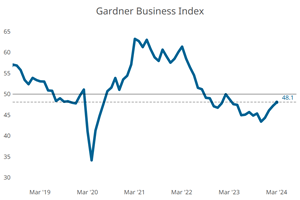

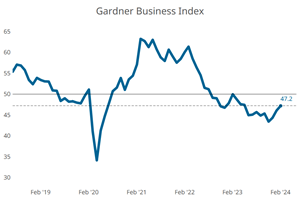

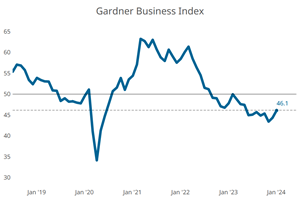

Methodology of the Gardner Business Index

How is the Gardner Business Index created?

Each month Gardner Intelligence surveys the North American durable goods manufacturing facilities on the current state of: New orders, Production, Backlog, Employment, Exports, Supplier Deliveries, Material Prices, Prices Received and Future Business Expectations.

We create a diffusion index for each of the above questions. The total index is an average of the first six sub-indices in the list above.

In addition to the nine factors above, each facility is asked how much they will spend on capital equipment in the next 12 months. We report the results as the average spending per plant. An individual facility’s planned spending is never shared.

Who is surveyed for the Gardner Business Index?

Gardner Intelligence is the research and industry intelligence sector of Gardner Business Media, which reaches readers at more than 100,000 durable goods and discrete parts manufacturing facilities every month. We survey 50,000 of those facilities each month, averaging about 600 responses to each survey.

When does the Gardner Business Index survey get sent out?

The Gardner Business Index email survey is sent out the second-to-last and last Tuesday of every month.

What makes the Gardner Business Index unique?

Most other diffusion indices focus solely on large companies, which we define as a manufacturing facility with more than 250 employees, because they are used to forecast GDP and other macroeconomic measures. This works because a significant percent of manufacturing production occurs in these large facilities.

However, there is a still a great deal of activity in smaller manufacturing facilities that is extremely important to any company selling equipment, materials, or other supplies to durable goods and discrete parts manufacturers.

For example, plants with 250 or more employees buy about $2.0-2.5 billion of machine tools every year. But facilities with fewer than 20 employees buy about $1.0-1.5 billion of machine tools every year. So, the smallest facilities spend about 60 percent of the total of the largest facilities. There are just 5,000 metalworking facilities with more than 250 employees and more than 35,000 metalworking facilities with fewer than 20 employees.

“There are just 5,000 metalworking facilities with more than 250 employees and more than 35,000 metalworking facilities with fewer than 20 employees.”

How is the Gardner Business Index data reported?

Each facility that responds to the survey has associated with it four pieces of firmographic data:

- Process (e.g. metalworking, plastics processing)

- Industry (aerospace, medical)

- Region (e.g. West, Southeast)

- Plant Size (e.g. 1-19 employees, 20-49 employees)

Each facility can be in only one industry, region, and plant size. However, facility responses can count in more than one process based on our knowledge of what that facility does.

For every combination of process, industry, region, and plant size, we report all the data in “How is the index created?” above. In addition, we report the number of facilities that respond in each unique combination of process, industry, region, and plant size.

Each subscription includes monthly updates with the latest data. In addition, subscribers also receive access to our historical data since 2011.