Automotive and Machinery/Equipment

Automotive market remains strong, and machinery/equipment is on the upswing.

#automotive

Automotive Market Strong, But Can it Continue?

The real 10-year treasury rate was 0.71 percent in October, an increase of just 1 basis point from the month before and below 80 basis points for the fourth straight month. A significant reason for this is that that the rate of inflation, while still low historically, has picked up from what it was in 2015. In October, the annual rate of inflation was the highest since October 2014, according to the Consumer Price Index. The year-over-year change in the real rate (the real rate is the nominal rate minus inflation) fell to -117 basis points. That was the sixth consecutive month that the year-over-year change declined and the fastest decline since July 2012.

The decline in the real 10-year treasury rate is boosting consumer spending on motor vehicles and parts. In three of the previous four months, the month-over-month growth in spending was above average. In October, the rate of growth was 8.5 percent, more than double the historical average. This has put motor vehicles and parts spending at the second highest level ever (see chart).

Featured Content

But, how long can this continue? The spending boom has been fueled by loans, particularly sub-prime loans, as the total amount of vehicle loans is nearly 30 percent above the previous peak level in 2007. Delinquency rates on auto loans, again particularly sub-prime, have been climbing. Plus, through the first three quarters of 2016, 32 percent of trade-ins had negative equity averaging $4,832, according to Edmunds.com.

This begs the question; What happens when interest rates rise? The result could be a significant pull back in auto production when spending can no longer be fueled by cheap rates.

Machinery/Equipment Market on the Upswing

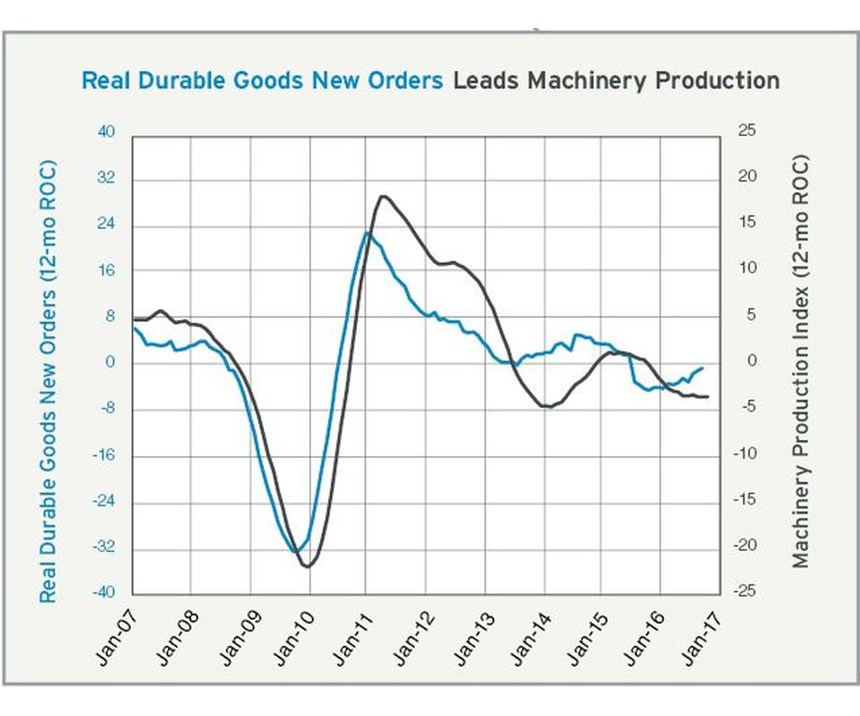

Real durable goods new orders are an excellent leading indicator for machinery/equipment production. In September, new orders were $241,857 million, growth of 0.5 percent over one year earlier, marking the second month in a row and fourth time in six months that orders have increased. The annual rate of change, now -0.7 percent, contracted at a slower rate for the third month in a row and at the slowest rate since it began contracting in July 2015.

Real durable goods new orders bottomed out in October 2015. As the chart shows, it looks like machinery/equipment is starting to bottom out now. Also, the Gardner Business Index in November showed that the industry had grown at an accelerating rate for four straight months. The current rate of growth is close to the rate for most of 2014. New orders and production both have grown for four months as well, and the backlog index also grew in November for the first time since October 2014.

RELATED CONTENT

-

Micro-Milling Opportunities and Challenges

An integrated approach to the design and machining of micro-milling components is key for mold manufacturers looking to capitalize on this growing opportunity.

-

In the Trenches: Tools of the Trade

Equipping yourself with the right tools for the job requires time, practice, ownership and maintenance.

-

Mold Builder Uses Counter-Intuitive Approach for Mold Challenges

Matrix Tool Inc. answers customers’ hard questions with creative solutions for cavity spacing, tool sizing, runner layout and melt delivery that reveal the benefits of running in a smaller press size at lower cavitation but higher yield.

.JPG;width=70;height=70;mode=crop)