High-Precision Molds Pay Off for P&G

Procter & Gamble stresses speed, repeatability and long life to maximize return in commodity production.

High-tech mold design and consumer products might not seem like an obvious fit, but the commodity market is making extensive use of advanced toolmaking capabilities to meet a range of processing needs.

Green Design

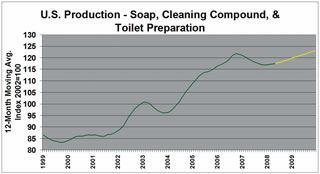

The most visible of these is probably green design, which to many consumers is as strong a selling point as performance and price. The demand for eco-friendly products and packaging is raising the bar on mold design. OEMs are increasingly using sophisticated mold engineering techniques to balance sustainable product designs with performance, aesthetics and economy.

At the forefront of this effort is Procter & Gamble (Cincinnati, OH), the world’s No. 1 consumer goods manufacturer. With $76.4 billion of gross revenue in fiscal year 2007 (ended June 30), the firm relies on precision mold design and high-speed molding capabilities to meet production goals in a timely and cost-efficient manner, says Ralph Neufarth, a Principal Researcher there.

Neufarth has 20 years of moldmaking experience, prototypes injection molds and blow molds for P&G, along with devices for the company’s Gillette and Braun personal care and home appliance product lines. He has no figures regarding the number or cost of molds P&G commissions every year, but the company’s extensive product line and global sales suggest that the value of the toolmaking business is well into the millions of dollars.

Lightweighting

“With the emphasis on going green and sustainability, there are huge efforts underway in lightweighting,” he says. “We are looking at how we can lightweight products and still make them efficiently moldable and capable of withstanding dynamics in packing, filling, shipping, storing and consumer handling.”

Another benefit of lightweighting is reducing the cost of raw materials, which by itself is a powerful economic incentive, considering the billions of containers P&G produces every year.

Package Design

Some dynamics of package design that Neufarth cites are topload strength, which enables boxes of product to be stacked on top of one another during transit and storage; high-altitude transportation and display of goods—truck shipments and sales across the Rockies, for example—that could make packages implode; and features that improve consumer handling, use and product recycling.

Accompanying these concerns is the need for high-volume production. While this is critical to meet manufacturing and delivery needs, many packaging components like closures and lids would be unprofitable to produce if they couldn’t be molded rapidly and in large numbers. Hence, the need for 24/7 operations in some cases and mold design features that assure repeatable production, while reducing mold wear and minimizing downtime for maintenance and repair.

High-Volume Tools

Procter & Gamble deals with volume production by commissioning high-cavitation single-face molds or 2- and 4-level stack molds. Neufarth says that the highest-output molds the company runs have 128 cavities. These are used to mold components for a personal hygiene product. Most molds commissioned by P&G are Class 101, which are certified for production of 1 million parts or more. (The company also orders molds for relatively low production runs.)

“We expect a certain volume at a certain price,” Neufarth says about mold design. “It’s always about saving money; that’s inherent in everything we do.”

Most high-volume tools are ordered with spare cavity components that can be dropped in should a problem develop with a production cavity. P&G sometimes orders duplicate molds as well to assure that production of popular items continues if a mold goes down for any reason.

The cavity inserts are all “plug-and-play,” Neufarth says, meaning they are interchangeable. “None is unique or dedicated.”

Tolerances

A major area of mold design involves tolerances. Neufarth says that in many instances, these are determined by resin flow. Since P&G typically uses low-viscosity packaging materials like polyethylene (LDPE and HDPE) and polypropylene, there is a tendency for the resins to flash through gaps as tight as 0.0004-0.0006 inches.

“There’s a big need to minimize flash,” Neufarth says. “Although the part will probably mold well and function with a tolerance of ±0.0002 inches, it will flash, so you have to tighten up the tolerance for the part to be flash-free.”

Another way of preventing flash is by assuring that all parting lines and closeout surfaces engage and match consistently throughout the production of millions of parts.

