End Market Reports

Market Outlook: Motor Vehicles; Market Outlook: Aerospace Products and Parts

Market Outlook: Motor Vehicles

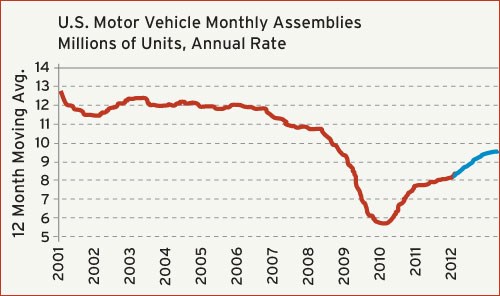

The total number of motor vehicles assembled in the U.S. registered a solid increase for the second consecutive year in 2011. After hitting a record-low level of only 5.7 million units in 2009, the number of assemblies in 2010 jumped 35% to 7.7 million units. In 2011, the number of assemblies escalated to 8.5 million units, which was a gain of 10%. Our forecast calls for another gain of 10% in 2012, and this would push the annual assemblies total to 9.5 million units.

Under normal circumstances, nobody would complain about a third straight year of double-digit growth, especially given the prevailing economic environment in the U.S. But as the accompanying chart illustrates, the U.S. motor vehicle industry is far from where it was prior to the last recession, and it will take several more years of growth in excess of 10% per annum to get us back to those levels. And as a wise man once said, “Who cares if the glass is half-full or half-empty … just fill it up.”

The average age of a car in America is 11 years. The value of the U.S. dollar is relatively low compared to the currencies of our major trading partners, and the price of gasoline is relatively high and rising. These are all strong reasons to expect solid growth in the global market demand for domestically-produced, fuel-efficient autos in the coming years. Unfortunately, the positive factors are mitigated by a high unemployment rate, slow income growth, low confidence, and increasing uncertainty amongst American consumers. So the activity levels for the U.S. auto industry will continue to rise at, at best, a moderate rate for the foreseeable future.

Market Outlook: Aerospace Products and Parts

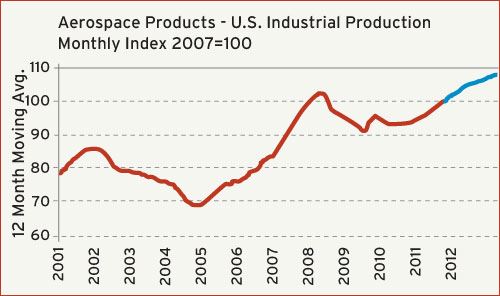

After a modest decline of just under 2% in 2010, total U.S. output of aerospace products escalated by a robust 8% in 2011. This industry is poised for another solid year of growth this year, and our current forecast calls for a gain of at least 6% in 2012. This sector did not suffer as badly as most others during the recession in ‘09, and the gains expected for this year will put total output above the pre-recession levels.

For the purposes of analysis, it is necessary to divide the aerospace industry into two categories: defense and non-defense. On the non-defense side, the expected increase in U.S. output is largely due to Boeing ramping up production of its new, fuel-efficient Dreamliner. The cost of jet fuel has jumped dramatically in recent years, and there is little reason to expect that this uptrend will not persist. And while there are a number of alternative fuels (electricity, propane, solar, etc.) under development that may ultimately prove viable for ground transportation, there are no new types of fuel in the pipeline for air transport. So planes must get more efficient. The good news for moldmakers is that more parts will be made from plastic and other composite materials in an effort to make planes lighter. The bad news is that this industry is so small that it is extremely difficult to enter the market if you are not already in it.

On the defense side, the fastest growing aerospace segment is un-manned aircraft (drones). These planes are cheaper to make, cheaper to operate, less dangerous to their pilots, and they are more effective at performing their tasks. The biggest knock against them is that they are maybe a little too effective, and their increased use also increases the risk of collateral damage. Nevertheless, military deployment of drones will continue to rise in the coming years. And sometime in the not-too-distant future, we can expect a sharp rise in civilian use of drones, particularly for law enforcement.

Related Content

From Injection Mold Venting to Runnerless Micro Molds: MMT's Top-Viewed June Content

The MoldMaking Technology team has compiled a list of the top-viewed June content based on analytics. This month, we covered an array of topics including injection mold venting, business strategies and runnerless micro molds. Take a look at what you might have missed!

Read MoreTransforming Moldmaking into Digital Industrial Manufacturing

Moldmaking and digitalization is at the core of this global industrial manufacturing company’s consolidation and diversification plan.

Read MoreOEE Monitoring System Addresses Root Cause of Machine Downtime

Unique sensor and patent-pending algorithm of the Amper machine analytics system measures current draw to quickly and inexpensively inform manufacturers which machines are down and why.

Read MoreMold Builder Uses Counter-Intuitive Approach for Mold Challenges

Matrix Tool Inc. answers customers’ hard questions with creative solutions for cavity spacing, tool sizing, runner layout and melt delivery that reveal the benefits of running in a smaller press size at lower cavitation but higher yield.

Read MoreRead Next

Reasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More

.jpg;maxWidth=300;quality=90)

_300x250 4.png;maxWidth=300;quality=90)

_970x250 1.png;maxWidth=970;quality=90)