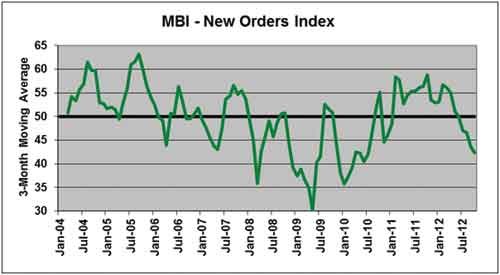

Increase in Employment Levels; New Orders Decline

Total Mold Business Index for October 2012: 45.6

For the fourth straight month, our survey shows overall activity levels declined with an MBI 45.6 for October 2012—a 1.2-point increase from September, but a 10.1-point decrease from October 2011.

A drop was reported in the important New Orders category for the sixth straight month. Yet despite this six-month erosion in new business, moldmakers are confident enough about the future to continue to hire new workers because there was another increase in Employment levels. Supply conditions are stabilizing as fewer respondents reported longer Supplier Delivery Times and higher Materials Prices when compared with the previous month. Mold Prices were again steady-to-firmer, though the gains in prices received for molds have still not caught up with the recent rise in the cost of materials. Future Expectations remain quite optimistic.

As the fourth quarter began, many of the major economic indicators in the U.S. started to gain some traction. The latest employment data blew past expectations while the recent trends in the residential construction and home price data gained upward momentum. All of this good news was tempered by the destruction of Hurricane Sandy, and also by the ongoing economic problems in Europe and the armed conflicts in the Middle East. And unless something is done quickly, the “fiscal cliff” problem will result in many Americans losing their jobs in a recession next year that will be directly caused by the inaction of our just re-hired legislators.

The New Orders component remained in a low range at 41.7. The trend of declining new orders over the past few months kept the sub-index for Backlogs down at 37.5. Production stayed in negative territory for the second straight month at 42.7. The only significantly positive factor in the latest survey was the Employment component, which came in at 55.2 this month.

The Mold Prices sub-index is 53.1. Mold prices are firmer, and this news is made even better by the fact that increases in prices paid for materials are decelerating. The sub-index for Materials Prices this month is 54.2. The Supplier Delivery Times component is 46.9. With demand for materials from moldmakers getting weaker this year, it is only logical that the supply conditions from their suppliers start to stabilize. There was little change in offshore orders, as the Export Orders sub-index is 51.0.

Once again by a wide margin, the most-cited problem confronting North American moldmakers in recent weeks is the shortage of skilled labor.

Related Content

-

Leading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

-

OEE Monitoring System Addresses Root Cause of Machine Downtime

Unique sensor and patent-pending algorithm of the Amper machine analytics system measures current draw to quickly and inexpensively inform manufacturers which machines are down and why.

-

Women Impacting Moldmaking

Honoring female makers, innovators and leaders who are influencing our industry's future.

.jpg;maxWidth=300;quality=90)