Automotive and Computers

Auto Sector Continues to Outperform; Computer Industry Finally Starting to Recover

Auto Sector Continues to Outperform

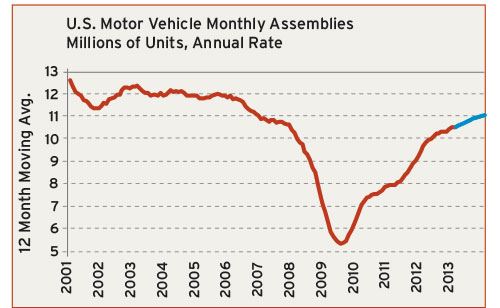

The auto sector continues to be one of the bright spots in the lackluster U.S. economic recovery so far this year. For the year-to-date, the total number of motor vehicles assembled in the U.S. is up 5% when compared with the same period in 2012. This rate of growth should be sustained through the end of next year. Following a jump of 19% in 2012, total motor vehicle assemblies will expand another 5% in both 2013 and 2014. This will result in a total of 11 million vehicles assembled this year and 11.5 million vehicles assembled next year.

The number of autos assembled so far this year is up 8.5%, while the number of light trucks (the category that includes pick-ups, minivans, and SUVs) is up 4%. The light trucks category has been the stronger sector in the U.S. for the past 20 years or so, but we may presently be witnessing a shift in the market. We have suspected for some time that fuel efficiency would become an increasingly important factor in the U.S. market for autos. If this is true, then smaller, lighter-weight vehicles with a greater proportion of plastics parts will take market share away from heavier vehicles, such as minivans and four-wheel-drive SUVs in the coming years.

The next couple of years will likely see auto industry growth that is above the long term, sustainable average due to a substantial amount of pent-up demand in the American marketplace. The average age of American cars is still quite high by historical standards. Households have postponed purchasing new cars due to their lack of confidence in the economic recovery. However, the economy is improving, and it is combining with an acute need to replace aging, less reliable vehicles. This pent-up demand is amplified by the market shift toward more fuel-efficient cars mentioned earlier.

Computer Industry Finally Starting to Recover

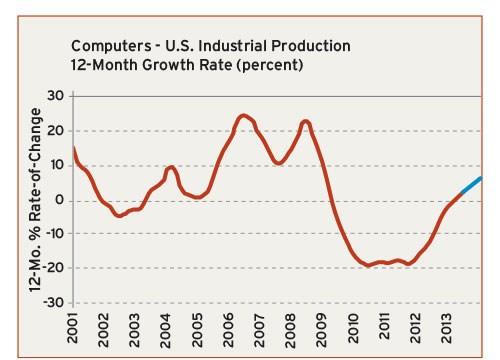

After four straight years of steep declines, the total output of the U.S. computer industry is poised to register a moderate increase this year. Our latest forecast calls for a 5% gain in the production of computers and peripheral equipment in 2013. Prior to this year, this industry suffered an average annual decline of 14% per year in total output since 2008.

There are two reasons why this once-dominant industry is now less than two-thirds the size it was just five years ago. The first is off-shoring. Most of the products in this category were invented and developed in the U.S., and Americans are the biggest consumers of these products. However, most of the manufacturing is performed overseas. Some of the production of these products is coming back to North America. Automation and other advances have lowered the cost of manufacturing, and there are always good reasons to manufacture close to the market as well as protect intellectual property. But this is not yet happening to a large degree, and probably never will.

One of the biggest obstacles for this industry is that Americans no longer consume as many computers as they did a few years ago. Mobile devices such as smart phones and tablets have replaced computers for many needs. Data are increasingly being stored on large servers and then accessed via mobile devices. The need for desktop or laptop computers to store and process data is diminishing. There will be some replacement demand for computers in the business environment for a while, but the output from the U.S. computer industry will likely never return to the peak it hit in 2008.

Related Content

How to Improve Your Current Efficiency Rate

An alternative approach to taking on more EDM-intensive work when technology and personnel investment is not an option.

Read MoreLeading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

Read MoreThe Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MoreMold Builder Uses Counter-Intuitive Approach for Mold Challenges

Matrix Tool Inc. answers customers’ hard questions with creative solutions for cavity spacing, tool sizing, runner layout and melt delivery that reveal the benefits of running in a smaller press size at lower cavitation but higher yield.

Read MoreRead Next

How to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More_970x90 4.png;maxWidth=970;quality=90)

.jpg;maxWidth=300;quality=90)

_300x250 3.png;maxWidth=300;quality=90)