Be Proactive, Not Reactive

News from the auto industry today is full of doom and gloom. However, there are steps mold manufacturers can take to remain profitable during this time.

The woes of the automotive market are widely known amongst mold manufacturers. Reductions in sales, cancelled programs and bankruptcies have had a significant negative impact on tooling vendors. Their place in the supply chain has traditionally been at the bottom with OEMs and Tier I suppliers dictating most or all relationship conditions. For the past two decades, tooling vendors have had to adapt to unfavorable payment terms, late design changes, and downward price pressure on material and build costs. In addition, they have been expected to take a greater role in responsibility for tool design. With the recent changes in the industry, the opportunity exists for tooling vendors to take on a more proactive role. The time is right for moldmakers to forget the past and focus on short-term wins and long-term survival.

Recently the Harbour-Felax Group (Berkley, MI)—an automotive consulting, and process assessment and improvement firm—conducted a study of the automotive industry that analyzed vendor tooling investment for the OEMs. According to President Laurie Harbour-Felax, the study showed that the tooling process was a window into larger issues existing at the Tier I suppliers and tool manufacturers that were surveyed—performance gaps being a major one. “The study highlights what companies can and should be doing differently to drive improved performance and achieve profitability,” Harbour-Felax emphasizes. “The following are some key differences that matter—separating the best from the rest and why the best have costs that are lower, what the major drivers are, and ultimately what the effect is on the supplier community.”

Common Vehicle Architecture and Global Components

“At the OEM level, they are commonizing their platforms and their architectures, which is driving common tools,” Harbour-Felax points out. “The long-term goals are going to have to be tools that are much more robust and can produce a much greater volume. They can commonize parts on a car that consumers don’t see and make them the same across all 7 million units that might be built at plants around the globe—and one tool needs to be able to make those. There are not a lot of things tool vendors can do in support of this, except for the role they play in support of product development.”

Tooling vendors also can support the Common Vehicle Architecture efforts of OEMs by looking to engage earlier in the product development process, Harbour-Felax recommends. “The vendor industry currently operates in a response mode to product development,” she states. “Look to engage early with meaningful contribution to the vehicle development process."

Program Volume Accuracy

OEMs, Tier I suppliers and tooling vendors need to work together to develop and communicate accurate vehicle volumes and option take rates during the supplier selection process. “Historically, over the past two decades, the Big Three typically overestimate their programs with the tool vendors,” she states. “The tool vendors are making tools to support a large volume that often fails to materialize. OEMs invest a great deal of money in vendor tooling and it is imperative to their long-term financial success to ensure that a financial return is attained. Overstating volumes drives unnecessary costs into the system that the OEMs cannot afford.”

Tooling Vendor Selection

This issue centers on how OEMs and Tier I suppliers choose tooling vendors. Typically, the OEM calls a Tier I supplier and asks for a quote and the Tier I supplier chooses a tooling vendor. More recently, the OEMs are telling the Tier I suppliers which tooling vendor to use, Harbour-Felax notes. “This is what is driving some foreign outsourcing,” she explains. “The issue here is how tool vendors can better position themselves. In this economy, tool vendors need to be the best they can be in every circumstance: operationally, cash management-wise, program management, sales, leadership. Excellence needs to be the highest standard. Businesses can’t operate like they did in the 70s and 80s.”

Technical Competency

Unfortunately, the shops that aren’t the best they can be won’t be around much longer, according to Harbour-Felax. “My biggest fear today is that tool vendors no longer have formal apprenticeship programs due to cost cutting,” she says. “When you walk the shop, you see older guys making tools and no younger generation being trained. If we don’t start investing back in our younger generation to build up the technical competency, the market will be forced to shift overseas in the future. Consideration for investment in maintaining this capability is the responsibility of all participants in the supply chain (OEMs, Tier Is and tooling vendors).”

Early Supplier Involvement

Harbour-Felax notes that the domestic OEMs typically do not bring Tier I suppliers or tooling vendors in early enough to the design and development phase. “While it may be difficult for a tooling vendor to change this, there are many that are really pushing back on their Tier I customers and those OEMs they have relationships with—pushing them to be involved sooner and being very persistent. It is important for tooling vendors to be proactive and market themselves better,” she comments.

Vendor Tooling Payment

The Detroit Three OEMs should take a cue from Japanese OEMs and provide a process to accommodate progressive payments to tooling vendors, Harbour-Felax maintains. “Most industry contracts state that tooling vendors are to be paid 100 percent, of the contracted cost, at PPAP (PPAP is supposed to take place prior to vehicle launch),” she states. “But—more often than not—this does not happen due to delays in vehicle PPAP and the relationships between OEMs and Tier I suppliers. In most cases that we have studied, tooling vendors receive payment from Tier Is between 14 and 24 months after vehicle launch. In the Japanese systems, tooling vendors receive payment much sooner in the process, as PPAP timing is maintained at a higher consistency level and systems exist that allow for progressive payments.

“Many tooling vendors in the Japanese OEM supplier networks receive payments on a 30/30/30/10 basis (30 percent at tool kickoff, 30 percent at tryout, 30 percent at sign-off and 10 percent at PPAP),” Harbour-Felax continues. “They do this to ensure a financially viable tooling vendor supply base. In addition, Japanese OEMs feel they attain a more competitive tooling cost by avoiding vendor finance charges associated with the significant delay in payment.”

Low-Cost Country Sourcing

According to Harbour-Felax, their data shows that going overseas has no significant cost advantage for OEMs. “Quite often, OEMs decide to source tooling from low-cost countries without considering all cost driving factors,” Harbour-Felax says. “Costs associated with increased overseas travel and program management efforts are not adequately considered in most decision processes. In response, tooling vendors need to understand—and quantify—the complete cost comparison and work to ensure OEMs comprehend the complete cost impact.”

The Bottom Line

“The entire industry is struggling right now and the most important thing to do is collaborate very early on in the process, get the waste out of the system, design the tool on the computer and push the cutting of the steel on the tool until as late as possible,” Harbour-Felax emphasizes. “Then, once the steel is cut, there should be minimal changes because of the early involvement and collaboration. It’s cost-effective for everyone, everyone gets paid for their time and effort, and the low-cost solution is provided. This is what the best-in-class do.”

Related Content

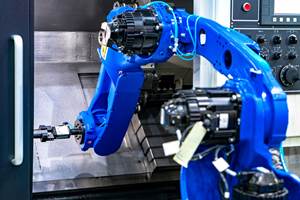

Mold Builder Meets Increased Domestic Demand With Automated Cells

Burteck LLC experienced significant demand increases due to reshoring and invested in automated machining cells to step up its production output quickly and avoid losing business.

Read MoreHow to Start Automating Your Moldmaking Operation

A few fundamentals of moldmaking automation include identifying key areas and places to avoid and addressing common concerns and roadblocks.

Read MoreReimagining Moldmaking with Technology

A look at some of the technology mold builders have expressed a growing interest in and are now actively investigating, including advancements in mold design, 3D printing, automation, machining, inspection and repair.

Read MoreHow to Automate Process and Design

Moldmakers can improve their operations and stop wasting time by taking these six steps for process and design automation.

Read MoreRead Next

Niche Auto Molds Prove to Be a Profitable for Cavalier Tool

Capitalizing on its specialty of molds for fans and shrouds in the automotive industry—on their own terms with no PPAP—drives this moldmaker’s success.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More.jpg;maxWidth=970;quality=90)

.jpg;maxWidth=300;quality=90)

_300x250 3.png;maxWidth=300;quality=90)

.jpg;maxWidth=970;quality=90)