMaking Technology team has compiled a list of the top-viewed June content based on analytics. This month, we covered an array of topics including injection mold venting, business strategies and runnerless micro molds. Take a look at what you might have missed!

Read MoreRead Next

Mold Industry Bending, But Not Breaking

50.5 Total Mold Business Index for August 2008 The total Mold Business Index is a weighted average of the sub-indices for new orders, production, employees, backlog, exports and supplier deliveries.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More

_300x250 4.png;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)