GBI: MoldMaking for June 2017—56.8

The moldmaking industry has seen a significant turnaround in the last 18 months.

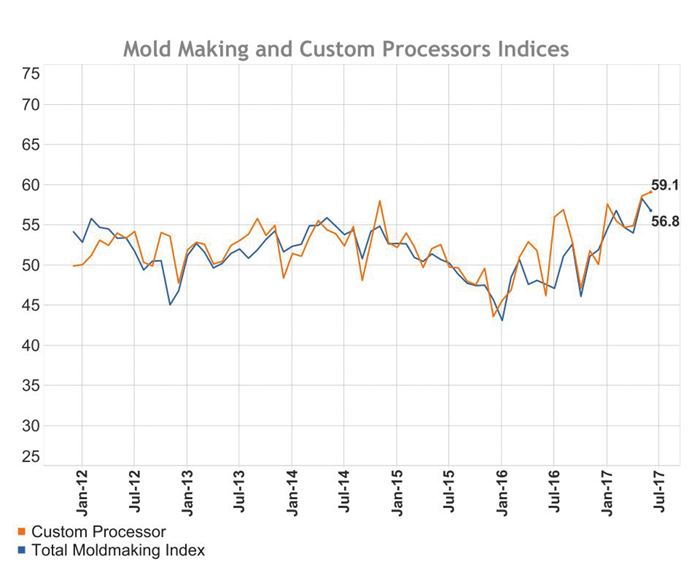

Registering 56.8 for June 2017, the Gardner Business MoldMaking Index pushed the year-to-date average for the index higher. By comparison, the index averaged 55.9 in the first half of 2017, 47.6 during the first half of 2016 and 48.8 for the full 2016-2017 calendar year. The index’s traversing of the “50 line” is important as it indicates that the moldmaking industry has seen a significant turnaround in the last 18 months. More respondents reported good conditions, versus poor conditions, this year.

Examining only custom processor responses within the index, the result for June was 59.1 and for the first half of 2017 averaged 56.7. By comparison, the index averaged 50.0 for calendar year 2016 for the same calculation. The improvement reported by custom processors closely mirrors the conditions reported by the wider molding industry and suggests wide-spread health in the industry.

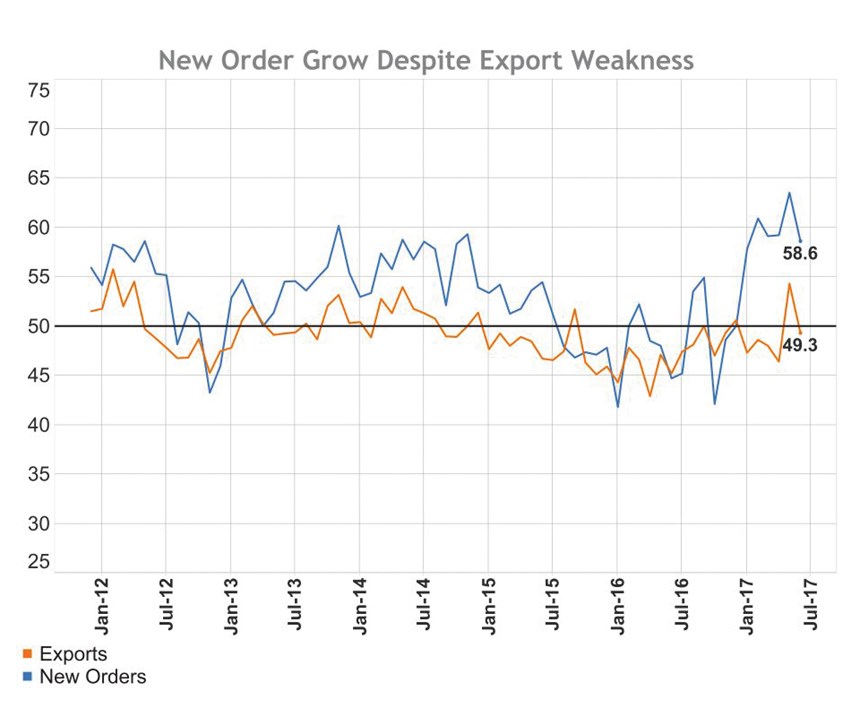

No one component of the MoldMaking Index caused June’s lower reading when June’s figure is compared to the prior month. Most components to the index were down only slightly. The exception is the Exports component, which dropped from a reading of 54.0 to 49.0. Year-to-date, Exports has averaged 49.0, which is only slightly lower than the average for all of 2016. This has been a surprise to Gardner as the dollar exchange rate against major currencies through the first half of 2017 fell. This should have assisted U.S. exporters’ competitiveness.

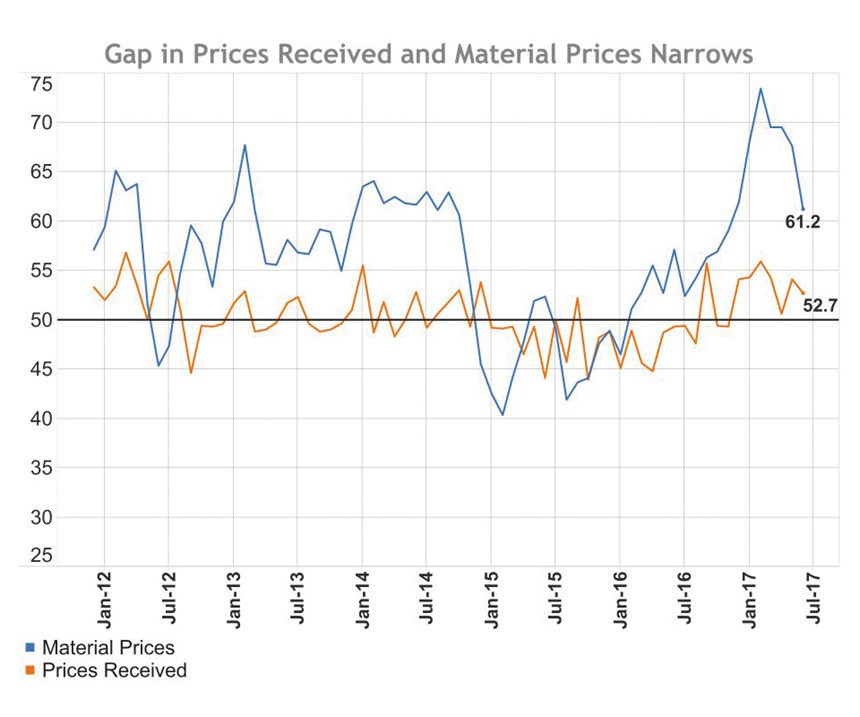

The gap between the indexes for material prices and prices received significantly contracted in June. The vertical space between the lines on the chart represents the gap. The wider the gap between the two lines, the worse things are for molders and moldmakers, as a widening gap means that many of them are experiencing cost increases, but only some of them are passing those costs along. This results in profit-squeezing.

In the three months from April to June, the Material Prices Index decreased 13 percent while the Index for Prices Received increased 4 percent. These moves close the gap between the two indexes by more than half. The closing of this gap means that the pain from higher input costs is subsiding.

Related Content

-

Predictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

-

The Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

-

Making Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

.jpg;maxWidth=970;quality=90)

.jpg;width=70;height=70;mode=crop)

_300x250 1.png;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)