Spare Cavity Inserts and Shut Down Mold Zones

Tolerances also affect the fabrication of spare cavity inserts, which must duplicate exactly the dimensions of the originals. “The spares and production cavity inserts need to be identical in all areas down to a tolerance of ±0.0002 inches,” he notes, “to assure balanced injection, uniform processing and plug-and-play repairs.”

Spare cavity inserts and the ability to shut down mold zones are vital due to the volume of products. Neufarth says that if a problem develops in one or more cavities, the ability to keep production running, even at reduced volume, is vital until it’s feasible to shut the mold down and repair it.

“It’s a safety margin,” he says of the zone-shutdown capability. “We won’t leave it like that. But the capital expenses for our molds are tremendous—millions of dollars per year. So we don’t want any more tools built than necessary. In the event that we have damage to a tool or cavity, we want to shut that down and not waste material. You can imagine that with the billions of packages we sell a year, we don’t want to be running scrap—especially now with material costs.”

Mold features for zone shutdown include valve gates and hot tips, or a pneumatic, electronic or manual sprue shutoff. “This helps us run production and possibly get ahead of schedule until we can pull the tool out and do repairs, or it buys us the time to get another tool built.”

Low maintenance is another requirement of molds. Neufarth says one way of minimizing downtime for maintenance is to reduce wear. “Precision is a huge factor in the life of a tool.” One way to do this is to assure that the gap or clearance of every moving part is fabricated to a tight tolerance.

Another technique is use of wear-resistant coatings. Neufarth believes that these are becoming a factor industry-wide for their ability to extend mold life and consequently, productivity and return on investment.

P&G sources molds worldwide from various sources. One factor is the local supply chain. Because the company prefers to site manufacturing where shipping and customs are not major issues, and where it benefits a local economy, it focuses on suppliers in these areas.

Moldmakers Wanted!

P&G usually finds moldmakers through its suppliers, its own molding plants, or the injection and blow molders it contracts to produce products. Neufarth says, however, that the company wants to move away from this approach and have more direct contact with moldmakers. “We want to partner with them and optimize toolbuilding.”

There is, however, no direct way for a moldmaker to approach the company. “It’s pretty much, don’t call us, we’ll call you. We have our own injection molding capability, and these plants are tasked with finding new suppliers and technologies.”

A moldmaker with the expertise to improve the value of P&G’s mold technology may have to scout around for the company’s local molders and work through them to get a shot at some of their enormous toolbuilding business. The payoff would be worth the effort.

Related Content

Hammonton Mold, ADOP France Forge Strategic Partnership in Injection Blow Moldmaking

Hammonton Mold Inc., a leading full-service mold shop based in New Jersey specializing in injection blow molds (IBM), proudly announces its official partnership with ADOP France, a prominent IBM mold manufacturer based in Normandy, France.

Read MoreMMT Chats: Applying Bench Lessons to the Business of Moldmaking

For this MMT Chat, my guest is Mark Gauvain, one of MMT’s newer Editorial Advisory Board members who has plenty to share as he recently made the move from working for some big manufacturers to working for himself as a consultant to moldmakers and molders on procurement and technology investment strategies.

Read MoreHow Hybrid Tooling Accelerates Product Development, Sustainability for PepsiCo

The consumer products giant used to wait weeks and spend thousands on each iteration of a prototype blow mold. Now, new blow molds are available in days and cost just a few hundred dollars.

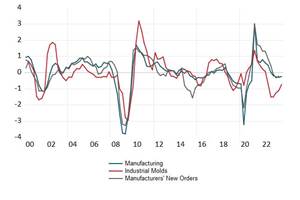

Read MoreNavigating Economic Resilience and Consumer Trends

Consumer behavior provides mold builders insight into the evolving market dynamics of goods and services that helps strategic planning.

Read MoreRead Next

Are You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More

.jpg;maxWidth=300;quality=90)

_300x250 3.png;maxWidth=300;quality=90)