Energy/Power Generation Outlook

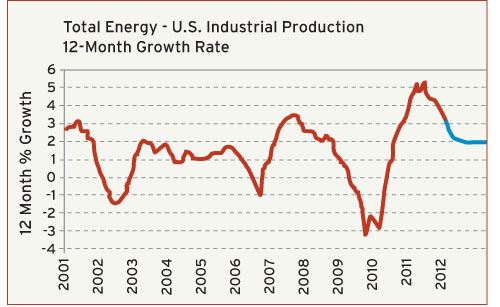

After a decline of nearly 3% during the Great Recession of 2009, total U.S. output of energy and power products enjoyed above average growth in both 2010 and 2011. At the present time, America is generating more power and producing more energy products than ever before. We expect this growth trend to continue in 2012, but the growth rate will settle down closer to the long-term average of about 2% this year. This forecast is based on expectations of moderate overall growth in the U.S. economy, which would be in the range of 2.5%-3.0% for the year.

Demand for electricity will continue to rise for the foreseeable future due primarily to the trend of rising demand for electronics products by both consumers and businesses. There will also be accelerating growth in demand for electric vehicles. Recent expansion in the capacity to generate electricity by traditional means has struggled to keep pace with this rising demand, and this has put premium on alternative ways to generate power (solar, wind, geothermal, etc.) and also on products that enhance efficiency. These efficiency gains are being realized by new types of appliances and machinery, and also by upgrades to the distribution system (think smartgrid).

Another energy trend that will gain momentum in the coming years is the increased substitution of natural gas for crude oil and its derivatives. The global market prices for crude oil and natural gas used to correlate strongly, but this relationship has diverged widely in North America in recent years. The good news is that not only is natural gas cheaper, but it is also cleaner and relatively abundant in this country. Look for a steady rise in demand for appliances and machinery that utilize natural gas as a fuel. This means there will also be a rise in the products used for the production, storage and distribution of natural gas in the coming years.

Computer Industry Outlook

It is difficult to think of a sector of the global economy that has a brighter long-term outlook than the computer and electronics industries. This statement holds true for all of the various segments of the electronics sector. Global output and sales of electronic products for computers, audio/visual, telecommunications, industrial uses, commercial uses, defense uses, medical devices, transportation, security devices, construction and energy generation are all expected to increase at an average annual rate of at least 5% for the foreseeable future.

And rest assured that U.S. manufacturers of computer products will benefit greatly from this global uptrend. The Fed compiles and reports a monthly index of the total U.S. production of computers and peripheral products. The chart is a graph of the 12-month growth rate for this monthly data. Like most segments of the manufacturing sector, the computer industry is vulnerable to recessions in the U.S. economy. Hence, the negative growth rates in the years 2002 and 2009. But what is most interesting is both the speed with which this industry recovers after a recession and also the high rates of growth this industry enjoys during periods of economic expansion.

In 2010, the total U.S. output of computer products surpassed its pre-recession peak, and then it grew by more than 7% in 2011. Our forecast calls for a gain of at least another 5% in 2012. This forecast is based on our expectations that the current recovery in the U.S. economy will continue to improve gradually. We are also factoring in a moderate recession in the European economy during the first half 2012 followed by slow growth during the second half of this year.

Related Content

Transforming Moldmaking into Digital Industrial Manufacturing

Moldmaking and digitalization is at the core of this global industrial manufacturing company’s consolidation and diversification plan.

Read MoreLeading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

Read MoreMMT Chats: Acquisition Trends and Lessons for Mold Builders

Jim Berklas is a former full-time M&A lawyer for several of the largest private equity firms in the country and has 25 years of M&A experience and 200 closed transaction. Today, he is founder and M&A Leader with Augmented Industry Services. He joins me for this MMT Chat on mergers and acquisitions trends and strategies within in the mold manufacturing industry. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

Read MoreMMT Chats: Marketing’s Impact on Mold Manufacturing

Kelly Kasner, Director of Sales and Marketing for Michiana Global Mold (MGM) talks about the benefits her marketing and advertising, MGM’s China partnership and the next-generation skills gap. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

Read MoreRead Next

Are You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More.jpg;maxWidth=970;quality=90)

.jpg;maxWidth=300;quality=90)